Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The Economist quietly relaunched its subscription mobile app in March, unveiling a new design, more personalized content, additional features and a higher price tag.

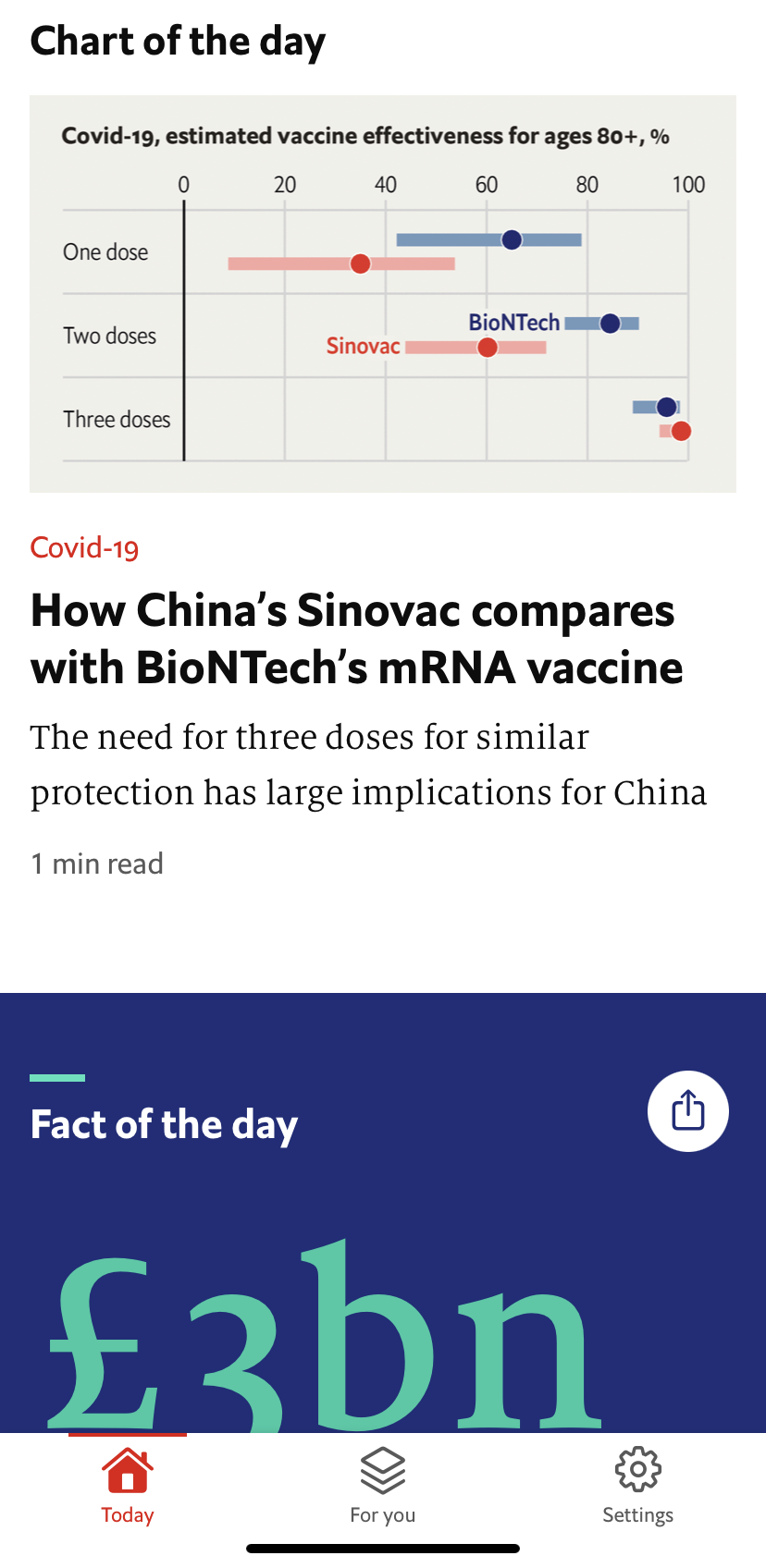

Available for $7.99 (or £7.99) a month, the Economist Espresso app offers a global news briefing round-up and five briefing-style articles a day, as well as a daily fact, chart, quote, quiz and an excerpt from an Economist podcast episode. On the weekends, Espresso has a word and cartoon of the week. Subscribers also get access to an audio version of all the content on the app, as well as four longer articles from the latest weekly edition of The Economist in a For You tab.

Those two additional features are the primary reason for the price increase, said Economist president Bob Cohn. The Espresso app, which was originally launched in 2014, previously cost $4.99. Espresso is also available to people who pay for the full Economist subscription, which costs $189 a year for digital access or $225 for a print and digital bundle at no additional cost. The Economist has 1.2 million total subscribers, Cohn said. He did not say how many subscribed to the app alone — or what subscription goals were for the app.

Before the relaunch, Espresso averaged around 200,000 active users per week (which includes Espresso subscribers and full Economist subscribers), Cohn said. The Economist’s daily digital news team for the website and Espresso has doubled in size since last year, a spokesperson said — they declined to share how big the team is now or how many work specifically on the app. But this headcount increase means the Espresso app is now updated more frequently throughout the day by writers and editors. It’s available globally on mobile devices on the App Store and Google Play.

The core mission of the app hasn’t changed with this redesign, Cohn said. “It’s a daily digital briefing that complements the core subscription with short bits of news and analysis aimed at readers on the go,” he said.

But the changes to Espresso do signal a shift in the target audience for the app, falling into several categories: people who are younger, more female and more global than The Economist’s core audience (which skews male and concentrated in North America and Europe), as well as existing subscribers who find The Economist’s full subscription too expensive and are at risk of churn, or canceling their recurring payments. Publishers are increasingly investing in product innovation to strengthen the retention of subscribers, noted Matt Lindsay, president of consulting firm Mather Economics.

“We think it’s important that we have a better gender balance and a younger reader as we plan for the future,” Cohn said.

This is one of the reasons the app contains more audio capabilities. Voice actors read the content available on Espresso daily. Women, according to The Economist’s internal research, listen to its podcasts “disproportionately” to its female subscribers reading its text-based products, Cohn said. While The Economist has subscribers in over 160 countries, according to Cohn, its subscribers “are concentrated in the U.S. and in Europe.” This revamp gives markets a product that is faster to consume and less expensive than a full Economist subscription, he added.

There’s an element of personalization in the For You section of the Espresso app, too. Subscribers can select three topics of interest (such as “China,” “finance” and “technology”), and Economist editors select the most important or relevant four articles each week to match those.

While Espresso is currently only available for purchase in device app stores, this summer The Economist will be able to directly sell a subscription to the app on its own site. Marketing campaigns for the Espresso subscription will roll out this summer as well, beginning in “key markets in secondary markets” such as in Asia, Cohn said.

The relaunch of the Espresso app comes within the same month the Financial Times, another U.K.-based business publisher, debuted a subscription mobile app called the FT Edit. FT Edit costs £0.99 (or $1.29) a month for the first six months, before going up to £4.99 (or $6.52), and subscribers get eight, deep-dive stories a day curated by FT Edit editor Malcolm Moore. While available globally, the current version of FT Edit is primarily tailored for a U.K. audience, a spokesperson said. User feedback and data over the next few months will inform the launch of a U.S. version of the app coming later this year. And The Guardian, another publication headquartered in the U.K., will soon begin testing a metered paywall on its news app, a spokesperson said.

These app subscriptions offer a limited number of articles for a price lower than what a reader would pay for a full subscription to get access to all of the publication’s content online. But the risk of subscription apps, according to the three media consultants Digiday spoke with, is “cannibalization,” or undermining the sales of a more premium product by offering a cheaper product option.

“What is the market for subscribers who are not willing to pay $15 a month but willing to pay $8 a month?” questioned Justin Eisenband, a managing director in FTI Consulting’s telecom, media & technology industry group. “What is the trade-off or opportunity cost of having people shift or self-select into a lower-priced product and giving up that [average revenue per user], versus the incremental volume of people who would now subscribe to a lower-priced product?… It’s a tough equation to make work.”

But The Economist received feedback from some existing subscribers that the full subscription “was just too much — too many stories, too much time consumed, or too expensive,” Cohn said. “We’re willing to accept the possibility that there might be trade downs because ultimately we think our mission is to create an Economist product for anybody who wants to be in the family.”

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.