Last chance to save on Digiday Publishing Summit passes is February 9

Walmart is making a push to grow its advertising by positioning itself as a media platform.

Walmart’s pitch is that it controls transaction data from customers, which can help brands retarget consumers off Walmart.com, according to executives familiar with the matter. The big differentiator being pitched is Walmart’s brick-and-mortar locations — fulfilling a big promise of retail media that it can connect online with offline. And Walmart is making it count, trumpeting its combination of scale and offline data as a differentiator from Amazon. It’s doing that via more meetings with buyers, as well as at learning sessions and summits it’s holding with brands and agencies.

Walmart has over 5,000 locations, and e-commerce in the second quarter has grown 50 percent year over year, according to its most recent filings with the Securities and Exchange Commission. Online sales are a smaller part of its $486 billion annual revenue, but ad buyers say its acquisitions of e-commerce sites Jet.com, Bonobos, Moosejaw and ModCloth indicate it will continue to grow its ad muscle. Retail purchases often begin with online searches — and if Walmart can own more searches, it can capture more of that valuable search traffic. “If Walmart.com can relaunch its advertising with the Jet.com back end, this will buy it some clout and some breathing room,” speculated one buyer.

Walmart did not respond to a request for comment.

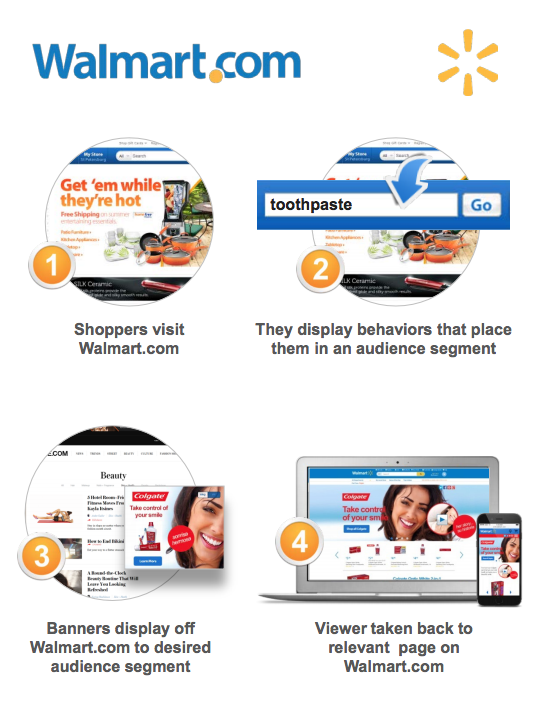

Walmart Exchange uses programmatic infrastructure combined with in-store sales data to target ads, through private marketplaces and ad exchanges. The retailer also offers display media across desktop, mobile and tablet as well as native ads within the shopping experience. There are also options for more traditional paid search and product listing ads, along with “audience extension” through Walmart co-branded ads. That means brands can target shopper behaviors through ads on and off Walmart.com. (Amazon began offering a similar program, “audience match,” in July.)

Results on Walmart’s ad platform vary. One buyer said ROI has been either flat or negative — and that the back end continues to lack sophistication. Another buyer said it’s somewhat effective, but that Walmart is subtly telling brands that for their advertising to be effective, they need to negotiate with Walmart for other things, like shelf space.

Agency executives report that Walmart holds invitation-only summits that replace training for buyers and brands. Partners including brands and agencies are invited to these summits, dubbed “WMX summits,” in which Walmart ad executives reveal new tools. Merchants also hold senior leadership sessions, where people gather to discuss changes to product lineups, back-end tools and advertising.

“You have to be super proactive to make sure you’re getting the most out of your relationship,” said Heidi Froseth, evp and senior group director at Catapult, a shopper marketing agency.

Buyers said Walmart doesn’t directly pitch its platform. That’s left to Triad Retail Media, a group part of WPP that helps Walmart and Sam’s Club sell ads and run product promotions. It also manages all of the asset execution with Walmart suppliers.

The big question, said Froseth, is how buyers and brands negotiate with Walmart to figure out what comes next. “That’s part of the deal; everyone has to learn in their own way how to grow their categories and what you’re getting from partnerships like this,” she said. “You find out where foot traffic is — is that through e-commerce or physical — get that data and then figure out how to use advertising.”

Retail media, like the kind Walmart is pushing hard to build, has sprung up in the past year. Aside from Walmart, big retail media players include Amazon, of course, but also companies like Kroger and Nordstrom. Even retailers that are dwarfed by Amazon or Walmart, like Overstock, have built up media, recognizing it as a high-margin revenue stream. The pitch is similar: Brands know what people are searching for and buying; therefore, the ad platform can offer them more sophisticated targeting and analytics.

“Every retailer is building a vendor marketing platform,” said Alex Sherman, founder of Spotfront, which works with retailers to help them build theirs. Sherman, who doesn’t count Walmart as a client, said the challenge is to figure out how to differentiate. “It’s a shift from a commodity ad network to a premium channel that benefits shoppers as well as advertisers.”

More in Marketing

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.

Programmatic is drawing more brands to this year’s Winter Olympics

Widening programmatic access to streaming coverage of the Milan-Cortina Games is enabling smaller advertisers to get their feet in the door.