Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

For years, social media platforms operated under the conceit that if they could simply accumulate enough users, a business model would eventually present itself. Now, publishers have adopted the same philosophy, posting their media (particularly their videos) directly to platforms such as Facebook and Twitter in the hopes that amassing an audience there will one day result in a revenue stream.

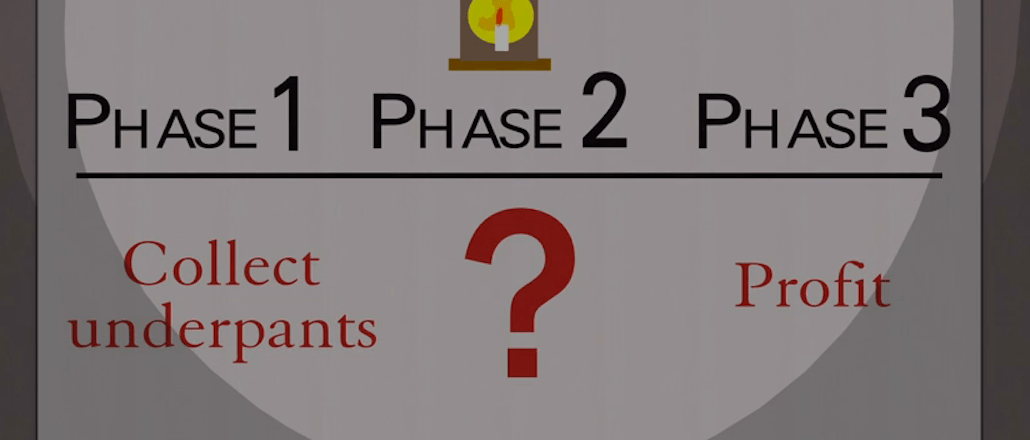

It’s a strategy reminiscent of the enterprising underpants gnomes from “South Park,” whose business plan was “Phase one: collect underpants. Phase two: ?? Phase three: profit.” Substitute “users” for “underpants,” and you’ll understand why CNNMoney started two weeks ago posting some of its videos directly to SlideShare, the LinkedIn-owned visual media platform.

“The amount of traffic we’re giving away for free pays huge dividends in attracting people to our brand,” CNNMoney’s executive producer of online video, Jason Farkas, told Digiday. “It’s really just about creating an affinity with the brand than it is about serving banner ads.”

LinkedIn’s allure extends beyond its mission to help professionals; with more than 106 million unique visitors in April 2015 — 85.7 percent more than during the same month last year — it affords publishers access to a massive number of potential readers who have already shown an interest in business news.

But as with the underpants gnomes, there exists a burning, unanswered question: “What’s phase two?”

That is, how will posting directly to and amassing an audience on LinkedIn lead to a revenue stream for CNNMoney and the other publications — including Simon & Schuster, The Economist Group and Jim Cramer and TheStreet — that have taken up LinkedIn’s offer to host their videos directly on SlideShare and then featured on LinkedIn’s main site.

When asked how TheStreet would monetize the videos it’s been posting to SlideShare since August, Elisa Bellcishta said: “No clue. There are no plans in the works yet.”

Same for CNNMoney, according to Farkas. CNN’s broadcast network would never hand its video over to a competing station for free. But when it comes to digital video, CNNMoney is more than happy to provide it to LinkedIn gratis.

“Whether it’s monetizable or not is not a primary concern,” Farkas said. “It’s a concern for the broader vision, but it’s not a concern for giving our content away on different social media platforms.”

LinkedIn spokeswoman Crystal Braswell declined to comment on its plans for monetizing publisher videos hosted on SlideShare, saying that it was “early days” and the initiative has elicited “good results” so far (although she declined to specify what those results were).

Despite the lack of a business plan, both CNNMoney and TheStreet were happy with the early results, saying plan to continue what they both framed as an experiment.

TheStreet has seen mixed results on its videos, with some netting thousands of views, and others — such as the ones that feature “Mad Money” star Cramer, who’s also a certified LinkedIn “influencer” — more than 10,000.

Its best video was a January 2015 explainer about the rather esoteric subject of the European Central Bank’s practice of engaging in quantitative easing.

CNNMoney’s video about former Hooters waitress Kat Cole, who rose through the corporate ranks to become president of Focus Brands Group, was the top video on SlideShare the day it was posted, according to Farkas.

Still, the eventual, if distant, goal is to monetize these videos.

“It’s about figuring out if this makes sense to us. So far, that answer has been yes. And once we have a little more growth, it makes sense to think about monetization,” Bellcishta said.

There are two likely means by which the monetization will occur: The participating media companies could distribute native video ads through their SlideShare accounts. Or they and LinkedIn could sell ads against the videos and split the revenue.

“Those are the two avenues,” Farkas said. “As each of the platforms figure out their monetization strategies, it’ll become an industry standard as far as how we approach it. But we’re not there yet, we don’t know.”

LinkedIn has forged similar partnerships with media companies in the past, such as last April when it expanded a program in which it pairs brands with media companies for sponsored content deals that are distributed on LinkedIn.

But LinkedIn also has a history of prioritizing its own media over that of outside media companies. For years, it delivered large amounts of referral traffic to business sites. Then LinkedIn launched its own, on-site media venture, and the referral traffic slowed to a trickle.

“I don’t see it as cannibalizing our views in any way on our site,” Bellcishta said. “What we’re doing on LinkedIn is reaching new people, not having our existing directed to our LinkedIn page.”

CNN’s Farkas echoed Bellcishta, saying that there was “only upside” to building out CNNMoney’s presence, as the audience gains were entirely incremental.

“All the social media networks are passionate about video and monetizing it, and we don’t need to worry about monetizing,” he added. “We want to be seen as one of the premium-content providers on those platforms. At some point, the monetization part will figure itself out.”

Which might remind you of a certain group of cartoon gnomes.

Homepage images courtesy South Park, Hulu

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.