This article is part of a cross-brand Digiday Media series that examines how the creator economy has evolved amid the Covid-19 pandemic. Explore the full series here.

Online shopping was exacerbated by the pandemic, which closed in-person stores and made customers look for safer shopping alternatives. But an ever-growing segment of those online purchases have happened on social media and that’s not a slowing trend.

By the end of this year, social shopping, meaning transitions made on or through platforms like Instagram, Facebook and TikTok, will become a $45.7 billion market, according to eMarketer. And for that, we have influencers and content creators to thank, in part, for their promotions, posts and reviews of products that have been known to sell out items after going viral.

Content creators are true arbiters of virality and if a brand is conversion-minded in its social marketing campaigns, working with influencers could be a good idea. But how truly impactful are creators and influencers on the individual level in driving transactions and how much money are they able to earn on average?

Shopping on social media is a growing trend

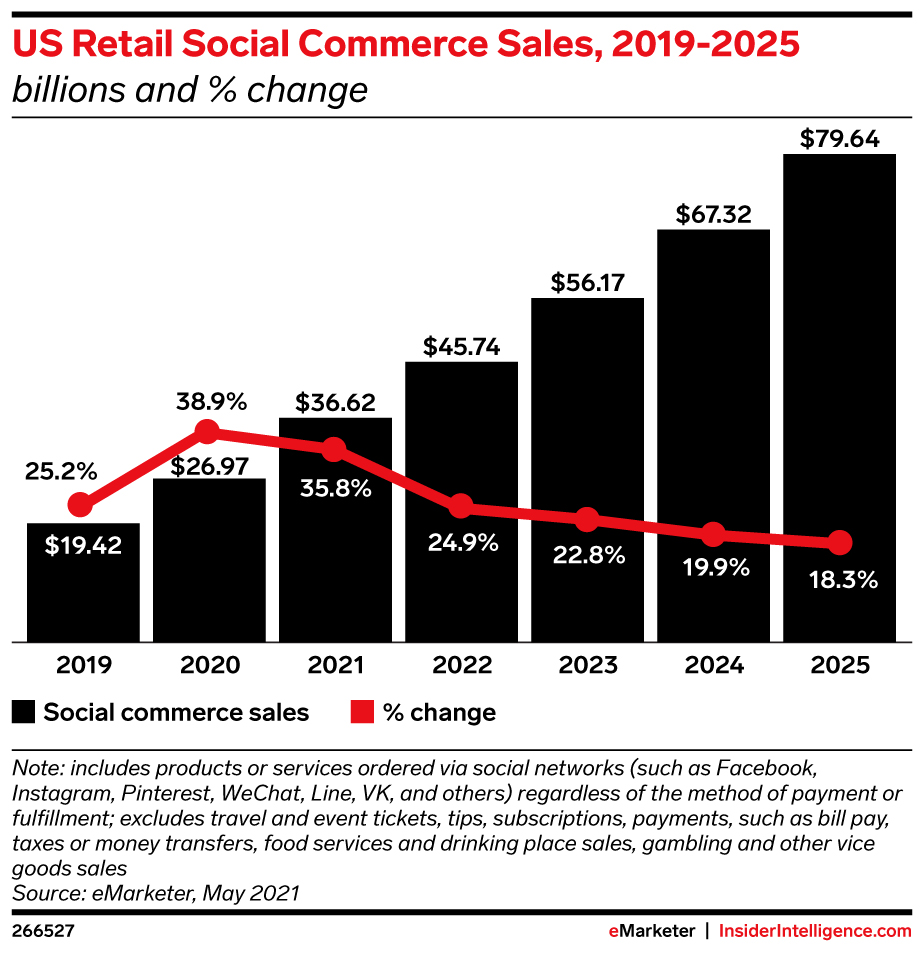

Purchases made through social media posts are expected to more than double between 2021 and 2025, according to eMarketer’s report from May 2021.

During the three years spanning 2019 to 2021, total retail social commerce sales increased on average by 33%, amounting to a total of $36.6 billion in 2021. While the annual rate of change is expected to fall to 24.9% in 2022, and to below 20% as of 2024, this market is expected to hit almost $80 billion by 2025.

Digging further into this, eMarketer reported that about 36% of all internet users in the U.S. bought something on a social media platform in 2021, while an even higher portion — about half — of all social media users aged 18 to 34 made at least one purchase via social media. Facebook was the most popular social platform last year with 56.1 million people transacting on its website.

And yet, social commerce accounted for just 4% of the U.S.’s retail e-commerce market in 2021.

Platforms also boosted their livestream shopping offerings last year chasing consumers who were kept at home during the pandemic. China alone had been forecasted to bring in $131.5 billion dollars in livestreaming social commerce sales, according to eMarketer.

Influencers carry an impact at all levels

Influencers range in number of followers, but the tide is turning in terms of how brands view working with influencers with smaller followings.

Furthermore, nano and micro-influencers might carry better engagement rates with their users because they have a higher capacity to engage with those followers via direct messages or comments on posts, which helps them to create communities and increase their audiences’ level of trust in them.

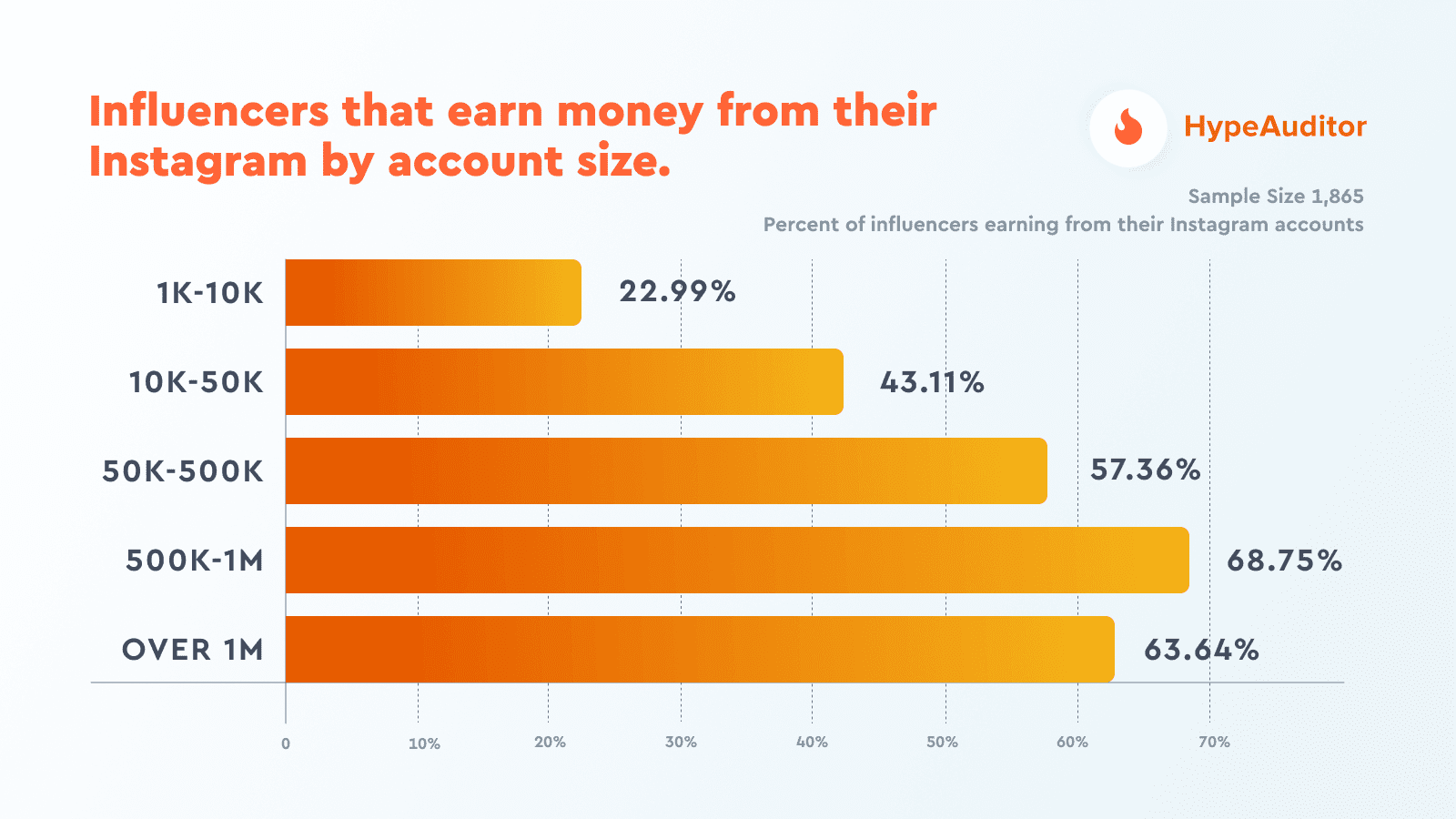

On Instagram, about one-quarter of influencers who fall in the “nano” range of followers make money from their accounts, while closer to half of all influencers in the “micro” range earn some amount of money from the platform, according to a survey of 1,865 influencers conducted by HypeAuditor in 2021.

The macro tier is the most profitable group with over two-thirds of all influencers in HypeAuditor’s study making money from the platform.

According to HypeAuditor, the average influencer earned $2,970 per month through Instagram at the time of the study. Micro influencers earned approximately $1,420 per month on average, while mega influencers with over 1 million followers earned an average of $15,356 per month.

However, the number of sales they drove through affiliate marketing links and commerce deals can widely vary based on product category and price point.

In 2019, one Forbes Agency Council member Maddie Raedts, the founder and CCO at IMA and the global head of social for fashion and luxury at MediaMonks, wrote in a post that one of her travel clients saw conversion rates of 3% to 5.8% on an Instagram influencer campaign thanks to swipe-up links offering discounts. And back in 2016, one influencer marketing agency Grapevine reported that the industry average conversion rate of consumers making a purchase through influencer content was 2.5%.

Don’t overlook micro influencers

This year, Influencer Marking Hub anticipates that micro-influencers will play a bigger role in contributing to the number of sales made through their content because while they may have fewer followers, their audiences tend to be more engaged.

Lindsay Hittman, president and co-founder of affiliate marketing and content monetization platform BrandCycle, said “the thing that we see work really effectively for some [micro-influencers] is [high posting] volume. Some of the micro-influencers we work with are posting to their [Facebook groups and on Instagram] 20 to 30 times a day and that allows them to test a lot of products, test a lot of price points and test a lot of different brands.”

Micro-influencers could also have a better understanding of what will get someone to stop mid-scroll. Whereas a larger influencer or celebrity may post more about limited releases or new launches from “cutting edge brands” that align with their inspirational and elusive allure, micro-influencers are going to focus on relatability and post about sales or discounts, Hittman said.

“With some of the larger influencers, you see some more of the cutting edge newer brands that have fewer skews that they’re promoting, where the micro-influencer may promote more of the traditional big box stores because the amount of things they can post day after day is so much greater,” said Hittman.

Because of this, macro-influencers tend to post fewer products on a daily basis, limiting the chances of conversion.

“From a brand perspective, it all depends on what their goal is. Is it a branding play or is it a conversion play? We find that micro-influencers can convert at a much higher rate [so] if it’s a conversion play, you go to the micro, if it’s a branding play, you go to the macro,” said Hittman.

More in Media

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

In Graphic Detail: AI licensing deals, protection measures aren’t slowing web scraping

AI bots are increasingly mining publisher content, with new data showing publishers are losing the traffic battle even as demand grows.

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.