Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: Q&A with Telemundo Streaming Studios’ Juan Ponce on the ‘upside-down’ streaming market

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing features an interview with Telemundo Streaming Studios’ Juan Ponce on how the market for streaming shows has shifted with services altering their risk profiles and investment strategies.

- ‘Everything is upside-down’

- Streaming holds watch time lead as YouTube matches Netflix

- WTF are frequency caps?

- YouTube’s creator monetization move, Instagram’s standing with creators, Disney’s pitch deck and more

‘Everything is upside-down’

Telemundo Streaming Studios only launched in May 2021. But already, the NBCUniversal Telemundo Enterprises-owned studio has seen the streaming market for shows change pretty dramatically, with streaming services altering their risk profiles and investment strategies.

“Everything is upside-down to what we thought last year,” said Juan Ponce, svp and general manager of Telemundo Streaming Studios, which produces English- and Spanish-language shows aimed at Hispanic audiences in the U.S., Latin America and Spain.

Many of these changes are in reaction to the economic conditions facing the major streaming services. As the number of streaming services on the market has swelled, individual streamers’ subscriber growth has slowed. Meanwhile, the broader economic downturn has companies seeking to cut costs, including programming budgets, while production costs have increased. Amid these challenges, there are opportunities for producers to cut more favorable deals, especially when pitching non-English-language programming that can travel internationally as the streaming wars go global.

In an interview, Ponce outlined how the streaming programming market has flipped upside-down and to what extent TSS is recalibrating its compass.

The interview has been edited for length and clarity.

You mentioned that everything is upside-down right now. What specifically are you seeing as upside-down that you’ve needed to prioritize adjusting or adapting to?

In terms of volume, what we see completely different for the global Hispanic audience is pretty aggressive shift that we’re noticing, a contraction in the number of shows. We see it in the market. We know it from our partners that there is a reduction. I think there is more curation by most of our partners. We were very dreamy about seeing the hockey stick about studio volume for the global Hispanic audience. But that’s no longer the case. What we see now is a normalized level of volume.

The second part is investments. The general consensus is that there is going to be fewer shows but probably more investment and more curation to each show that is produced. And what’s important is the marketing and the risk to it. Meaning, as important as content is, now promotion and the programming schedule is going to be as important as the content itself. Making sure that people can see through the large amounts of content in the platform is going to be critical going forward.

And lastly, given the changes for all the platforms and changes in the macroeconomic conditions, there’s a lot more risk-aversion. There is a general search for more established [intellectual property]. So we see bigger trends in book IP and known or established stories that can be taken and adapted. There’s a little bit of a more conservative approach to new and original content.

Given the shift in volume and the risk appetite among the streaming services, how have you adapted how you package your shows?

We’re trying to be extremely acute on the regional parameters. That’s one of the largest value propositions that we have. We have a history of producing for 15-plus years, and we have produced in every single region. So there’s the ability or infrastructure and supply chain to produce effectively, efficiently and with the standards that most, if not every, platform requires. That entails [environmental, health and safety guidelines], labor reforms, compliance, et cetera.

What we are seeing is that more general-market productions are looking outside the U.S. for opportunities to be more efficient with the infrastructure, with production capabilities and in tax credits, like regional tax credit opportunities. There is an internationalization in terms of physical production that is happening.

To what extent did those considerations figure into the recent opening of the Mexico City production unit?

We are very thoughtful and strategic about where we have physical production versus having a co-producer partner or strategic partners. And so we honestly think that basically comes down to the volume and timelines that we expect. In Mexico, it’s a core area for our business, for our productions. And so having a presence there was critical.

For at least a few years now, there’s been a trend of non-English-language shows accruing audiences internationally, regardless of their national languages. That can make the shows more valuable for streaming services that either are already international or are looking to expand internationally. Are you seeing that the streaming services are primarily looking to buy up full international rights on an exclusive basis?

That’s another element in things that have changed. Until recently, that was the biggest priority, the biggest push to try to basically get all the international rights and distribution rights. Basically all of the ownership. Now what you’re seeing in some cases is a more openness to share windows or share territories or share in terms of the economics. It is still very nascent. We don’t see it yet as a massive dynamic.

In some of our pitches last year, [the situation] was either you’re okay with selling all of the IP or we can end the meeting now. Now [the situation is] instead of paying for all of the production budget for cost-plus, more platforms are open to share the windows, particularly if it’s with linear [TV] and the investment that goes into it. They’re seeing that the audiences are not necessarily cannibalized.

I imagine that’s beneficial from the producer standpoint and gives you more options when it comes to signing deals. When you have a show that you’re taking out to market right now, are you prioritizing distributors in certain territories or certain types of windows?

Being part of such an incredible and large company such as NBCUniversal, we have the infrastructure to invest in the stories we like but also we are powered by a worldwide distribution arm, which can help us at the push of a button with incredible relationships around the world. And so our ability to find the required funding on the different windows, distribution channels, et cetera, is part of our DNA. That distribution is really a moat and valuable proposition for this type of condition.

For the right ideas, we try to find what I call our anchor clients or our anchor lead. Meaning, if there is a show that one of our Spain clients really likes, we bring to the table the opportunity to say, “Look, this is the investment you can make for your platform. Let us find the rest of the windows.” And we can maximize that opportunity to find the other locations.

We’re not prioritizing any specific winner. The nature of Telemundo Streaming Studios is to go first with streamers. So that’s the first step; we need a streaming client first. But in terms of the second windows or linear windows or paid channels, et cetera, we don’t have prioritization. We try to ensure the content will fit the distribution channel it needs.

Production costs have gone up between the Covid-19-related costs and fees going up for cast and crew members, locations and set materials. And then interest rates have also gone up. How have you adapted to these rising costs of production?

Yes, there is a rise in costs and Covid. But for us in Latin America, it’s still a backlog from the last couple years when there was a volume glut. Meaning, there was saturation in terms of the supply chain trying to deliver all the content requested by the platforms.

There’s more volume in the region, and that’s exciting for us. But the adverse effect is there was difficulty finding crews or prepared crews to be able to execute on this project. So there’s been significant labor inflation in most regions that we are working in, particularly Latin America and that’s the case in Spain. So right now there has been a huge push to train and prepare more technical and creative individuals so that we can address this over-saturation.

We have secured our own talented individuals to try to avoid having to be subject to finding the trained professionals. But then we’re also working with the right partners who have the right staff and the right teams. There is certainly an inflation factor. But that’s how we have been able to protect ourselves as much as the environment allows us to.

This interview has been updated to reflect that Ponce said Telemundo has a 15-plus year history of producing. A previous version mistakenly quoted him as saying it was a 50-plus year history.

What we’ve heard

“They’re not allowing QR code or any other way for advertisers to figure out if [an ad is] having any impact. It seems like they’re going out of their way to protect their view. They don’t want to upset their user base and are willing to forego satisfying advertisers.”

— Agency executive on Netflix’s advertising parameters

Streaming holds watch time lead as YouTube matches Netflix

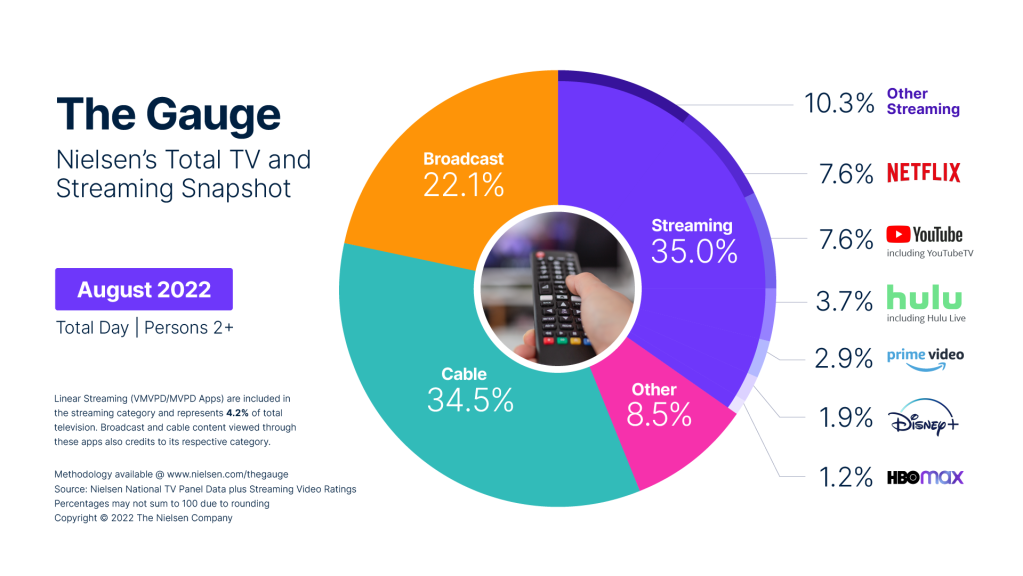

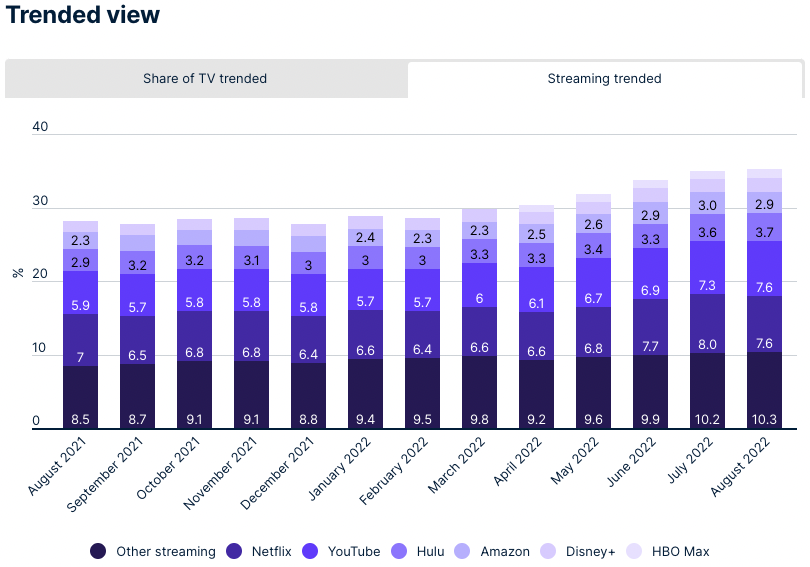

After surpassing cable TV’s share of TV watch time in July, streaming maintained the largest viewership share in August, according to Nielsen’s latest The Gauge report.

The caveat to the July numbers also apply to the August figures: This is not exactly a peak TV watching period. People are traveling and/or spending time outside the house during the summer, most major sports are on hiatus and TV networks and streaming services don’t air as many high-profile shows.

“Total TV usage was down slightly in August, which is typical as summer winds down. In fact, broadcast was the only category that had a volume increase, up 1.6%,” Nielsen wrote in a company blog post announcing the August results.

Not that streaming’s watch time decreased in August from July. Instead, it flattened month over month.

However, within that flattening, the share of watch time among streaming services did shift. Of the streaming services broken out by Nielsen, Netflix lost the most share, while YouTube gained the largest chunk. As a result, YouTube matched Netflix’s share for the first time.

Numbers to know

45%: Percentage share of ad revenue for YouTube Shorts videos that YouTube will pay to eligible creators.

$750,000: How much money TikTok’s top star Khaby Lame has been paid for a single sponsored video.

99.4%: The ratio of Disney’s female employees pay compared to their male counterparts.

10: Number of unskippable ads that YouTube had been testing showing viewers during a single ad break.

70%: Percentage share of adult Gen Z viewers who said they primarily watch videos, shows and movies with captions enabled.

WTF are frequency caps?

Ad-supported streaming audiences complain about being besieged by the same ads over and over again. This streaming ad overexposure issue has also aggravated advertisers that want their campaigns to attract customers, not annoy them.

However, frequency management for streaming advertising is not so simple, as covered in the explainer video skit embedded above.

What we’ve covered

Why Facebook, Instagram and TikTok have stepped back from social commerce:

- Apple’s anti-tracking changes hurt Facebook’s ability to prove performance.

- The social commerce experience for users is clunky across platforms.

Read more about social commerce here.

DTC skincare brand Truly turns to TikTok to reach Gen Z and millennials through short-form videos:

- Truly’s in-house marketing team produces all of its TikTok videos.

- Instead of relying on influencers, the brand uses real people in its videos.

Read more about Truly’s TikTok strategy here.

What we’re reading

YouTube’s creator monetization move:

YouTube will lower its requirements for creators to be eligible to participate in its ad revenue-sharing program and start sharing ad revenue for YouTube Shorts, according to The New York Times.

YouTube’s female creator harassment issue:

Female YouTube creators continue to be besieged by misogynistic comments and harassment on the Google-owned video platform, according to The Washington Post.

Instagram’s standing with creators:

Instagram has admitted internally that it trails TikTok and YouTube when it comes to creator satisfaction, including in enabling creators to make money on the Meta-owned platform, according to The Information.

Disney+’s advertising pitch:

Disney’s ad sales pitch deck for Disney+ shows the streamer will run pre-roll and mid-roll ads with strict frequency caps and inventory sorted by audiences’ age groups, according to Insider.

Netflix’s ad-supported expectations:

Netflix expects to have 4.4 million people using its ad-supported tier by the end of this year and more than 40 million by the third quarter of 2023, according to The Wall Street Journal.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.