Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘We have seen increasing demand’: Facebook video powers a user-generated content surge

The viral video has been making a comeback on Facebook.

Just as YouTube created a niche economy nearly a decade ago for licensed clips of people doing outrageous things, the opening of Facebook’s video advertising business has ushered in a second era of demand for user-generated content, with companies like Jukin, ViralHog and Newsflare all benefiting as individual page owners and creators rush to monetize the low-cost clips.

Facebook now drives more demand for ViralHog clips than YouTube does, founder and CEO Ryan Bartholomew said. Jukin Media, which got its start mostly by licensing content to legacy broadcasters, quietly launched a self-serve platform late last year that allows anybody to license clips for as little as $49, and through the first half of this year nearly half that platform’s 1,200 customers are individual creators, a company spokesperson said.

So far, ad buyers and creators say the surge in supply hasn’t yet had a noticeable effect on ad fill rate or CPMs, which can vary widely depending on the variables in play. But media companies and creators that make significant investments in their productions grouse that the move puts them at a disadvantage.

“We’re all competing for so many ad placements,” said one creator whose videos have accumulated more than 100 million views on Facebook.

Demand for user generated content has surged across media this year. The coronavirus’s spread made it impossible for ad agencies and production companies to make high-end, original shows or commercials, so agencies, production studios and publishers all began looking around for alternatives.

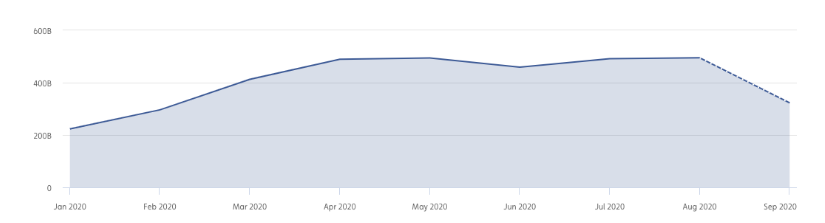

And so far, the audience on Facebook seems not to mind. In the aggregate, video views on content not produced by brands or media companies has grown steadily all year, climbing from 223 billion views in January 2020 to 495 billion in August 2020, Tubular data showed.

“Influencer and user-generated content has been growing for years, but 2020’s production limitations due to the pandemic have allowed this sort of ‘homemade’ content to become more of a rule than an exception,” said Neil Patil, chief commercial officer of Tubular Labs.

Brendon Mulvihill, svp of licensing at Jukin Media, said much of the new demand Jukin has seen this year has come from advertisers, who have needed more video content to make up for production shortfalls.

But a lot of the demand for the clips has been fueled by individual creators who see an easy opportunity to monetize videos on a second platform.

This summer, Facebook greatly expanded the number of pages eligible for in-steam video monetization. In August, the number of pages leapt more than 30%, to 109,000. As of September 14, that total has held steady since then, according to a document Facebook regularly updates for advertisers inside its ads manager.

Mulvihill noted that licensing demand among Jukin clients has been strong for longer clips, particularly those that are at least three minutes in length— the minimum length of a clip that Facebook will monetize; a quick addition of some captions or commentary is usually enough to satisfy the originality requirements that Facebook put in place two years ago.

Those pages are all subject to an approval from Facebook, though several ad buyers said that the growth felt like a move meant to juice supply rather than exert any kind of brand safety control, with one buyer saying they “stay away” from in-stream ads unless they absolutely need to hit a scaled audience number.

But the surge has not had any effect on the price or how those videos perform inside Facebook’s platform. ViralHog CEO Bartholomew noted that most of the videos his company licenses are done on a rev-share basis, where ViralHog takes a cut of the ad revenue generated from videos using the clips it licenses, and “we have not had any downward pressure on rev share,” Bartholomew said. “We have increasing demand across the board.”

While large media companies have complained for years about having to compete with user-generated content for ad dollars, some say they sense that Facebook’s in-stream program is doing a good job ensuring that higher-quality content is paid for.

“I have a feeling that not all content is created the same,” said Sharon Rechter, the president of First Media, which operates media brands including Blossom and So Yummy.

Like virtually every media company with a distributed video strategy, Rechter said the instream ad fill rate for First Media’s Facebook videos slid when the coronavirus first hit, though the videos remained profitable thanks to higher view counts. First Media does not have a direct sales team selling its inventory.

But as more and more pages have become eligible, Rechter said her company’s fill rate didn’t get hit.

“Premium stuff will convert better than other stuff,” Rechter added. “I think the algorithm probably recognizes that.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.