How Google is using its search clout to steer publishers to use AMP

Google and Facebook can exert their power on publishers in varied ways. Take Google’s effort to get publishers to adopt its fast-loading article page code, Accelerated Mobile Pages.

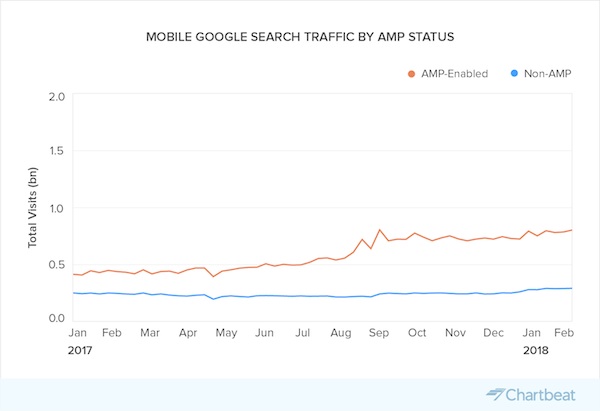

In theory, adoption of AMP is voluntary. In reality, publishers that don’t want to see their search traffic evaporate have little choice. New data from publisher analytics firm Chartbeat shows just how much leverage Google has over publishers thanks to its dominant search engine. Total Google traffic to Chartbeat’s client base is up 25 percent since January 2017, but AMP publishers had a 100 percent increase in mobile search traffic from Google. In contrast, non-AMP publishers’ mobile traffic from Google was flat in the same time period. For all publishers, using AMP or not, overall desktop traffic from Google was flat. (Google makes up about 40 percent of Chartbeat publishers’ referral traffic to Facebook’s 30 percent.)

“Google is increasingly becoming a mobile-first platform,” said Chris Breaux, data science director at Chartbeat.

The findings have implications for sites that aren’t using AMP, and there are plenty. Twenty-five percent of Chartbeat’s 50,000-publisher client base uses AMP. AMP publishers tend to be larger publishers, but not always, Chartbeat said. On a traffic basis, AMP users now get 18 percent of their mobile traffic from AMP, up from 16 percent last summer. For comparison’s sake, only 10 percent of the client base uses Facebook’s fast-loading Instant Articles template and those using Instant Articles see 11 percent of mobile traffic from Instant, down from about 15 percent last summer.

The growth of AMP traffic is another sign of the power Google wields over the web. Publishers are warming up to Google these days for sending them more traffic and being easier to work with, especially as their relations with Facebook deteriorate. Google said AMP pages load 85 percent faster (too fast for some publishers, who said their ads weren’t keeping up). Still, some are wary of the tech giant’s growing influence.

Along with AMP, Google is turning on a new ad filter in Chrome on Feb. 15, which will block ads based on its own research and that of the Coalition for Better Ads, an industry group that Google helped found. And publishers have gotten in line: 37 percent of those that Google identified as having violations, including Forbes and the Los Angeles Times, have fixed them, according to Google. All these initiatives are presented as voluntary, but publishers that don’t go along with them risk losing out on search traffic, ad revenue or both.

“The increase in traffic, entirely driven by AMP, far outweighs the decline in Facebook referrals that drives all the news,” Chartbeat CEO John Saroff said. “For those that haven’t done AMP, we want to make sure they’re running that ROI calculation to make sure it makes sense because it’s a more meaningful source of traffic.”

The issue for some publishers is how well Google monetizes AMP. To speed up the web, Google had to strip down pages, which in turn limited the kinds of ad units publishers could run. According to the Distributed Content Revenue Benchmark Report from trade group Digital Content Next, revenue from AMP has been slow to build. In the first half of 2017, search represented just a sliver of the revenue from distributed content for publishers, behind OTT, syndication and social media, according to the report, based on data from 20 member publishers.

John Potter, CTO of Purch, said the publisher has been able to monetize AMP pages at a competitive rate with the mobile web since its header bidding solution was accepted as an AMP tag last year. His bigger concern, he said, is that “you don’t know where your AMP page will be shown on the Google results page, that the branding has been missing due to it being a Google URL and that the sessions that start on an AMP page versus a mobile page are shorter.”

Google said in a Feb. 14 blog post that publishers have tripled the amount of money they’re making from AMP pages in the past year and sped up the load time of ads, but also acknowledged there’s still progress to be made.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.