Last chance to save on Digiday Publishing Summit passes is February 9

Header bidding has had an uptick in popularity in the past two years, and is now used by the majority of the internet’s most popular sites.

Header bidding allows publishers to simultaneously offer inventory to multiple exchanges before making calls to their ad servers — giving most of its adopters a 20-30 percent bump in CPMs, according to separate studies by Prohaska Consulting and Sonobi. But it’s also contributed to slow page-load times and strained the infrastructure of programmatic platforms.

Here are four charts that summarize the state of header bidding.

Industry adoption

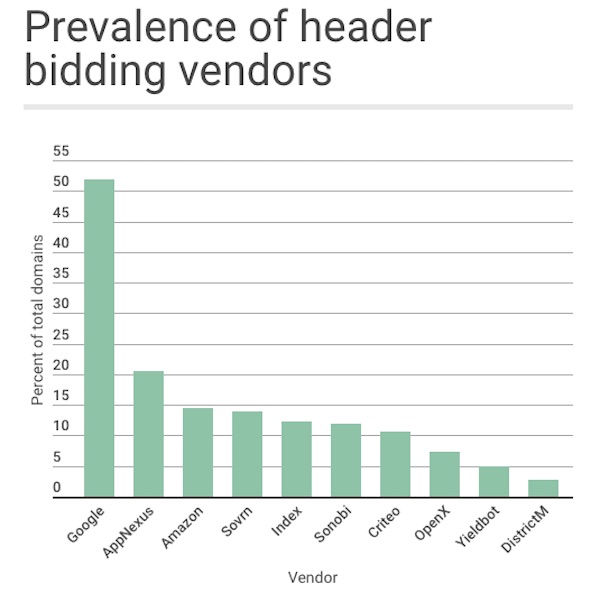

In July, Sizmek examined the code of the 30,000 most popular websites on the internet and found that 60 percent of the domains included tags from header-bidding vendors. Sizmek didn’t track vendor tags that are hosted in server-to-server connections, it still provides a good idea of the prevalence of header bidding since few publishers have gone all-in on server-side bidding.

The most popular bidder remains Google, which appeared on more than half of the domains Sizmek analyzed. But given that Google had a near monopoly back when the publisher waterfall was the dominant method for selling inventory programmatically, it’s clear header bidding has opened the door for other vendors to sell large swaths of inventory.

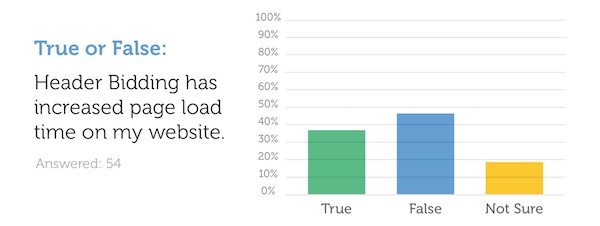

Slow load times

The biggest problem with header bidding is that it often slows sites by adding code to the publisher’s site. About 40 percent of publishers who adopted header bidding noticed it slowed down their sites, according to a survey by ad tech firm Sovrn.

Most publishers’ tech setups aren’t sophisticated enough to identify the ad units or vendors that cause the most latency. For publishers that have lots of third parties plugged into their tech stacks, the sluggishness that header bidding causes can be a wake-up call to re-examine their ad setup, said Emry Downinghall, vp of advertising at online book rental company Chegg.

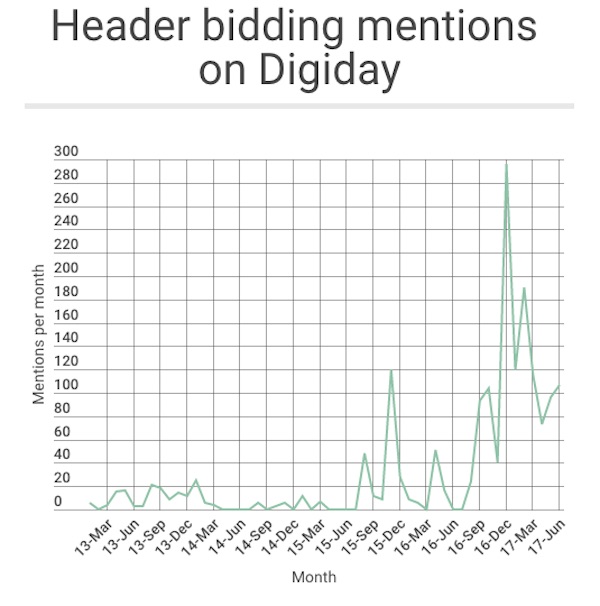

Entrenched buzzword

People didn’t always use to the phrase “header bidding” to refer to unified auctions. For years, vendors pushed their own nomenclature. As the chart below shows, the phrase took off in the summer of 2015. The term’s growth is credited to a private programmatic Slack channel, AdMonsters events and AdExchanger articles using the buzzword.

Digiday has also jumped on this bandwagon. Shift Communications ran a crawler on our site and found that our use of header bidding has skyrocketed over the past year.

Platform strain

Header bidding lets publishers make their inventory available to as many exchanges as they want at the same time. This has contributed to an explosion in bid requests that programmatic platforms have to process.

There are no industrywide figures on the uptick in bid requests, but the trend is seen across large platforms. Turn processed around 1.3 million ad impressions per second in 2014, but by December, it was processing 4.5 million impressions per second. The Trade Desk processed about 1 million impressions per second two years ago; by December, it was processing 5.7 million impressions per second. Rubicon Project processes about 20 billion ad impressions per day, about five times what it processed two years ago.

Since processing bid requests strains DSP servers, these platforms are looking to algorithms to determine which impressions they’re unlikely to win and should avoid bidding on to reduce their infrastructure costs. This problem isn’t going away anytime soon.

“The [infrastructure] issues are going to be the biggest problem facing the industry, and until the major DSPs take significant steps to figure it out without relying on buzzwords like ‘machine learning’ and ‘artificial intelligence,’ then someone will be losing money,” said Adam Hecht, vp of monetization at ad tech firm SintecMedia.

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.