Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘We’re getting more used to the uncertainty’: BBC Global News chief on ad-funded news

BBC Global News, the commercial, international arm of the BBC, has, like other publishers, weathered sudden double-digit percentage drops in digital ad revenue over the last six months from coronavirus-induced spending freezes.

And like other publishers, March’s record traffic of 115.3 million global unique monthly visitors, according to Comscore, did not yield the revenue they normally would have. That is until August, where digital ad revenue was up year-on-year due to the release of pent up demand or deferred campaigns.

Now, with programmatic ad rates rebounding, outgoing CEO Jim Egan is optimistic about the prospect of ad-funded news. We spoke with Egan about where the green shoots are and how publishers’ relationships with platforms are shifting. The interview has been condensed and edited.

What’s the outlook for the fourth quarter?

It does vary so much by geography and sector. But at the aggregate level, the outlook is still pretty hard for the second half of the year. Hopes we had back in March about a quick snapback are starting to recede. Although, there’s a lot of pent up demand and people want to get back to business. But until we’ve got more concrete visibility of a vaccine and when people are reliably able to go back to work safely, that rush of money back into the market is going to hold off.

We’re finding Canada and the U.S. really quite robust. And we’re seeing some clients which are new to the BBC and bigger deals from existing clients, particularly in Home Entertainment, technology, enterprise software, those sectors. They’re helping make this year much better than it might otherwise have been.

What are you doing differently to get marketers spending?

With those long-standing clients who are facing the biggest challenges, this is a moment for a different type of client service. We have to be as patient and as responsive as we can and acknowledge the challenges that many of these major advertisers are going through as they face fundamental threats to their business models.

How has your ability to forecast improved?

Everyone will say the same thing: We always felt we were having to be much more short term than we would like. And that’s just got worse.

The ‘in the moment’ sense of crisis has receded since March when every day was unprecedented. This has been an endorsement of the adaptability of human beings and communities and also businesses. We’re just getting more used to the uncertainty rather than the uncertainty receding.

Has the make-up of BBC Global News revenue changed for good?

The importance of our distribution revenues — which has been mainly pay-TV revenues — but also money that we get from syndication and licensing to a growing number of digital partners. In a relative sense that went up.

I’m optimistic rather than pessimistic about [digital advertising] there has been a short-term change in the proportions of the revenue mix, but some of the longer-term trends are still there,

Mark Thompson talks very interestingly and eloquently about how reader revenue and subscription income became very important but that’s not to say that advertising revenue didn’t matter anymore. These are topics that we’re thinking about very very hard right now. When you start to sign people in, and you have a first-party database relationship with them as well as moving people through the funnel of subscription revenue, that’s helpful for your advertising outlook. That trend of having a first-party data relationship with audiences, that’s long term and will outlive the coronavirus crisis by a long way.

How is BBC Global News impacted by Apple’s recent announcement?

For us, Apple’s recent announcements aren’t all that significant. Of course, we’re paying close attention. We’ve always been more cautious than others about where we get data from and how we build up all audience profiles, we try to rely on site information that we have. We’re thinking about a world in which data availability is more about zero-party and first-party data, where there’s a more closely targeted offer for advertisers. While doing a better job of keeping our users’ data private and responding to those concerns. But there isn’t quite as much at stake for us in the transition because our reliance has been less.

How has the relationship with platforms changed?

The interesting frontier is what’s happening to Facebook and Google and the way regulation is becoming a very serious reality and their attempts — which are not the same — to either preempt that regulation by coming up with renewed terms of trade with new publishers or respond to the regulation.

What’s your view on what’s happening in Australia?

I’m surprised Facebook has gone there that quickly with threats to go dark in terms of news. Its argument that news isn’t that important to it commercially may well be true. But reputationally, news and a healthy relationship with the news publishing community is probably more important than they would like to admit. If you can’t find some peaceful and harmonious accommodation with the news industry — and by extension the political sphere — things start getting really, very, uncomfortable.

Having a sensibly regulated and moderated framework for how platforms work with news publishers — which helps to maintain the news ecosystem which Facebook and Google claim they’re so committed to— hat’s what everybody wants to see. Getting so acrimonious and so hostile at this early stage in the process doesn’t feel like a positive step.

This is the first really significant regulatory move on the economic front. This is the first time someone’s tried to come up with a regulated rate card for how it should work and trying to arrive at a fair set of terms without invoking all sorts of unintended consequences and perverse outcomes. That’s really hard for the regulators to do.

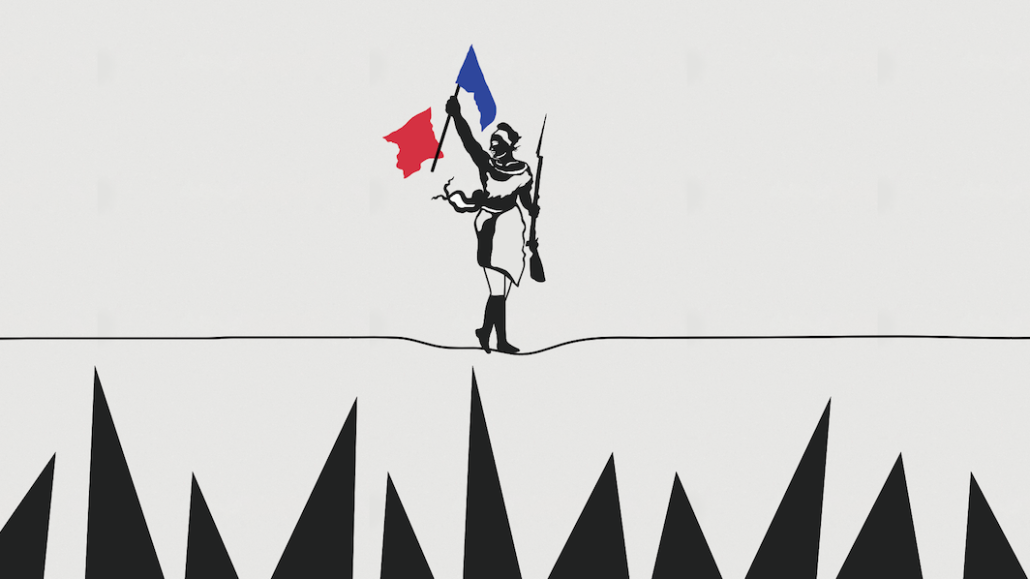

Commercially funded journalism and publishers’ relationships — both with audiences, advertisers and social media platforms — is very complicated. But good journalism doesn’t have an underlying demand problem, people want to have access to news that they can believe in. I’m fundamentally optimistic about the future of this business.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.