Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: YouTube’s dynamic brand insertions could unlock the upfront market for creators

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how YouTube’s plan to enable creators to swap out sponsored segments normally baked into their videos may be the most disruptive development in the creator economy in 2026.

- YouTube’s new deal dynamics

- OpenAI’s entertainment industry gaslighting, Facebook’s creator charm offensive and more

YouTube’s new deal dynamics

YouTube’s move to let creators swap out sponsored segments normally baked into their videos may be the most disruptive development in the creator economy in 2026.

Obviously, that’s an extremely bold call to make two months before the year even starts, let alone when next year already stands to start with TikTok’s U.S. spinoff. But hear me out.

YouTube’s plan to enable dynamic brand insertions — which the platform will begin testing with some creators in 2026 — can lead to a complete rewriting of how YouTube creators’ content is pitched to advertisers. That includes not only how these individual sponsored segments are priced but more broadly how YouTube creators’ video libraries are packaged. That is to say, it can create the conditions for YouTube channels to be sold like traditional TV networks and streaming services.

“[YouTube enabling dynamic brand insertions] is huge. It gives you so many more opportunities with brands and how you frame things, how you structure a deal,” David Huntzinger, an agent at talent management firm Night, said on the latest Digiday Podcast episode.

Let me explain: Right now if a brand sponsors a creator’s YouTube video, the video carries that brand’s sponsored segment forever (unless the creator takes down the entire video and, in turn, surrenders all of its views). That can make sponsoring a YouTube video a pretty great bargain if it’s a creator whose videos reliably receive a sizable audience. On the flip side, it can make sponsoring a YouTube video prohibitively expensive if the creator (or the creator’s representatives) take into account the video’s potential longtail viewership when setting the price for sponsored segments.

“[Creators’ sales representatives] often say, ‘It’ll be this many views forecasted or even willing to guarantee this many views in the first, like, three days or first week.’ And it’s almost like, ‘And then the rest is bonus,’” said Jon Morgenstern, evp of media at VaynerMedia.

But that’s all out the window with dynamic brand insertions. Because for the first time creators will be able to replace a video’s sponsored segment without taking down the video, that means creators and brands will be able to sign shorter-term deals. It also means, for the first time, creators’ entire YouTube back catalogs will be reavailable for sale, like Disney taking “Snow White” out of the vault during the VHS days.

“You have to look at it now as an ad slot versus a permanent integration: What’s the start and end date of the brand segment? Is there going to be renewal and extension rights to it? What are the exclusivity windows?” said Jonathan Chanti, CEO and co-founder of creator economy company Reign Maker Group. “There’s going to be new criteria of negotiating with brands.”

These new deal dynamics could result in creators being pressed to charge less for new brand insertions that aren’t permanent. Case in point: A sponsored Instagram post with a 3-month lifespan can cost 50% to 60% less than a sponsored post with no time cap, Chanti said. Conceivably creators could make up for the initial price hit by being able to resell that insertion slot, similar to a TV show producer reaping multiple rounds of revenue from syndication deals. But that assumes brands will want to pay up for an old video, which will depend on the likelihood of that video continuing to generate significant views months after it was originally posted.

“Working out the cost and the CPM formula for that is going to be something of a task,” said Huntzinger. “And that will be different because different creators have different long-tail viewership.”

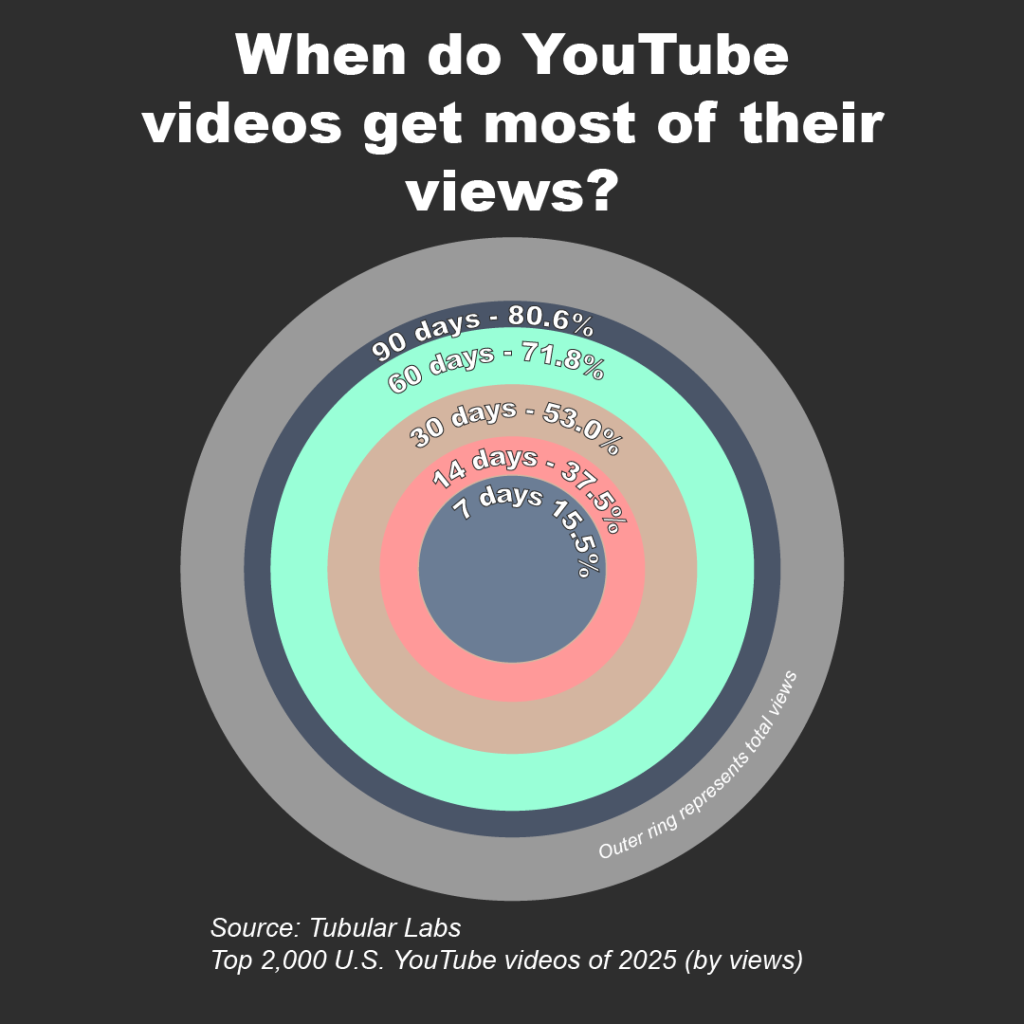

More creators may have more long-tail viewership than you might think, though. While brand insertion deals may be framed around a video’s first week’s worth of views with the rest being bonus, as Morgenstern indicated, only 25% of a video’s views come within the first seven days, according to an analysis conducted by Tubular Labs of the top 2,000 videos uploaded to YouTube in the U.S. in 2025. More to the point, only half of the videos’ total views were received within the first 30 days of being uploaded.

The opening up of creators’ back catalogs opens up a whole new deal type – one that could justify an upfront marketplace for major creators.

Consider creators like MrBeast and Michelle Khare who don’t upload new videos every single week but whose videos quickly rack up millions of views and whose older videos continue to attract significant viewership. These creators’ sales reps will be able to pitch brands on buying out not just the new video but every other video on the creator’s channel until their next video drops. If the creator only uploads a new video every other week, that’s 26 sponsor windows. That’s scarcity. That’s the ingredient that continues to drive the traditional TV upfront marketplace and that has dogged the digital video industry’s attempts to adopt an upfront dynamic.

The idea of an upfront market for creator brand insertions runs counter to the current trend of marketers pressing for proof of creator deals driving product sales. But this is where the dynamism of dynamic brand insertions still comes in. For mid-sized creators, brands will be able to negotiate for shorter windows at lower prices.

“If it’s pay-as-you-go versus ‘I’m going to lock this in in perpetuity, but I have to pay up accordingly,’ it’s de-risking,” Morgenstern said.

That’s risky for creators, though. But if a creator is able to prove an ability to push product, then that creator will be in position to push for higher fees for shorter windows as well as for new brands to be inserted into new-ish videos (i.e. ones within a month or two of being uploaded).

Which is kinda the entire point. If and when YouTube officially rolls out dynamic brand insertions to all creators, it will not only open up new sources of inventory on creators’ channels but new opportunities to package that inventory and new deal dynamics.

As Chanti said, “it’s going to be a lot of negotiating.”

What we’ve heard

“Agencies dominate a lot of the YouTube market in particular. Blue chip brands and some of those marquee brands in the space, you’re likely cutting those bigger campaigns directly with the brand.”

— Night’s David Huntzinger on the latest Digiday Podcast episode

Numbers to know

$10.99: New monthly subscription price to HBO Max’s ad-supported tier.

8%: Percentage of Disney+ subscribers who canceled their subscriptions in September, the same month that Disney temporarily took “Jimmy Kimmel Live!” off-air.

$140 million: How much Apple will pay per year for five years to stream Formula 1 races on Apple TV starting next year.

56%: Percentage share of Hispanic audiences’ TV watch time that is spent on streaming.

25: Maximum length, in seconds, of videos that ChatGPT Pro subscribers can create using OpenAI’s Sora 2 AI video model.

45%: Percentage share of U.S. households with internet access that watch free, ad-supported streaming TV services.

$6.99: Monthly subscription price for CNN’s standalone streaming service that will launch next week.

$14.99: Monthly price for a subscription bundling Apple TV and NBCUniversal-owned Peacock’s ad-supported tier.

What we’ve covered

How creators are becoming their own networks with Night agency’s David Huntzinger:

- As some brands take influencer marketing in-house, the talent agent explains what that means for influencer deals.

- Huntzinger breaks down the differences in working with brands directly versus going through influencer agencies.

Listen to the latest Digiday Podcast here.

L’Oréal builds the data backbone to its creator marketing:

- The cosmetics giant is looking for help analyzing its creator campaigns.

- L’Oréal specifically wants to connect its creator campaigns to product sales.

Read more about l’Oréal’s creator marketing here.

Sora 2 copyright calculations highlight new role for agencies as risk whisperers:

- Agencies’ legal teams are being held out to help brands wrap their heads around AI-related copyright concerns.

- It’s unclear why a brand would be looking to its agency for legal counsel.

Read more about Sora 2 here.

5 questions marketers have about Sora and the synthetic social era:

- Advertisers are concerned about the legal and ethical implications of AI video apps.

- They’re also worried about how interested audiences are in AI-generated content and AI slop ruining social feeds.

Read even more about Sora here.

Brands are betting on creators to make their next hit series:

- Cava, Hot Topic and Zola are among the brands hiring creators to produce episodic shows for short-form video platforms.

- It’s the latest branded entertainment gambit.

Read more about brands and creators here.

What we’re reading

OpenAI’s entertainment industry gaslighting:

The AI company told one major talent agency that copyright holders would need to opt in for its Sora AI video model to train on their intellectual property, a claim that turned out to be entirely untrue (until OpenAI later reversed course), according to The Hollywood Reporter.

Facebook’s creator charm offensive:

Almost inexplicably, Facebook has become an important revenue-generating platform for creators in 2025 thanks to the platform’s program to pay creators for post performance instead of a share of ad revenue, according to The Hollywood Reporter.

Animation studios are tailoring their output toward YouTube to attract younger viewers and offset lowered spending on animation from traditional distributors, according to Variety.

The Meta-owned platform is testing ads in Reels that people can skip after an unknown period of time, according to Adweek.

While the TikTok U.S. owners will license a copy of the platform’s hallowed algorithm, TikTok employees aren’t sure that TikTok U.S. will be able to replicate enough of the original algorithm’s recommendation performance, according to Business Insider.

The platform is testing shoppable ads within livestreams with E.l.f. Cosmetics ahead of the holiday shopping season, according to Marketing Dive.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.