5 charts: The 2015 back-to-school season saw record mobile search, spending

September is underway, meaning kids’ days are busier and parents’ wallets a little emptier. For retailers, the 2015 back-to-school shopping season is largely in the books — Deloitte data shows that 74 percent of back-to-school shopping is completed by the time the semester starts.

This year, cross-channel shopping and researching reached a peak. Smartphone and tablet shopping carts grew, as well as mobile search traffic, according to IBM’s Digital Analytics Benchmark report.

“Mobile is rocketing up for both researching and purchasing,” said IBM product strategy specialist Hannah Egan. “For retailers, providing the right kind of engagement on that platform means that we’ll interact.”

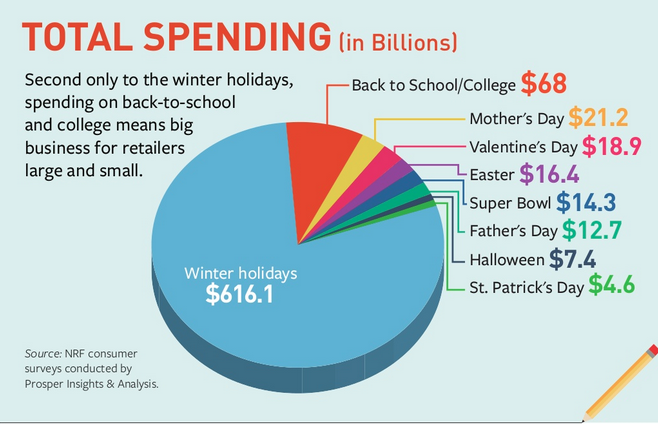

The National Retail Federation estimated in June that back-t0-school shopping (for grades K-12) would reach $29 billion this year, with families expected to cut back on individual spending from the $669 in 2014 to $630 in 2015. With the back-to-college crowd factored in, the shopping season is a $68 billion industry, still a very distant second to the winter holidays, a $616 billion industry.

IBM’s report shows that this year more parents shopped and browsed on their smartphones than ever before. The month of August saw a year-over-year boost in online sales of 12 percent, while mobile transactions jumped 42 percent over last year in the same period. In a June report titled “Back-to-School Ecommerce Preview 2015: Forecast and Trends for Retail’s ‘Second Season,’” eMarketer predicted that July and August retail sales in the U.S. would spike 4.6 percent overall.

This year, according to IBM, mobile research was a major player in influencing back-to-school purchases. Parents looked to their smartphones to research before buying just as frequently as they looked to desktop, for the first time. Traffic from mobile websites, at 49 percent, matched traffic from desktop, at 50 percent, in August, with mobile traffic seeing at 19 percent jump from 2014. Last year, 58 percent of shoppers browsed on their desktops, compared to 41 percent who browsed on smartphones.

“This really reflects how much mobile is growing,” said Egan. “Retailers have to realize that consumers have their phones on them at all times, and they have to be investing in their digital channels.”

IBM’s report showed that smartphones drive the most momentum in both researching and purchasing for back-to-school: 37 percent of all online traffic in August took place on smartphones, while 13 percent of all online traffic took place on tablets. But thanks to the bigger screen, the tablet’s average shopping cart had a greater value. (The desktop shopping cart, however, had the greatest value of all three.)

According to Egan, it’s not necessarily that people are buying more items on their desktops and tablets but that people are making bigger purchases on those devices, which have clearer visuals than the smartphone.

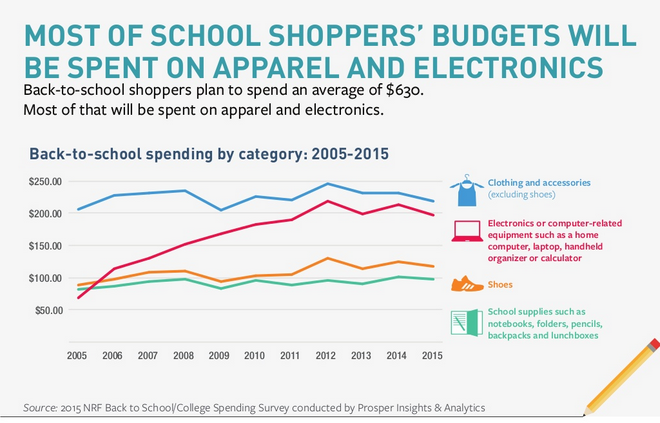

The categories that see the biggest boost in sales for both grade-school and college students are apparel and electronics, according to the NRF. With an average seasonal spend of $630 per family, three-quarters of that is spent on electronics and apparel, followed by shoes and then school supplies.

IBM found that both online and mobile sales increased for department stores, home goods stores and apparel stores in August over the same period last year, with the percentage of mobile sales seeing a bigger boost than overall online sales.

Egan said that as the back-to-school shopping season moves toward digital channels, it’s still a time spent between parents and kids in preparation for the school year.

“Retailers can now provide the same experience online, so parents will sit down with their kids and go online to shop,” she said. “It’s a way to spend the last few weeks of summer not in the stores.”

NRF data shows that for 75 percent of parents, half of their back-to-school season spending is directly influenced by their kids’ opinion — meaning online or not, the kids are helping to call the shots.

More in Marketing

The case for and against organic social

Digiday has delved into the debate, weighing the arguments for and against marketers relying on organic social.

Inside Google’s latest move to postpone the cookie apocalypse

Despite Google’s (most recent) assurances that it would stick to its (newest) game plan, there has been a lot going on as of late.

While Biden signs the TikTok bill, marketers still aren’t panicking

No one seems convinced (yet) that an outright ban will happen anytime soon.