Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Why streaming ad formats are due for an update

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the appetite among ad buyers for streaming ad formats to expand beyond the traditional TV-style interstitials.

- Ads+

- Netflix’s Q4 2023 earnings report

- Netflix goes off the top rope, Twitch exits publisher deals and more

Ads+

For as new as the streaming ad market is, its primary ad product is pretty old.

Traditional-TV style ads pervade the streaming marketplace. While those old-school 15- and 30-second spots very much have their place in advertisers’ media plans, ad buyers are hoping the increasing competition among streaming ad sellers will spur more innovative ad options.

“They can’t just compete on [audience] incrementality over linear. They can’t just compete on content because a lot of people have premium content. The expectation from the marketplace is you have to show us something different,” said one agency executive.

“As everyone’s trying to break through the clutter, focusing on attention, I think we’ll probably see an increase in ad innovation and interactive ads in the space,” said a second agency executive.

That heightened attention on ad innovation has become pretty apparent. To kick off the year, GroupM announced the formation of a group, which includes Disney, Roku, NBCUniversal and YouTube, that aims to spur the development of new streaming ad formats. Meanwhile, Disney used its tech and data showcase presentation during CES to introduce new shoppable ad formats. Even the QR code is making a comeback.

“I think QR codes are certainly a factor. It’s so funny; I thought QR codes were dead a few years ago. Who knew?” said the second agency executive.

“The reemergence of the QR code, that was a big deal, like no one saw coming. That became a big deal in this space. We can measure that,” said Andrew Miller, evp of digital activation at CMI Media Group, on stage during the Digiday Programmatic Marketing Summit in December.

To be clear, it’s not like there haven’t been any updates to streaming ad formats over the years. Hulu introduced pause ads back in 2019, and the format has been adopted by NBCUniversal’s Peacock and Warner Bros. Discovery’s Max. And while Amazon Prime Video’s upcoming ad-supported tier will increase the competition for ad dollars, it’s not like the streaming ad market is only just now becoming competitive enough to encourage innovation.

A factor beyond the heightened competition is likely the pressure on streaming services to expand their ad options – and ad revenue opportunities – without overextending their ad loads. Streamers such as Peacock and Max hit the market by pounding their chests about how they would only show a handful of minutes’ worth of ads per hour as a way to not annoy audiences with too many interruptions. These lighter ad loads, however, put a limit on streamers’ abilities to increase revenue at a time when the increasing supply of streaming ad inventory stands to bring down pricing.

“There’s more to buy and more quality to buy, so pricing should actually depress. But that doesn’t equal every streamer is just going to be making hand-over-fist more money because of that depression in price,” said a third agency executive.

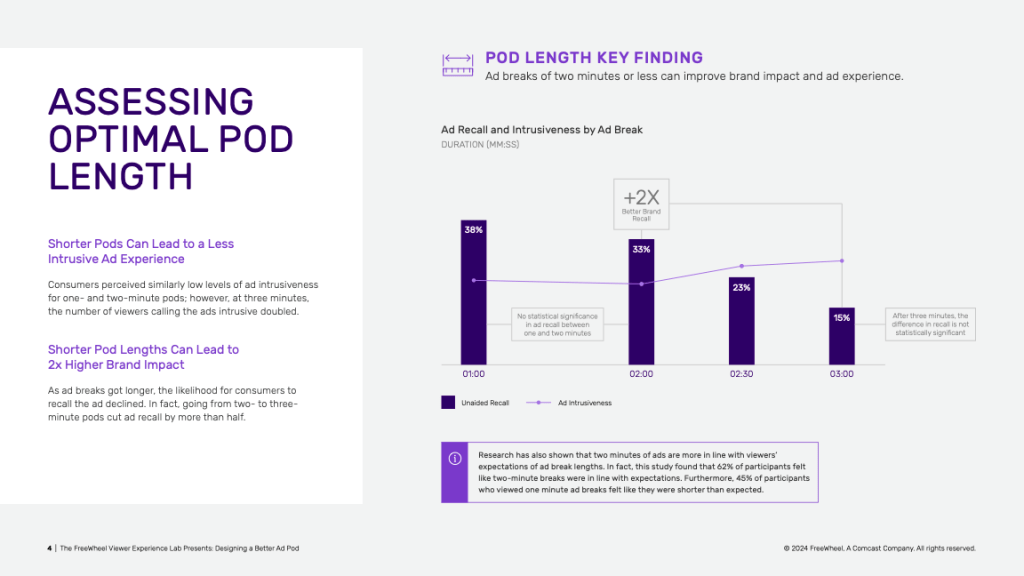

Additionally, while there could be a financial upside to extending the length of ad breaks, there’s a performance hit. According to a study conducted by Comcast-owned FreeWheel, two-minute-long ad breaks result in average brand recall rates of 33%, whereas the average brand recall for three-minute-long ad breaks is half that at 15%.

There is a limit to advertisers’ innovative ad appetites, however. For the most part, ad buyers are interested in ads that are attached to content, as opposed to the out-stream display ads that appear on CTV platforms’ and streaming services’ home screens.

“For entertainment [clients], those are super important. I haven’t seen clients outside the entertainment industry really craving that stuff. They’re still in a video mindset and being within the actual content that somebody is viewing,” said a fourth agency executive.

What we’ve heard

“What we’ll do is we’ll launch that article on one of our [publications like] PureWow. And then what we’ll do is we’ll cast a whole team of influencers that [use the green-screen feature on TikTok for] that article. [They’ll say] ‘PureWow is announcing XYZ beauty product is launching. I’m going to go out and validate and really try this product.’”

— Gallery Media Group CRO Chris Anthony on the Digiday Podcast

Netflix’s Q4 2023 earnings report

Netflix ended 2023 on a high note. The predominant streaming service added 13.1 million subscribers in the fourth quarter, with its ad-supported subscriber base expanding by nearly 70% compared to Q3 2023.

In a letter to shareholders published on Tuesday, the company described Q4 2023 as “our largest Q4 ever.”

The key details:

- 260.3 million subscribers, up 13% year over year

- $8.8 billion in revenue, up 13% year over year

- Gained 13.1 million subscribers in Q4

- Gained 2.8 million subscribers in the U.S. and Canada

Ads update

Netflix didn’t break out many metrics regarding its advertising business in its quarterly earnings report. How much ad revenue the company generated nor how many ad-supported subscribers it has were reported.

“The ads plan now accounts for 40% of all Netflix sign-ups in our ads markets and we’re looking to retire our Basic plan in some of our ads countries, starting with Canada and the UK in Q2 and taking it from there. On the advertiser side, we continue to improve the targeting and measurement we offer our customers,” the company wrote in its letter to shareholders.

Q1 2024 outlook

The first three months of the year is typically a slow period for streaming services, and Netflix thinks Q1 2024 to be no different. While the company expects its subscriber base to grow compared to Q1 2023, it estimates it will lose subscribers compared to Q4, though it didn’t say how many.

As for 2024 overall, Netflix expects there to be more consolidation in the entertainment market, “particularly among companies with large and declining linear networks.” Cough, Paramount, cough, which reportedly may be sold to Skydance Media or Warner Bros. Discovery, cough. Netflix won’t be joining the potential Paramount suitors, though.

“We’re not interested in acquiring linear assets,” the company wrote. “Nor do we believe that further M&A among traditional entertainment companies will materially change the competitive environment given all the consolidation that has already happened over the last decade.”

Numbers to know

$26: The low end of the CPMs Amazon Prime Video is reportedly asking advertisers to pay for Prime Video’s ad-supported tier.

100: Number of employees that YouTube is laying off.

-4.7%: Estimated percentage decline in national linear TV ad spending in 2023 compared to 2022.

15: Number of new shows that Tastemade will produce for Amazon’s Prime Video and Freevee streaming services.

-21%: Percentage decline year over year in new and returning TV and streaming show premieres in the strike-affected fourth quarter of 2023.

418: Number of scripted TV shows that were ordered in the U.S. in 2023, compared to 722 in 2019.

What we’ve covered

As influencer marketing RFPs mature, measurement, attribution and emerging trend strategies come into focus:

- Brands’ influencer marketing requests are prioritizing measurement and attribution.

- Specifically, brands are demanding more detailed data that like, comment and engagement metrics.

Read more about influencer marketing trends here.

How social-centric Gallery Media is taking on events, TikTok Shop and ever-changing algorithms:

- The publisher of PureWow and ONE37pm is among the companies testing out TikTok’s e-commerce platform.

- The company’s influencer business grew revenue by nearly 20% year over year in 2023.

Listen to the latest Digiday Podcast episode here.

What we’re reading

Netflix gets in the live sports ring:

Netflix will pay $5 billion in a 10-year deal to air WWE’s “Raw” on its streaming service, the company’s latest move into live sports (yes, I’m saying professional wrestling is a sport), according to Bloomberg.

The Amazon-owned livestreaming platform has opted not to renew deals that paid publishers, such as Complex Networks, Rolling Stone and Vice Media Group, $1 million to $5 million for distributing exclusive content on Twitch, according to Adweek.

CNN seeks a new subscription product:

Less than two years after CNN+’s debut and immediate demise, the Warner Bros. Discovery-owned TV news network’s new CEO Mark Thompson is open to exploring a new subscription product in addition to figuring out how to update CNN’s mobile video strategy, according to The Wall Street Journal.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.