Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: A look at Netflix’s streaming bundle playbook

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how Netflix is going about bundling subscriptions to its streaming service.

- The streaming bundle playbook

- Netflix moves up the TV watch time ranks

- Netflix loses Naylor, Warner Bros. Discovery considers split, NBCUniversal wraps upfront and more

The streaming bundle playbook

As major streamers continue to combine sales efforts by packaging themselves into singular subscriptions a la the traditional pay-TV bundle, Netflix has drawn a line in the sand when it comes to streaming’s bundle bonanza. The company is not keen on combining sales efforts strictly with other streaming services like in the case of Disney’s and Warner Bros. Discovery’s Disney+-Hulu-Max bundle.

“We haven’t bundled Netflix solely with other streamers like Disney+ or Max because Netflix already operates as a go-to destination for entertainment thanks to the breadth and variety of our slate and superior product experience. This has driven industry leading penetration, engagement and retention for us, which limits the benefit to Netflix of bundling directly with other streamers,” Netflix wrote in a letter to shareholders released on July 18.

With that said, Netflix has put itself into bundles with other streamers. For example, Comcast’s StreamSaver bundle includes Netflix’s ad-supported tier as well as Apple TV+ and Comcast-owned NBCUniversal’s Peacock. And just last week, Verizon introduced a bundle of sorts by offering a free year of Netflix’s ad-free tier to annual subscribers of Peacock’s ad-supported tier.

But there are three important callouts when it comes to Netflix’s participation in those two bundles. First, they are centered around aggregators — Comcast and Verizon — selling the subscriptions to those companies’ existing customers. Second, the Comcast bundle sells access to Netflix’s ad-supported tier. And third, the Verizon bundle only offers one year of access to Netflix’s ad-free tier.

“By Netflix being a part of the [Comcast] bundle, it will expose Netflix to [Comcast] customers that may not subscribe to Netflix without that. And what that does is simply increase the share for Netflix,” said Mike Proulx, vp and research director at research firm Forrester.

By contrast, Netflix abstaining from Disney-WBD-style bundles appears to be the company’s way of ensuring the bundles provide incremental subscriber increases — or, put another way, of making sure the bundles don’t cut into its existing subscriber base.

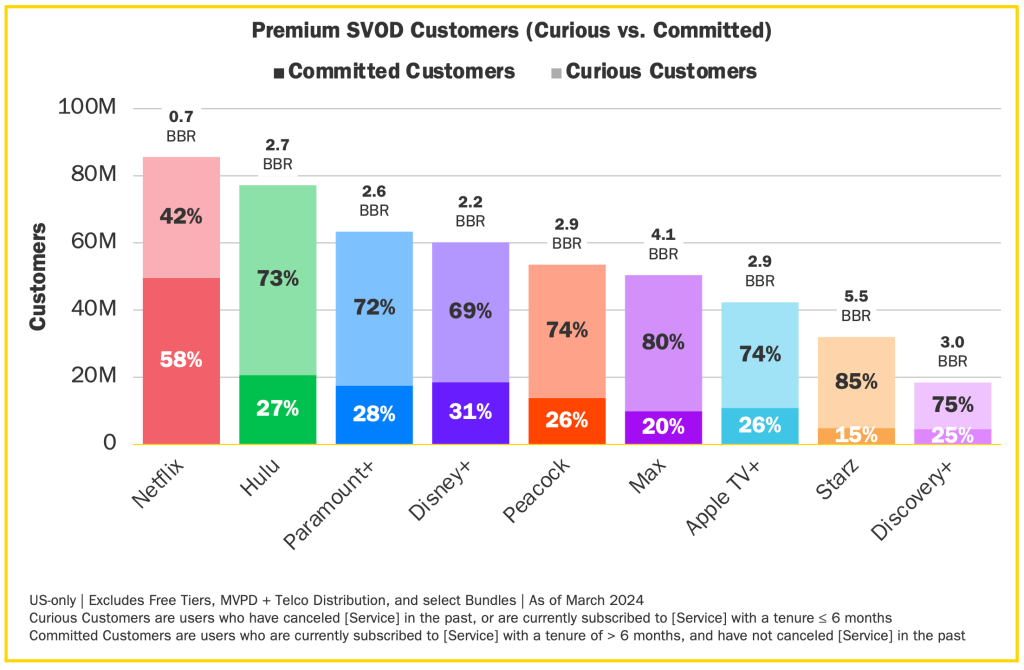

As subscription research firm Antenna noted in its “State of Subscriptions” report released in June, Netflix “should carefully scrutinize potential bundle offerings.” The reason being that Netflix has a higher share of longstanding subscribers versus new or previously churned subscribers compared to other streamers.

In other words, Netflix may be more at risk than other streaming services of bundles cutting into its profit margins. Given that the whole point of a bundle is to give subscribers more for their money, a streaming service like Netflix likely stands to make less money per bundled subscriber than per a direct subscriber.

Which helps to explain why Netflix would only make its ad-free service available to Verizon’s bundled subscribers for a year: The lower per-subscriber revenue could be accounted for as subscriber acquisition costs (assuming enough of these subscribers graduate to direct subscribers after the initial year).

But then, the Comcast bundle isn’t a limited-time offer. Nor is it for Netflx’s ad-free tier. It’s for the ad-supported tier and for good reason. For starters, Netflix could use the help, considering it doesn’t expect to reach “critical ad subscriber scale” until next year. But perhaps more notably, advertising raises the per-subscriber revenue cap to potentially more than offset any downward margin pressures.

And so, yeah the bundle is back. But Netflix’s approach indicates that the bundle’s primary value is narrower than being a means of acquiring subscribers, full stop. That’s true in the near term. But in the long term — and as has long been the case for the traditional TV bundle and its value to cable TV networks — the bundle’s big benefit is providing a stable pipeline of ad-supported subscribers that streamers can mine for revenue to the depths of advertisers’ pockets.

What we’ve heard

“I don’t feel like we have enough insight to know what the right price tag is for any of those kind of deals, and I don’t think anyone does.”

— Entertainment lawyer on content licensing deals with AI companies

Netflix moves up the TV watch time ranks

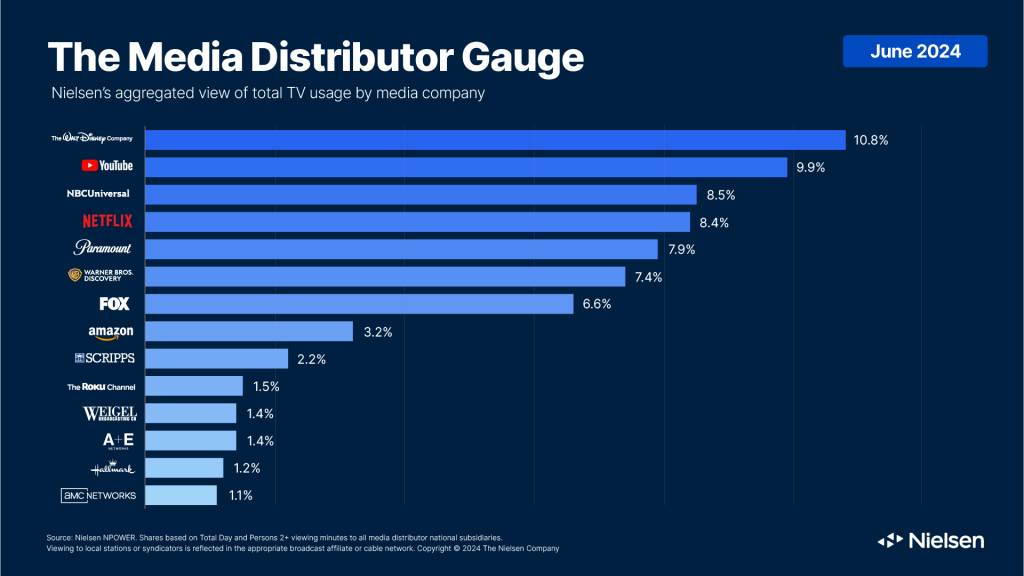

Netflix has leapfrogged two TV network owners — Paramount and Warner Bros. Discovery — to rank as the fourth most-watched media company in terms of TV watch time, according to Nielsen’s The Media Distributor Gauge report for June 2024.

Aside from Netflix’s ascendance, the rankings remained in line with the previous month’s report. Disney retained its overall lead, with YouTube maintaining the No. 2 spot, though the gap between the two did close to less than a percentage point.

Numbers to know

278 million: Number of paid subscribers that Netflix had as of the second quarter of 2024.

-500,000: Number of subscribers that NBCUniversal’s Peacock lost during Q2 2024.

>50 million: Number of global monthly active users that TelevisaUnivision’s streaming service ViX had, as of Q2 2024.

$2.2 billion: How much TV network and streaming service owners will pay over 11 years to air WNBA games.

30: Number of employees that Fox Entertainment is laying off.

-3.73%: Percentage year-over-year decline in TV ad impressions in the first half of 2024.

What we’ve covered

What Naylor’s exit from Netflix means for streaming overall:

- Netflix’s global ad sales lead Peter Naylor is leaving the company amid the upfront negotiations.

- The company plans to hire a new of head of sales for U.S. and Canada.

Read more about Netflix here.

How Revolut’s creator strategy is benefitting from YouTube’s long-form swing:

- The U.K.-based challenger bank is prioritizing YouTubers in its creator strategy.

- Personal finance content lends itself to longer durations.

Read more about Revolut’s creator strategy here.

What we’re reading

The Comcast-owned conglomerate has wrapped its upfront negotiations for the year and claimed an increase in the amount of money advertisers and agencies committed, according to Variety.

Warner Bros. Discovery weighs going separate ways:

Warner Bros. Discovery may become Warner Bros. and Discovery, with the company considering splitting its studio and streaming business into one company and its TV network business into another, according to the Financial Times.

Warner Bros. Discovery’s last-ditch NBA bid:

TNT’s parent company (for now at least) has decided to exercise its matching rights to nab NBA games away from Amazon, though the league may not agree to WBD’s proposal, according to The Hollywood Reporter.

Netflix loses top ad sales exec:

Former NBCUniversal, Hulu and Snap sales leader Peter Naylor can now add Netflix to his list of former employers, with his departure coming less than a year after Netflix’s original ad boss Jeremi Gorman left and was replaced by Amy Reinhard, according to Business Insider.

The iPhone maker may be worth more than $3 trillion, but having spent $20 billion-plus on original shows and movies, the company is looking to tighten its budget, according to Bloomberg, which also reported that Apple is interested in licensing more movies from major studios.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.