Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The Washington Post cuts off ad tech vendors slowing its site

It’s hard for publishers to say no to vendors that advertisers want to work with. But in its effort to speed up advertising, The Washington Post has had to rethink its use of vendors.

As the Post has built on its own proprietary ad products, it has cut out several of the ad servers, ad builders, native-ad and video vendors it used to work with.

“We go to our partners and say, ‘This is how fast things need to be executed; if you don’t hit this threshold, we can’t put you on the site,’” said Jarrod Dicker, the Post’s head of ad product and technology. “We found that vendors we do use are ones that went back to their engineering teams and found out how to expedite their loads. … The vendors that haven’t been able to come to the table with faster solutions, we no longer integrate with.”

The Post declined to name which vendors they’ve dropped or share how many vendors they’re currently working with. But Dicker said that over the past year, the publisher has decreased its reliance on vendors “significantly.”

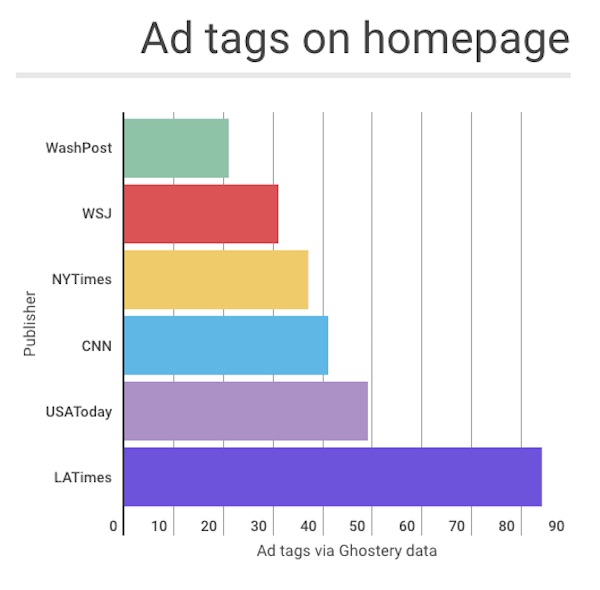

The Ghostery tracker tool shows that the Post has fewer tags fire on its homepage than do other large news publishers.

The Post has been able to reduce dependence on vendors because its growing internal product development team creates products that it uses in lieu of third parties. Over the past year, the team has grown from three to 10 members. And it has licensed its products to about 110 companies, which include publishers like Tronc.

But the Post can’t end its reliance on vendors altogether, though. Publishers need exchanges and programmatic platforms to bring in advertisers at scale. And advertisers want to have the option to use vendors their clients want.

To keep track of the vendors advertisers bring on, the Post relies on (another!) vendor called Domo, which tracks and analyzes the performance of other vendors. But since new ad tech companies are always springing up, it’s unlikely that even a specialized firm like Domo can immediately plug into every third party that Post advertisers use. What matters is whether the service can track the majority of them.

“Even if we only tracked 80 percent, that is still a win,” said Jason Tollestrup, director of programmatic at the Post. Tollestrup declined to estimate what percentage of vendors he believed Domo could track.

Having relationships with vendors has other uses aside from driving revenue. The Post’s internal product-development team can learn from them as it creates new products that it licenses to other publishers.

“In the past year, our focus has been to build first, and not just replace reliance on vendors, but to actually infiltrate the vendor space ourselves,” Dicker said.

Photo via The Washington Post

More in Media

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.