Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: A Q&A with BET’s Louis Carr on the upfront market so far

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing features an interview with BET’s Louis Carr about how this year’s upfront market is progressing.

- ‘People are not taking it serious enough’

- TV, streaming watch time habits are getting stale

- Netflix’s ad prices, upfront ad rollbacks and more

‘People are not taking it serious enough’

Louis Carr didn’t need to go to the South of France to immerse himself in work this week.

BET’s president of media sales is preparing for the BET Awards on June 30. “I call it like hosting a wedding party for 175,000 people,” said Carr. At the same time, he’s girding up for this year’s upfront market to kick into its next gear. And then there’s small matter of parent company Paramount Global’s on- and off-again sale status, as well as BET’s own potential sale.

But Carr was able to carve out some time to discuss BET’s corporate status and the status of this year’s upfront market as well as the state of BET’s streaming ad business and the industry’s diversity efforts (or lack thereof).

This interview has been edited for length and clarity.

First off, elephant in the room, BET has reportedly been up for sale on and off for at least the past year. What’s the current status?

There’s a Paramount headline every other day, sometimes two or three times a day. So at this point, the last headline is that the Skydance deal is off. So we don’t know where we are at this point.

Does that affect how you approach the upfront or the conversations that you’re having or the questions that you’re getting from buyers?

The only question is: Are you going to Black-owned or you’re not going to be Black-owned? And so at this particular point, the only [thing] we can say [is] today we’re not Black-owned, which is the truth.

And that’s always something of a challenge because obviously your audience is predominantly Black — multicultural, writ large — but not being Black-owned limits to what extent you can be competing for advertisers’ multicultural budgets that typically require media companies to be minority-owned. How are you tackling that?

We tell the people, you know who our audience is; we are the scale player with that audience. We have more platforms reaching that audience than anybody else. We have more content reaching that audience than anybody else. We use more Black creators than anybody else in the space, whether [those other media companies] are Black or non-Black. We still are the scale player in every measurable aspect of the business. So as I tell a lot of clients, “Don’t hurt yourself. Help yourself out and use the scale player to the fullest extent so that you can move your business forward.” It’s about growth at the end of the day.

And that’s been a big theme this year heading into the upfront, the performance side of the upfront. Everyone’s really interested in business objectives. Not necessarily transacting against business outcomes, but having outcome-based measurement be a key thing on the table. How’s BET adopted this, or to what extent have you incorporated that into this year’s pitch?

Well, it’s always been there. When you’re the biggest in your particular space, they look for you for those analytics.

Are they looking to you for different metrics?

You know, we’re getting ready for the BET Awards, and we’ve had more advertisers this year [asking], “Can we do a brand lift study? Can we do a brand lift study around our messaging, around our integrations in the BET Awards?”

Anything that you attribute that to, so many more advertisers being interested in brand lift studies?

I think people are trying to say, “Is it working?” I think agencies are being held more to business goals and objectives in their overall deals, and they want to do business with partners and people who understand that and are willing to put the resources and go the added mile to say, “Hey, we believe in our product. We believe in this audience. And we’ll do what it takes to help you prove out the case.”

Speaking of, having launched BET+’s ad-supported tier — BET+ Essential — last year, what’s the big thing that you’ve learned and are applying to the streaming side of the upfront pitch this year?

The big thing I’ve learned is that it is as popular as they say. The streaming channel’s doing extremely well. We have extremely high sellouts around BET+ Essential. It’s just continuing to get more subscribers and broaden the distribution.

How many subscribers does it have now?

The ad-supported tier currently is at a little over a couple million.

And how does that compare to the ad-free tier?

The ad-free tier’s about 3.8 million [subscribers] right now.

Do you expect at some point the ad-supported tier to overtake the ad-free tier in subscriber count? Is that a goal for you?

No, that’s not. We want to continue to grow, and we believe, as you continue to grow the overall ecosystem — as BET+ gets over 4 million subs — that the ad-supported tier will continue to grow right along with that.

And how’s the interest around the ad-supported tier grown in terms of the upfront this year? What percentage of the commitments that BET lands this year do you expect to be earmarked for streaming?

The good thing about us is most of our clients are trying to do it all, not one or the other. What we saw a year ago in the upfront was, “Let’s wait and see what happens.” Now it has happened, and most of our clients are extremely interested in it.

Is it something where you would expect 100% of deals this year to at least incorporate it?

I wouldn’t say 100%. I would say probably a good 50%.

One thing that’s interesting to see how it plays out each year is the measurement currency conversation. What are you learning this year? Is it just another test-and-learn year, or are there any new flavors to it this year?

Everybody’s trying to find the right mix. I don’t think anybody is using just one thing. I think everybody’s using multiple things to try to make sure that they get the proper and most accurate measurement for the content that they’re producing. Some people are like, “Yes yes we like VideoAmp.” Some people are like, “Eh not so.” Some people are still pushing panels.

Are there any specific measurement providers that BET is getting behind in this upfront and really pushing?

Right now we are looking at big data. We were there last year. We’re going to continue to try to do more with people this year. We have taken a look at VideoAmp; we’ve taken a look at iSpot. We’re looking at having conversations with everybody.

When I speak to people at non-English-language TV networks about the measurement currency conversation, they say there isn’t enough talk about accrediting and certifying the measurement providers for diverse viewership. And obviously one thing that kicked off this whole changeover has been the lack of representation in Nielsen’s traditional panel. Is there anything you’re seeing or feeling like the industry isn’t paying enough attention to when it comes to what needs to work for the future of measurement?

Clearly they are not giving multicultural audiences the attention that it needs. It’s been broken forever. And you know what they will say is they say it’s all broken. But when you look at the importance of multicultural measurements to the whole, you can’t say let me fix this piece over here first, and then we’ll get together. You’ve got to fix the whole thing because multicultural audiences are so important to the overall whole. It’s not one or the other. Both have to be fixed.

Do you feel like there’s enough prioritization of fixing the multicultural part in order to fix the rest?

No. Not even with some of the new guys. There’s still deficiencies there on counts and sample sizes. Somebody at some point has to make it a priority and then figure out how to build a business off of it. But I do think the business case is out there.

Anyone that you see as candidates for building that business, being that catalyst?

I think that all of them have it in their sights. Have they moved fast enough? I would say no.

I feel like that could be a blanket statement.

People are not taking it serious enough. So we’re hoping that we are driving that conversation in the space as the biggest in the space.

And lastly, what stage is the upfront market in right now? Two years ago, it felt like right now was when everyone was wrapping up and trying to be done by Fourth of July.

It’s gonna be drug out a lot longer than that. If you look at the marketplace right now, some have registered budgets; some have not registered budgets. And those who have registered budgets said, “This is first pass.” And so the negotiations really haven’t even started with a lot of guys.

Are you expecting to be able to get firm budgets? Because what was it, two years ago when everybody got their commitments in, but then when it came for orders in August and September, everybody was freaking out because orders were coming in a lot lower?

I’ve heard that a lot in the industry, but I’ve never had that experience. I would say 98%, 99% of what is registered goes forward. Very, very little drops off.

Sounds like you have a relatively smooth summer compared to a lot of folks.

I don’t know that it’s going to be smooth. We haven’t gotten into negotiations yet. I’m not thinking it’s going to be smooth, though. Trust me.

What we’ve heard

“TTD’s interpretation of the IAB Tech Lab’s definitions for video inventory does not align with the broader industry consensus.”

— Yahoo spokesperson Erin Miller on its dispute with The Trade Desk over in-stream video ad labeling

TV, streaming watch time habits are getting stale

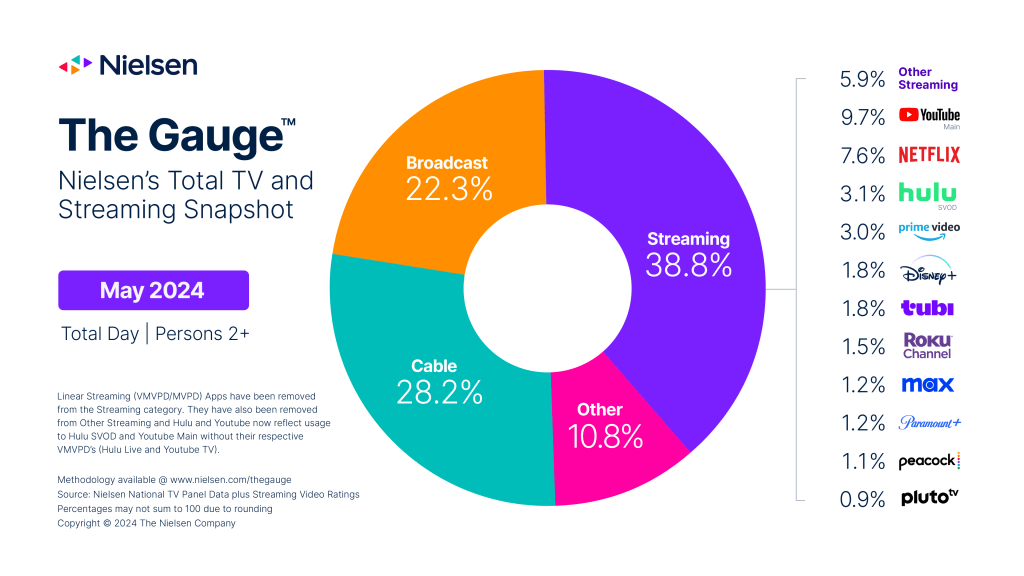

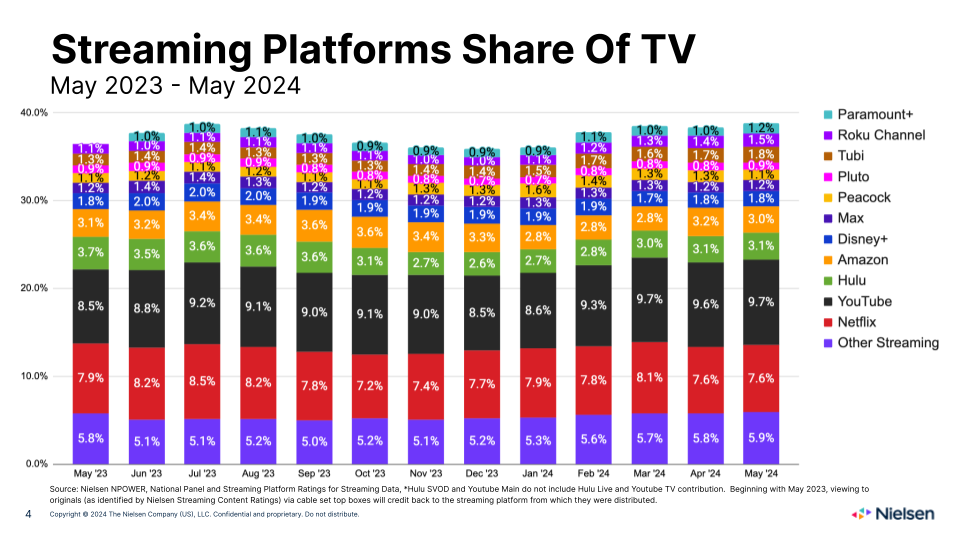

People’s TV watching habits seem to be getting a little stagnant. While the amount of time people in the U.S. spent watching their TV screens dipped in May compared to April but ticked up compared to May last year, how they spent that time didn’t change all that much, according to Nielsen’s latest The Gauge viewership report.

If you squint, you may notice that streaming’s viewership share ticked up to its highest mark to date (by 0.1 percentage points). You’ll have to squint harder to see much of a shift when it comes to how watch time broke down by streaming service.

To save you the eye strain, the biggest month-over-month changes were Paramount+ gaining 0.2 percentage points and Amazon Prime Video and Peacock losing 0.2 percentage points. That’s zero point two.

Numbers to know

61%: Percentage share of top-bill actors in this year’s top 50 shows who were white, a 5% increase year over year.

>15 million: Number of subscribers that Apple said it could deliver for the NFL’s Sunday Ticket package, which was too many for the league.

16%: Percentage decline in canceled subscriptions for streaming bundles versus standalone subscriptions.

100,000: Number of motion picture and sound recording employees in Los Angeles County, 20% below the pre-pandemic mark.

What we’ve covered

Omnicom and The Trade Desk co-develop new data solutions to optimize CTV budgets:

- The companies are plugging TTD’s TV data and Flywheel’s commerce data into Omnicom’s Omni platform.

- Omnicom used the data to plan this year’s upfront deals for 40 clients.

Read more about Omnicom and TTD here.

Daily Mail plans to debut a dozen YouTube shows in 2024 in long-form video push:

- Daily Mail has 20 shows in development that will feature episodes around 20 minutes long.

- The publisher has hired 12 full-time employees to work on the new shows.

Read more about Daily Mail here.

Why influencer agencies are drawing attention at Cannes Lions:

- Cannes could provide the impetus for a wave of M&A activity among influencer agencies.

- One influencer agency CEO made the case for agency holding companies as potential buyers.

Read more about influencer agencies at Cannes here.

The Trade Desk and Yahoo are locked in a trading dispute with a looming deadline:

- TTD disagrees with Yahoo’s labeling of in-stream inventory.

- Yahoo believes TTD is not adhering to the industry standard definition.

Read more about the video inventory dispute here.

How influencer agencies vet and navigate past fake influencers and followers:

- The rise of virtual influencers and AI-generated content can make it harder for influencer agencies to validate influencers.

- The industry lacks singular tools for authenticating influencers’ followings and engagement metrics.

Read more about influencer vetting here.

What we’re reading

Netflix has cut back its ad rates to the low-to-mid $30s CPM to be more in line with Amazon Prime Video’s pricing, according to The Wall Street Journal.

Upfront advertisers nab streaming price cuts:

Netflix isn’t the only ad-supported streamer cutting its rates. Some upfront advertisers have been able to secure lower streaming and traditional TV ad prices in this year’s market compared to last year’s, according to Variety.

As Paramount’s controlling shareholder, Shari Redstone has ultimate say in whether the media conglomerate is sold — or not, as demonstrated last week — and seems to be ultimately stripping Paramount of its value the longer she holds onto it, according to Puck.

Roku’s demand-side platform may be on the way out, but the connected TV platform owner is introducing a new ad tech arm to sell its inventory … to DSPs, according to AdExchanger.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.