Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Influencer shops hope to entice creators with talent platforms that offer CTV, AI features

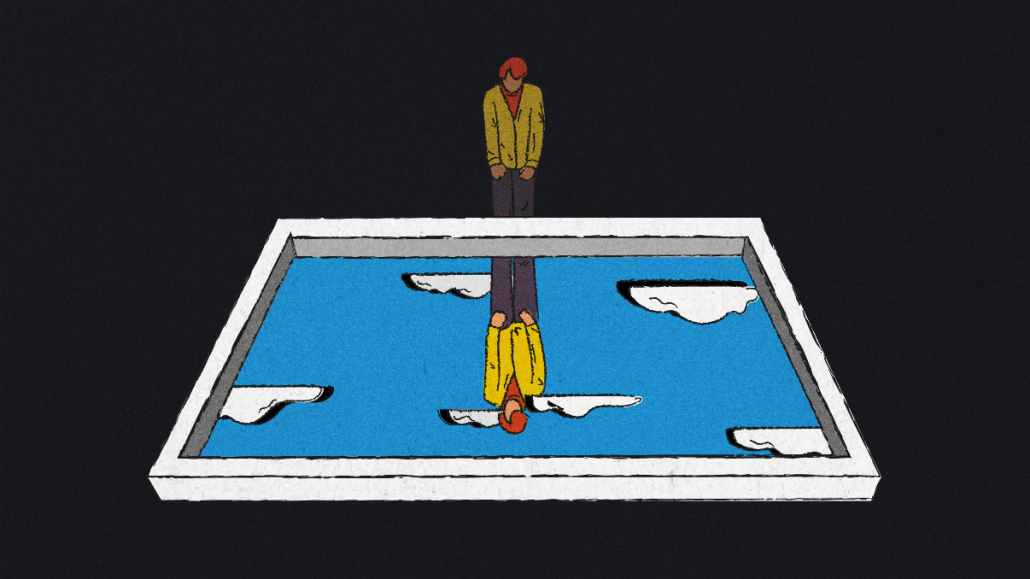

Influencer companies have been muscling into the talent management business recently — and now they’re hoping to make use of artificial intelligence and connected TV gimmicks to entice talent managers and brands to broker more creator deals on their platforms.

Two agency groups have recently added new services to expand their share of this growing corner of influencer marketing as the channel continues to grow and mature. This momentum is largely driven by an evolving creator business and the increasing need for all-in-one platforms to manage the various communications and business management aspects of the talent, deal negotiations, pitches and campaign measurement.

There’s a lot to gain if these players can attract talent agents, brands and creators to adopt their technology — the increase of scale on creators and campaigns, as well as a larger pool of relevant data. The talent industry is booming too, with certain platforms looking ripe for acquisition, coupled with growing creator opportunities in social media revenue-sharing models and streaming services expanding their partnerships. The global celebrity talent management market size was estimated at more than $15 billion in 2021 and expected to exceed some $20 billion by 2027, according to 360 Research Reports.

Yet the brand-creator matchmaking can get increasingly complicated in a crowded market. In May, Horizon Media’s social agency Blue Hour Studios and talent management platform Key launched talent platform Swell Audience Network to address some of the creator vetting and measurement challenges.

“We see [influencer marketing] being still small compared to display online video, CTV and even TV,” said Monika Ratner, head of growth at Blue Hour Studios. “We’re placing a bet that that might be where we’re at today, but it’s not where we’re going to be at in months and years to come.”

As the agency continues signing brands to its platform, this month it is introducing Swell.AI, an offering designed to turn creator content into interactive TV creative assets adapted for various screens, Digiday has learned. Developed with AI video company Kerv Interactive, the AI can use social content to churn out hundreds of TV-format content, like shoppable tiles and QR codes next to the social content, that adapt based on location, performance and engagement. That happens within 24 hours, instead of the typical “six months [it might take] to do a TV ad,” Ratner added.

For instance, an ad might swap out products for cold weather from a retailer if there is a storm in that area. This also makes brands’ influencer marketing data more accessible.

Ultimately, Swell.AI aims to build an infrastructure for influencer programs, Ratner explained. With the platform, the firm hopes to collaborate with more talent at scale and make that process more seamless for the 23 million or so creators it has in its system. This data is gathered through social network APIs, such as Instagram and TikTok, and from the agency’s own talent recruitment over the years. Ratner estimates the agency works with about “a thousand” creators every year.

With the growth of influencer marketing, many sizeable agencies have acquired service-based agencies or developed the technology in-house — so the next wave of M&A will likely target independent technology platforms, as Sanja Partalo, cofounder and managing partner at venture capital firm S4S Ventures, recently noted.

“There’s only a few independent technology platforms in this vertical,” Partalo previously told Digiday. “That begets the question of what happens to all the agencies that are being serviced by these companies if they cease to remain independent.”

Creator company Whalar Group is another player entering the space with a tool for the talent manager side, as AI makes it possible to streamline much of the talent management processes. Whether managers oversee content creators, influencers, athletes or celebrities, the work historically revolves around a lot of “spreadsheets and slides,” said Simon Moss, chief product officer of Foam, a new operating system for managing digital talent developed by Whalar.

“Everyone looks the same on a spreadsheet,” Moss told Digiday. “The supply side, or creator and manager side, is ignored … They don’t want to be managing spreadsheets and putting together numbers, and that is just a massive gap in the marketplace that has been ignored by the technology companies today.”

Launched this month, Foam gives managers access to a network of more than 40,000 creators and a host of other data points on audience, social feeds and pitching and credentialing tools. Moss estimates that any creator with more than 200,000 followers is likely to have representation these days — that amounts to a lot of agents and brands needing some place to keep track of everything.

Whalar started out building tech as a self-service platform for brands, and Foam was originally built for its talent division for creators. Named in line with the company’s other nautically themed products, Foam’s ultimate goal is to become the “Bloomberg Terminal for creator management,” Moss explained.

In the future, Foam may include an online reputation metric for creators that is based on a current internal tool called Orca. Moss compared it to a FICO score for creators, but Whalar is still debating whether it computes as a number or another rating system.

Even though the basic version of Foam is free to use, Moss acknowledges that Whalar gets the benefit of accessing more talent. Managers can opt in to share their talent more widely to increase the likelihood of brand deals, some of which could include those “multi-million dollar campaigns for large brands,” Moss added.

“Long term, what that means is that the technology will scale for us to be able to power more creators, more agencies … It gives us unprecedented scale.”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.