Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: Publishers turn to retailers to sell their products

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

As publishers get more serious about generating commerce revenue, they’re looking beyond simply adding affiliate links to their pages. Many have taken steps to create their own online store through which to sell products, but increasingly publishers are selling their own products via third-parties too.

A survey of 53 publishers at the Digiday Hot Topic: Commerce for Publishers found that 41 percent of publishers now sell products via a third party, such as Amazon or other retailers.

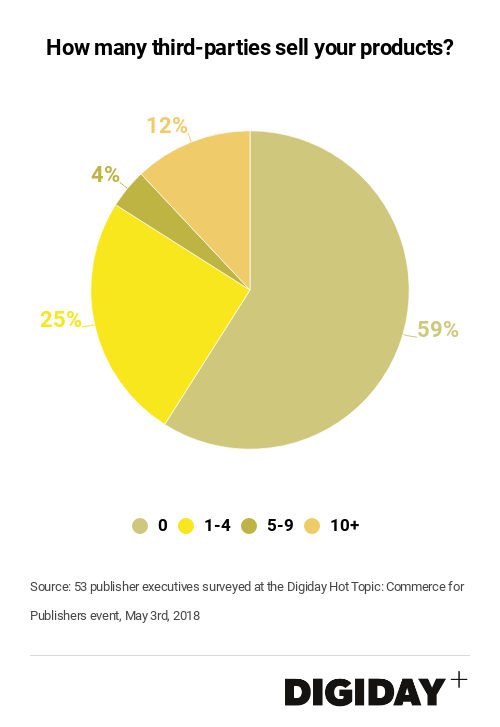

Even for publishers with their own online stores, there’s a general consensus about the need for third-party partners. Seventy-six percent of publishers with owned online stores that were surveyed at the Digiday event said they also sell goods through other retailers.

Because Amazon already holds a dominating grip on many publishers’ e-commerce businesses, working with additional retailers could help ensure they avoid becoming dependent on a single platform. To that end, PopSugar which began selling branded products earlier this year is launching a new line of apparel with Kohl’s and Clique established an early relationship with Target.

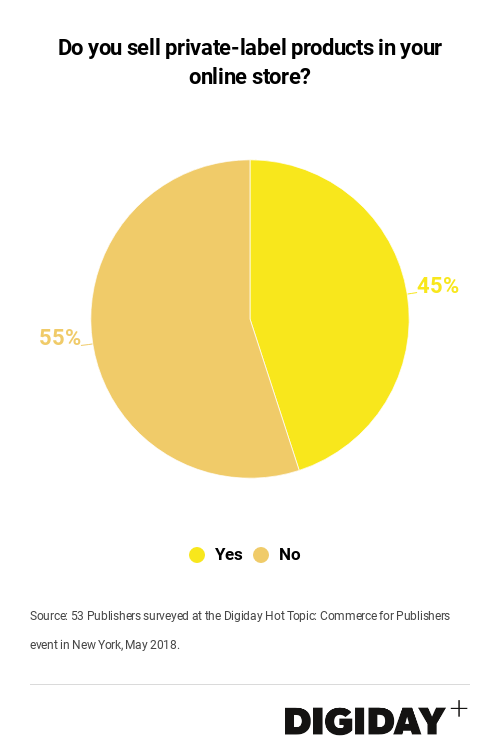

Another step publishers can take to beef up their commerce strategies is to include private-label products in their own online stores. Forty-five percent of publishers with online stores surveyed by Digiday say they sell private-label products. BuzzFeed acquired rights to several private-label products to bolster the number of products it can sell online.

One advantage for publishers in retailing private-label products is that it can help them track consumer preferences and trends. There’s also lower risk for publishers because they don’t need to worry about developing products that won’t sell.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.