Secure your place at the Digiday Publishing Summit in Vail, March 23-25

As it gears up for a pre-IPO roadshow that will launch on Monday, Snap co-founder Evan Spiegel will reportedly focus on how much time Snapchat’s users spend inside the app, rather than his company’s plans to grow its user base. That’s sound strategy for a company whose flagship product has essentially stopped growing: Snapchat’s daily active user base has been essentially flat on Android, and is slightly down over that same period, according to data from mobile app analytics firm Apptopia. Snapchat did not respond to a request for comment.

But before anyone freaks out, it’s important to note that digital media as a whole seems focused principally on engagement, rather than raw audience size. Spiegel’s selling points could be pointing to a new paradigm in social media: In a world where groundbreaking ideas can become commoditized within months, something Snapchat has experienced not just with Stories, but also with video chat, maybe the most important thing is remaining important to users.

“More time spent on these platforms in new capacities assigns them more value in the lives of the people that use them,” said Mike Dossett, a manager of digital strategy at RPA.

While Snapchat’s experienced its share of torrid growth, it’s also experienced its fair share of theft. As far back as 2014, when Snapchat added video chat to its service, it’s earned plaudits in the tech press for features, only to have competitors swoop in to copy them.

Today, video chat is one of the hottest areas of competition in mobile media, and Stories, after being ripped off by Instagram, is even being copied by publishers, and that rip-off might be the first of many. Just as the Huffington Post stole Snap’s story idea, the obsession with video chat, as a way to encourage users to spend more time with them, has spread to companies as disparate as Tinder and Signal.

Some startups, like Houseparty, focus on live group video; others, like Marco Polo, treat video as a walkie talkie; still others, like Jam, have skipped the struggle of trying to scale on their own, casting themselves as extensions that can be launched inside apps like Apple’s iMessage. “This space is fun because there are many apps at work,” said Adam Blacker, a brand ambassador for Apptopia. “Basically, there are too many.”

Now that everyone can do it, more and more platforms are looking for ways to make their video connections stand out. But it’s not yet clear what works. “I think it’s still very unknown how people are going to use this new tool they have,” said Erik Martin, the vp of marketing at Airtime, a mobile video app that allows multiple users to stream content and experience it together.

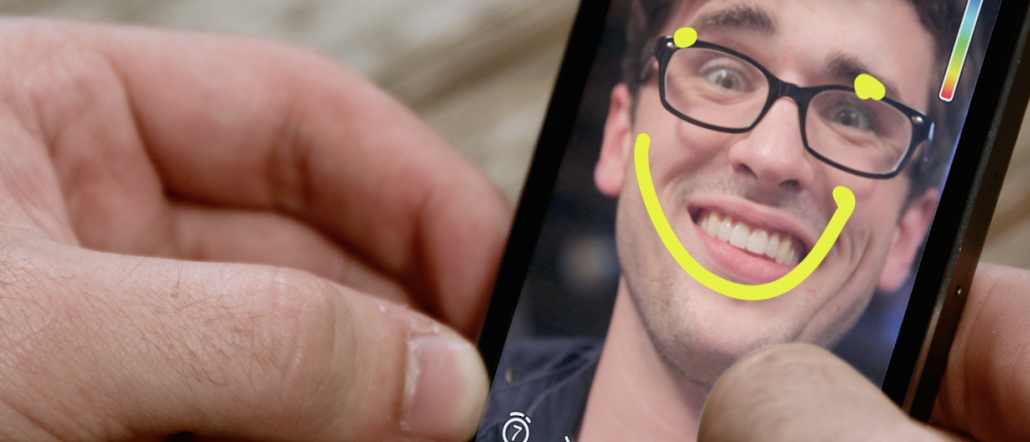

Features like stories, video chat, filters and Discover are surely part of the reason why more teens say they’d make Snapchat the only app they’d bring to a desert island than anything else. But they might not be the thing that gets new people to sign up. Starting next week, and then ultimately on March 1, we’ll find out whether investors worry about that or not.

More in Media

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.