Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: The coronavirus pandemic left marks on publishers’ 2021 revenue plans

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Publishers have spent years trying to get creative about diversifying their revenues. A deadly, and lingering, pandemic appears to have reshaped those priorities a bit, according to the latest Digiday Research.

For a second consecutive year, Digiday conducted a survey of publisher professionals to ask questions about the coming year. This year’s survey used a sample of 181 respondents; last year’s went to 135.

While the survey touched on several topics, the bulk of it focused on publisher revenue streams, both as they exist now and where they fit into respondents’ plans for 2021. Respondents were asked to choose from a list of six responses to describe how focused they were on building out a particular revenue stream over the next six months, ranging from “not focused at all” to “a very large focus.”

After a year that challenged almost every facet of most publishers’ businesses, publishers enter 2021 with a list of priorities that is largely unchanged from last year’s.

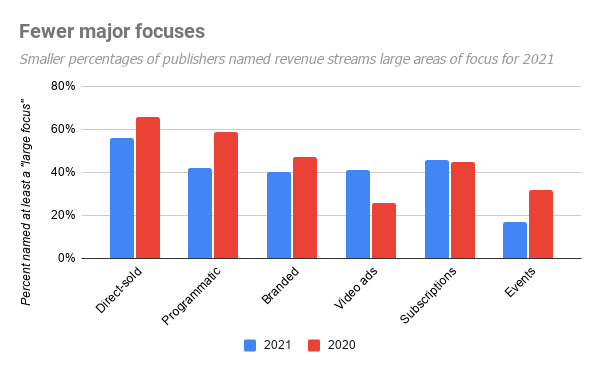

Direct-sold advertising and subscriptions, the two top priorities among respondents to last year’s version of this survey, again topped lists this year, with 56% of respondents saying growing their direct-sold business was at least a “large focus” for this year; 46% said the same about growing subscriptions.

But further down the list of priorities, however, evidence of coronavirus’s lingering effects can be found. The effect on events is most obvious, with the percentage of publishers who said events would be a large focus in the first half of 2021 at 17%, down from 32% the previous year.

Sources: Digiday+ Winter 2021 Publisher Survey; Digiday+ Winter 2020 Publisher Survey

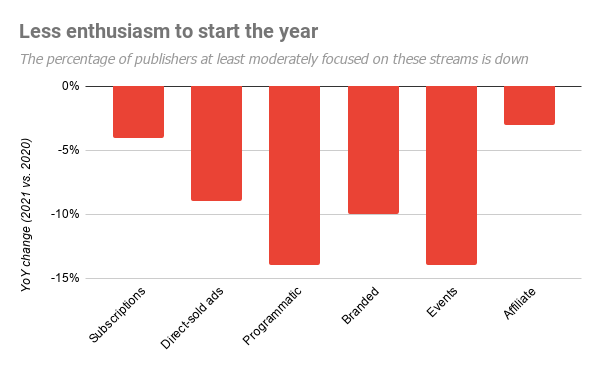

Similarly, advertisers’ interest in campaigns with shorter turnaround times has made branded content less of a focus. Going into 2020, nearly three quarters of survey respondents said branded content growth was at least a moderate focus; going into 2021, fewer than two thirds of respondents said it was a moderate focus.

Conversely, video advertising showed a large jump in interest. Forty-one percent of 2021 respondents called it at least a large focus, compared to 26% of 2020 respondents.

Interest in affiliate commerce, despite the banner year of growth it delivered for several publishers, was slightly down, dropping from at least moderate focus for 39% of respondents in the 2020 survey to 36% of respondents to 2021’s.

Sources: Digiday+ Winter 2021 Publisher Survey; Digiday+ Winter 2020 Publisher Survey

Taken in total, publishers appear to largely be shifting their attention away from anything that does not have traction in their own businesses. When the survey’s responses were given numerical value, with 0 representing “not a focus” and 5 representing “a very large focus,” the weighted averages for almost every option were down this year.

Just one choice on the 2021 survey — direct-sold ads — recorded a weighted average greater than 3, and four choices recorded weighted averages lower than 2.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.