Digiday Research: The most effective tactics for driving subscriptions

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

For publishers looking to drive more subscriptions, email is king.

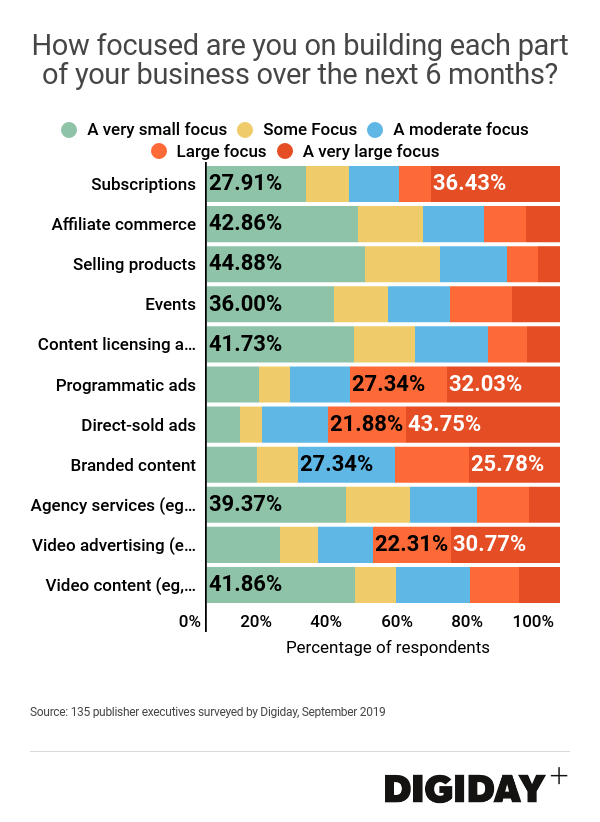

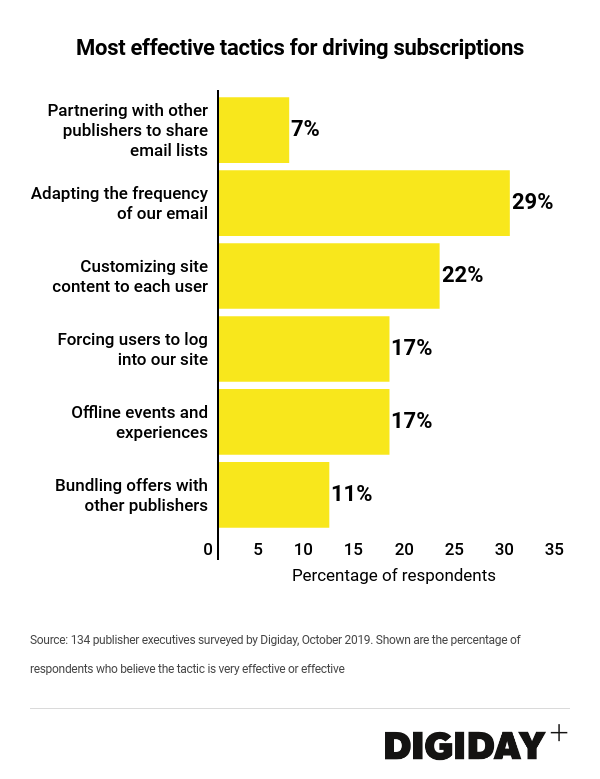

Digiday Research asked 136 publishing execs about various tactics they use to drive subscriptions and which they find most effective. The most effective tactic was “adapting the frequency of email,” followed by customizing content for each user.

Publishers use email in various ways to drive people to sign up for subscriptions — either with marketing via offers sent to those already in their database, or sending more email about specific parts of the subscription product, like dedicated member-exclusive pieces, to their audiences.

However, only 23% of respondents said sharing email lists has proved an effective tactic for them.

When Digiday last conducted this research, 65% of publisher executives said their most effective tactic for customer acquisition is email, and 16% said it was house ads.

Subscriptions are the most important focus for publishing execs. Almost 46% of respondents said growing subscriptions were a major focus for them over the next six months. Other major priorities are building direct-sold ads: 64% of publishers said that was either a large focus or a very large focus area for them.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.