Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The Rundown: Travel, entertainment ad spend expected to remain strong in 2022, while early pandemic trends drop off

The travel and entertainment industries are slowly bouncing back nearly three years after the global pandemic hit and punished them mightily. Other sectors that took off earlier in the lockdown, however, are seeing a slowdown in advertising spend as companies consider a possible recession.

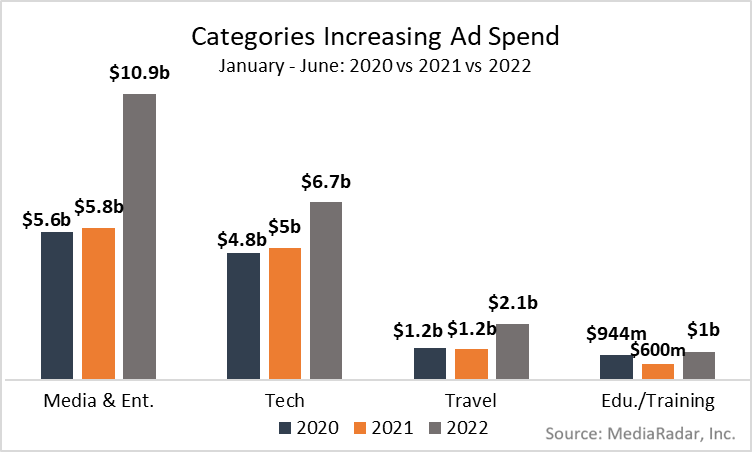

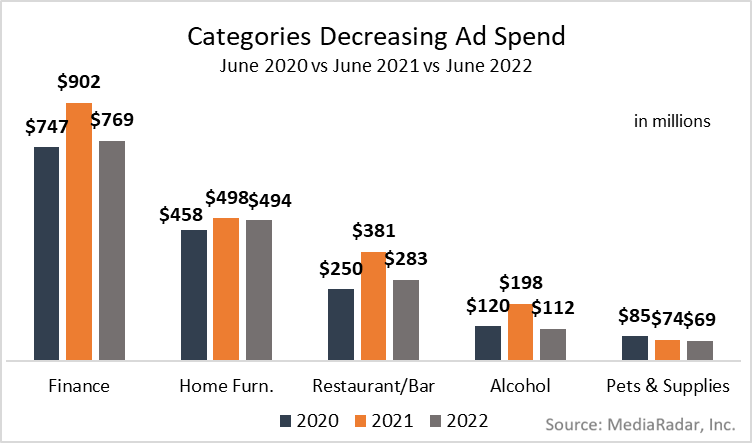

In a new analysis by intelligence platform MediaRadar, ad spend categories including travel and entertainment in the first half of 2022 (January through June) both increased to record levels – while ad investments in real estate, home goods and pet supplies declined when compared to last year. Consumer shopping trends embraced in the last two years, such as with home office furniture and pets, are starting to drop off as those markets shift.

“Similar to the beginning of the pandemic, we are seeing a shift in advertising investment,” said Todd Krizelman, CEO and cofounder of MediaRadar. “Rising interest rates, fuel expense and high inflation of course raise the spectre of recession.”

While 2019 spending data was not available, H1 2020 levels were lower across the ad spending categories. There have been major increases this year, especially in media and entertainment and tech investments when compared to the early months of the pandemic year. The home products and restaurant categories that are seeing decreases now are actually returning to spending levels similar to what we saw in 2020, perhaps as a correction to the boosts they got in 2021.

MediaRadar expects these 2022 increases to remain strong through the second half of the year, even though travel costs and gas prices have spiked recently. Krizelman explained this probably won’t deter people from going out again, whether it’s traveling or going to the movies.

“Even with surging crowds, long queues at airports and higher-than-ever rental car and flight prices, there is record demand for travel. Because of this, we are not forecasting any downturn in the travel industry in the second half of 2022. This may be one of the more resilient segments of advertising for the next 6-12 months,” Krizelman said.

Winners: entertainment, tech and travel on the rise

- The media and entertainment ad investments by far showed the largest increase, growing from $5.8 billion in H1 2021 to $10.9 billion in H1 2022. This is almost double the spending compared to last year, driven mostly by streaming companies, according to MediaRadar. Movie promotion also grew within this category, with $1.2 billion invested so far this year.

- Tech ad spend went up from $5 billion in H1 2021 to $6.7 billion during same period this year, reflecting a 34% year-over-year increase. There was growth in semiconductor chips, mobile and business software.

- Travel ad spend grew from $1.2 billion in H1 2021 to $2.1 billion in H1 2022, representing an 83% year-over-year increase. Investments were driven by major airlines, cruise lines and tourism groups.

Losers: home furnishings, real estate and restaurants see a drop

- The financial and real estate investments saw the biggest slowdown in the last month, dropping from $902 million in June 2021 to $769 million in June 2022. There was high demand as people bought homes outside cities and ordered furniture and goods for working remotely, but things are cooling down on this front.

- Home furnishings ad spend was down slightly from $498 million in June 2021 to $494 million this June. Restaurants and bars are also seeing a significant decline in ad spend, down 25% from $381 million last June to 283 million this June.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.