Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: YouTube develops new program to pitch brands on top creators’ shows

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing reports on YouTube’s new pilot program that would have brands sponsor shows from top creators.

- YouTube TV (2026 edition)

- Netflix’s all-cash offer for WBD, a “Creator’s Bill of Rights,” TikTok’s micro-drama app and more

YouTube TV (2026 edition)

Shows have become a focal point for YouTube. And now getting brands to sponsor those shows is becoming a priority.

YouTube is developing a program to pitch shows from top creators for advertisers to sponsor, according to executives at ad agencies and talent agencies with knowledge of the matter. The executives described the program as a pilot program that is in early development. YouTube is not funding the shows but would instead secure the sponsors for creators.

The program would give brands the opportunity to run sponsored takeovers of creators’ show episodes. An ad agency executive said the program is being aimed at brands with large budgets already being spent on YouTube. YouTube is being similarly discerning about whose shows are being pitched by focusing the program on top creators. The Google-owned platform has taken pitches from a select group of creators, according to talent agency executives.

“They’ve launched a pilot program that essentially allows for notable figure clients who have these formats on their channels to activate ad dollars in an evergreen capacity outside of upfronts. The media dollars are not tied to running media – the pre-roll or mid-roll assets – but to native integrations into the content itself,” said one talent agency executive.

A Google spokesperson said that brands are able to integrate into episodic programming from creators, such as Mythical Entertainment’s “Good Mythical Morning” and Trevor Noah’s stand-up comedy special.

The program is kind of a hybrid of two previously launched YouTube programs – Public Figures and BrandConnect – according to talent agency executives. The Public Figures program was YouTube’s effort to get traditional celebrities like Will Smith and Kevin Hart to create YouTube channels featuring original episodic series. Meanwhile, BrandConnect is YouTube’s program to pair brands with creators for sponsored videos that stems from the platform’s acquisition of influencer marketing platform FameBit.

“They have been coming to us as talent reps on an almost-weekly basis, asking for feedback and understandings of how we prefer to operate and maneuver brand deals for talent,” said a second talent agency exec.

BrandConnect has historically focused primarily on one-off sponsorships of creators’ videos. But there has been a broader trend toward longer-term deals between creators and brands. And the show sponsorship pilot program seems to feed into that trend.

“YouTube is demonstrating an important shift in influencer marketing in 2026. One-off creator posts are no longer enough to cut through a saturated market or build trust. Brands need long-term creator partnerships that align deeply with a creator’s tone of voice and audience expectations,” said Jennifer Quigley-Jones, founder of PMG-owned influencer marketing agency Digital Voices, in an email.

YouTube’s sponsored shows push comes at a time when other platforms are cherry-picking top YouTube creators. YouTube’s main rival Netflix, for example, has begun streaming original shows from YouTube stars including Ms. Rachel and Mark Rober, and on Tuesday announced a deal for a scripted show from YouTube Shorts star Alan Chikin Chow. Amazon and Tubi have also been onboarding programming from YouTube talent.

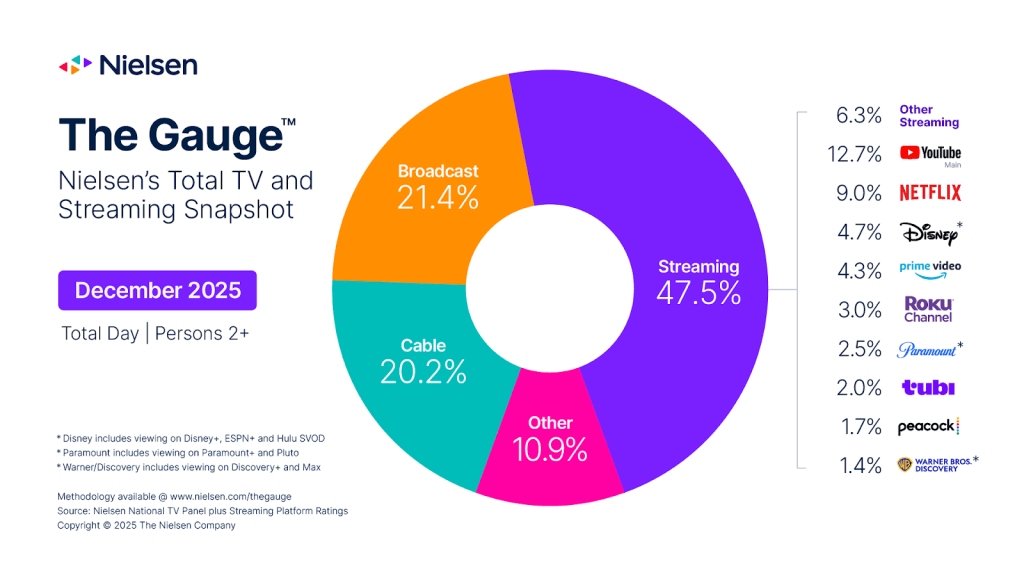

At the same time, YouTube has become the dominant streaming service on TV screens. In December the platform accounted for 12.7% of the total time people spent watching their TV screens, with Netflix a distant second among streamers at 9.0% of total watch time.

While clearly the traditional one-off nature of YouTube videos isn’t exactly hurting the platform’s TV watch time, using shows to establish a more traditional, binge-able viewing behavior would likely only increase its TV watch time.

YouTube seems to have laid the groundwork for brand-sponsored shows with two developments in the past two years. In 2024, the platform introduced YouTube Select Creator Takeovers as part of its upfront pitch to advertisers. That program allowed brands to effectively buy out a YouTube channel’s entire ad inventory for a two-week period. And then last year, YouTube added a feature for creators to organize their videos into Shows. At the time, a YouTube exec Romana Pawar told Digiday that the platform was “still thinking through the exact plan” on selling show sponsorships to advertisers.

The beginnings of that plan were made apparent last November. That was when it hosted an event for ad buyers in New York City in November for creators, including Cleo Abram, Dhar Mann and Ms. Rachel, to present their shows. It’s likely an encore performance is in store for this May when YouTube typically hosts its annual upfront presentation for advertisers, a timely opportunity for the platform to formally pitch the sponsored shows program.

What we’ve heard

“Sponsored content mostly performs worse than organic, ask yourself why? Some of it is because brands are ruining content with over-disclosures.”

— Linqia’s Keith Bendes on influencer marketing disclosures

Numbers to know

48%: Streaming’s share of the time people in the U.S. spent watching their TV screens in December.

62%: Percentage share of creator marketing dollars that went to the top 10% of creators in December.

$1.8 billion: How much revenue Warner Bros. Discovery expects CNN to generate this year.

46%: Percentage share of time spent on Instagram in 2025 that went to watching Reels.

-12%: Percentage decline in the number of production days for film, TV and commercial projects in Los Angeles in the fourth quarter of 2025 compared to Q3 2025.

What we’ve covered

Avocados From Mexico turns to AI to advertise around Super Bowl:

- The brand will launch a digital stunt featuring AI-generated game predictions and recipes using Rob Riggle’s likeness.

- This is the third straight year the brand has opted to sit out the Super Bowl.

Read more about Avocados From Mexico’s non-Super Bowl strategy here.

BBB National Programs is setting standards for creator marketing:

- The non-profit organization has launched a certification program to educate creators on regulatory requirements, like sponsorship disclosure best practices.

- Certified creators will be listed in an official, searchable database.

Read more about creator marketing standards here.

After an oversaturation of AI-generated content, creators’ authenticity and ‘messiness’ are in high demand:

- Creators will need to figure out ways to signal their content isn’t AI slop as the latter pervades platforms.

- They may also need to develop and disclose their stances on using AI in their content workflows.

Read more about creator content here.

How the creator economy breaks down by business model:

- Ad platform Agentio has categorized YouTube creators into three buckets based on average views per video: micro creator, mid creator, macro creator.

- Creators can also be categorized based on other factors, like their type of content.

Read more about creator categories here.

What we’re reading

Netflix’s all-cash offer for WBD:

The streamer has upped the ante in its bid for Warner Bros. Discovery’s streaming and studio businesses as Paramount refuses to relent despite the consistent dismissals, according to CNBC.

Netflix co-CEO Ted Sarandos said the streamer plans to continue to release Warner Bros. movies in theaters if and when its acquisition of WBD’s streaming and studio businesses close, according to The New York Times.

Congress member Ro Khanna has proposed a “Creator Bill of Rights” that aims to provide benefits for creators and standard revenue-sharing terms for platforms, according to Tubefilter.

The short-form video platform has launched a separate app in the U.S. and Brazil called PineDrama for people to watch short-form series that would otherwise seem at home on TikTok, according to Business Insider.

The clothing retailer has hired former Paramount exec Pam Kaufman to develop a “fashiontainment” strategy that seems to boil down to entertainment-based marketing, including collaborations with film and TV companies, according to Variety.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.