Q4’s stasis provided a launchpad for publishers’ Q1 advertising businesses

The fourth quarter of 2023 wasn’t so bad for all publishers. In fact, overall the final three months of the year ended up being a period of “stabilized growth” for digital publishers’ advertising businesses, according to Boostr’s Q4 2023 Media Ad Sales Trend Report, which covered more than 100 U.S.-based digital media companies.

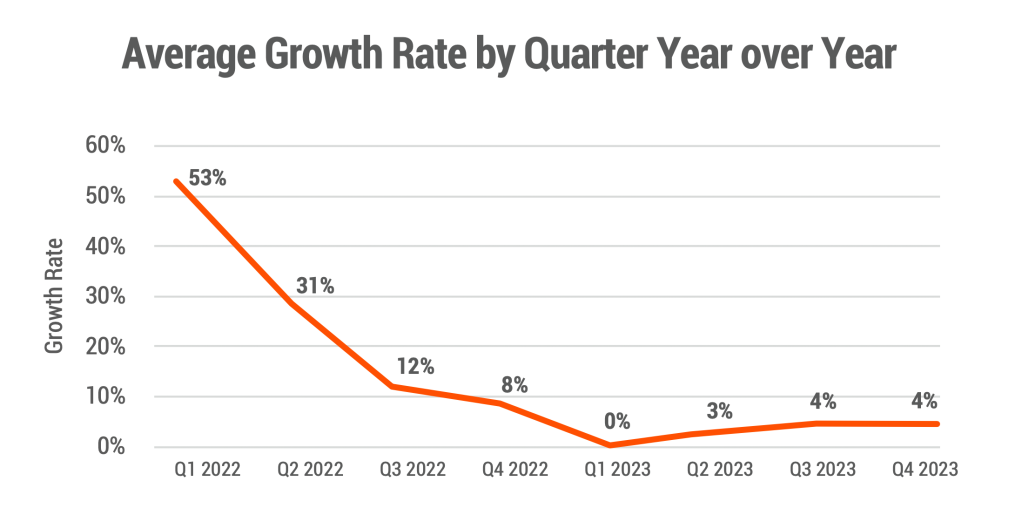

Patrick O’Leary, CEO and founder of Boostr, told Digiday that publishers are seeing a return to stability with ad revenue having an average growth rate of 4% in Q4. Compared to the previous two quarters, this does reveal a leveling out, versus the continued steep declines experienced throughout 2022.

That average is about on par with what Dotdash Meredith reported for its digital advertising business, which was up 3.7% year over year in Q4 2024. But The New York Times, Gannett and Dow Jones didn’t fare as well in their final earnings reports for 2023.

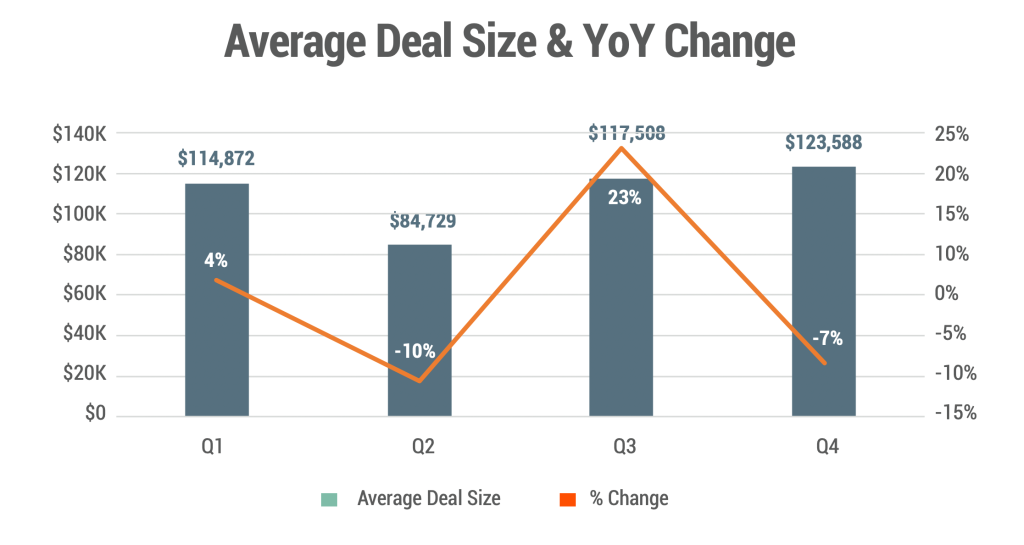

Average deal size in the fourth quarter was the highest for the year at an average of $123,588. However that figure was down 7% year over year, according to Boostr data, which O’Leary said indicates a surge of last minute, in-quarter deals coming to round out the year.

The majority of deals (66%) that closed in the quarter were for campaigns that were meant to go live in Q4 2023, as opposed to deals signed in advance of campaigns going live in the new year. However, that share did decrease by 5% quarter over quarter and 3% year over year, according to Boostr, which supports the idea that some advertisers were returning to old behaviors and making some plans for 2024 campaigns before the year even kicked off.

Lindsey Abramo, CEO of World of Good Brands, said that Q4 “stayed the same steady drumbeat” as the rest of the year and while “it didn’t nosedive by any means,” ad revenue for the quarter didn’t jump up like it traditionally does.

What did happen in Q4, however, was solidify WGB’s position heading into the new year, something that many publishers haven’t been able to feel confident about for the past several years.

“It started obviously in Q4, but we have simply walked into the quarter almost booked-to-goal, which is a really strong place to be. I haven’t seen that happen in a while,” said Abramo. She added that in-quarter selling (A.K.A. campaigns going live during the quarter they’re sold) is still going to be the norm, but certain clients in the CPG and auto categories have locked in seven-figure deals that will go live later in the year.

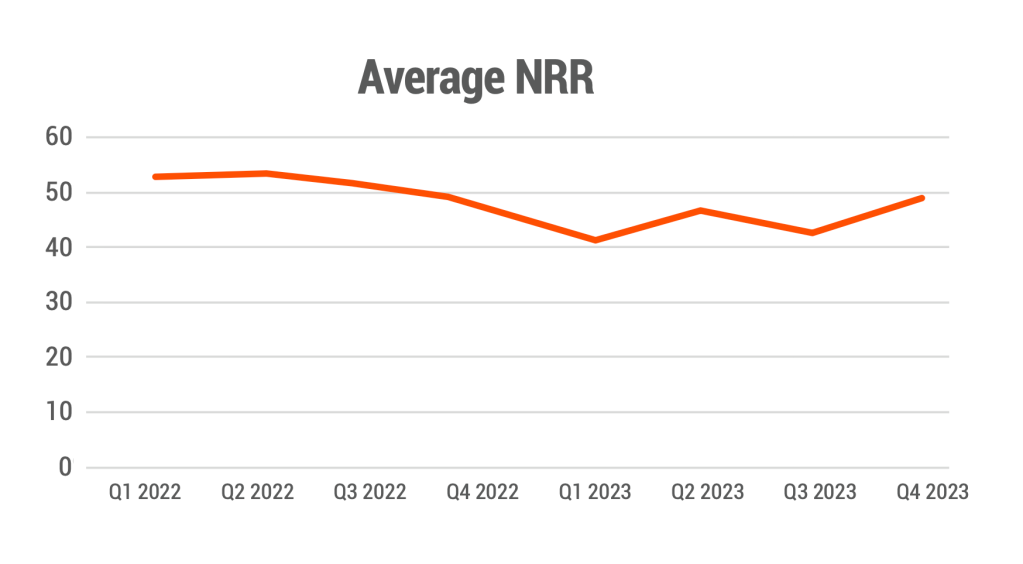

Boostr’s report found that the average net retention rate (NRR) for publishers’ ad clients – calculated from the percentage of ad revenue that came from existing advertisers in the previous quarter – was a sore point for publishers in 2023. The fourth quarter was the highest NRR rate for the year (at 49%), but that still meant that the majority of ad revenue in Q4 came from new business. Between 2020 and 2021, O’Leary said average NRR hovered between 70-80% for most publishers.

Looking at this year, the publishers that want to grow their ad businesses will have to “have a more focused effort [on retention] because it costs a lot of money [to pull in new clients]. It’s the old [lifetime value and customer acquisition cost] ratio problem. If you don’t keep them around, your unit economics are really going to suffer this year,” said O’Leary.

One publisher told Digiday on the condition of anonymity in December that client renewals were up in Q4, which they attributed to launching a new client success team a year prior and expect will continue a positive renewal trend in 2024. “I think we invested in the right apparatus at the right time and that’s paying off for us now in renewals,” they said.

During the first quarter, Riva Syrop, president of Apartment Therapy, said that the company’s “close rate is much higher than anything we’ve ever seen before, but I think that’s in part because probably about 65% of our deals on the direct-side to date are renewals.” Leaning on the existing client roster, Syrop said that the company was able to head into 2024 with full year bookings up 40% year over year.

More in Media

Publisher execs talk AI licensing deals, new applications for AI in latest earnings calls

Publicly-traded media companies touted new deals with generative AI tech companies and other new applications for the technology in their Q1 2024 earnings calls.

Transparency shift: CMOs navigate new norms in agency profit models

Many CMOs seem to be okay with their agencies finding new ways to increase margins, as long as the process is transparent, or at least openly acknowledges a lack of transparency.

Media Briefing: Publishers’ Q1 earnings show promise, but also room for improvement

Publishers’ Q1 earnings show some promise in the digital ad market.