Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Publishers expect advertising to drive revenue growth in 2019

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Update: A previous version of this story incorrectly stated Bustle expects to generate most of its new revenue in 2019 from events. In actuality, it expects events to be its fastest-growing revenue stream next year, but for most of its new revenue to come from advertising overall.

Most publishers expect the majority of their revenue growth in 2019 to come from advertising, despite the challenges they face in the online ad market and their ongoing efforts to cultivate alternative revenue streams.

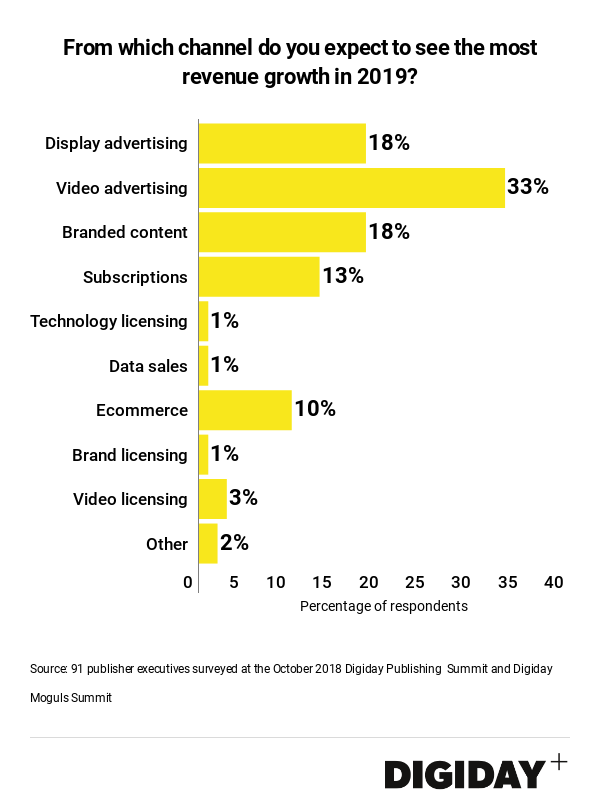

Of the 91 publishers surveyed at last month’s Digiday Publishing Summit and Digiday Moguls event, 69 percent said advertising is where they expect to see their most significant revenue increases next year. That’s despite many publishers attempting to build new, non-advertising revenue streams such as subscriptions and commerce.

More than any other channel, publishers said they expect to see their biggest revenue growth from video advertising next year, which is perhaps surprising given that some publishers have scaled back their video ambitions and operations in the past year. Companies such as Refinery29 have been downsizing their video operations as video ad revenue lags their expectations. Meanwhile, publishers are at the mercy of changes being made by the major platforms and are coming to terms with those challenges. It emerged recently that Facebook inflated it’s video stats, for example, which may have encouraged publishers to push more heavily into video despite audience limitations.

Behind video, survey respondents also said they expect to see strong revenue gain from display ads and branded content. Those channels play important roles for publishers’ revenues but come with their own challenges. Programmatic display ad revenues are often eroded by exorbitant and hidden tech fees, for example. And publishers are struggling to compete with the efficacy of the data-driven ad products offered by Google, Facebook, Amazon and others. Meanwhile, publishers pushing branded content face shrinking margins and high content production and distribution costs.

Publishers are adopting various tactics in an attempt to eke out more revenue from their display ad operations, including introducing header bidding and switching to vendors operating first-price auctions.

Publishers with growing ad businesses are still seeing revenue growth elsewhere. Bustle, despite increasing its audience size and advancing its programmatic ad business this year, isn’t counting solely on advertising for new revenues. According to its Chief Revenue Officer Jason Wagenheim, experiential events — driven by its recent acquisition of Flavorpill — will be its fastest-growing revenue stream in 2019.

For mature publishers with established ad business, it can be difficult for advertising to generate significant growth compared with newer streams, such as subscriptions or e-commerce, which can scale faster, albeit from a much smaller base.

Camilla Cho, general manager of New York Magazine’s The Strategist, said that its e-commerce business grew 300 percent this past year. And while she declined to say how much The Strategist earns in e-commerce revenues per year, she said it was a “double-digit percentage of New York Magazine’s overall revenue,” and the fastest growing part of its business.

Even though more publishers are getting into the e-commerce game according to Cho, getting people to make purchases online remains tricky.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.