Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: Publishers are lukewarm on market for short-form video

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Key takeaways:

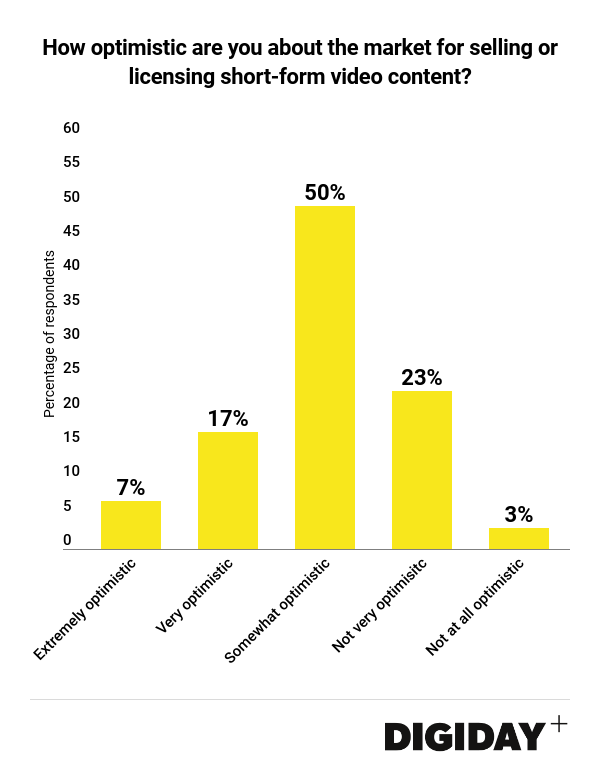

- Only 24 percent of publishers say they are optimistic about the market for short-form video.

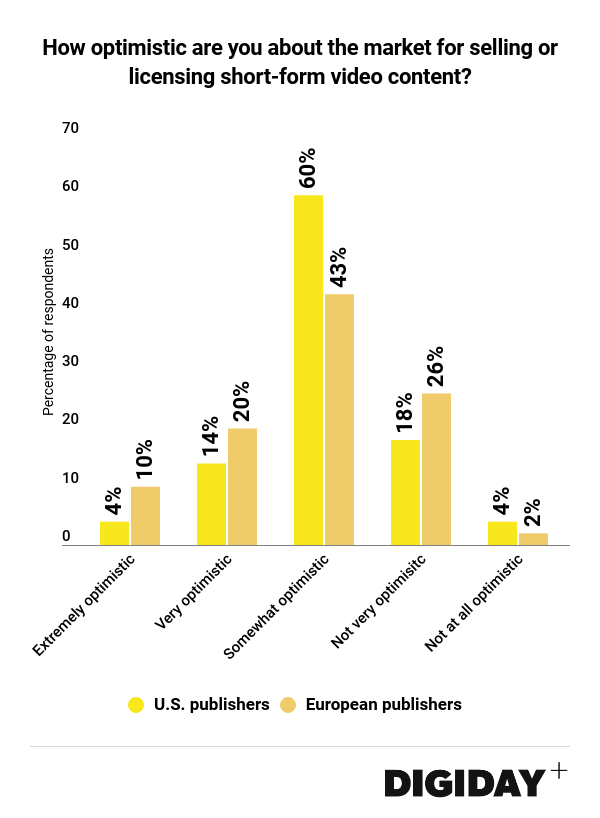

- U.S. publishers are slightly less optimistic that European publishers.

Video, once hailed as the digital media industry’s only hope, has failed to live up to the lofty expectations industry “experts” placed on it. Several companies that bet heavily on it have either missed revenue targets, been sold for a fraction of previous valuations, or folded entirely.

Against that dour backdrop, Digiday surveyed 111 publishers at Digiday Video Summits in Scottsdale and Amsterdam last month to gauge their optimism around short-form video. Their responses can be described as lukewarm at best, with just 24 percent of publisher respondents saying they are extremely or very optimistic, and 26 percent saying they aren’t. U.S publishers were slightly less optimistic than their European peers. Only 18 percent of U.S. publishers labeled themselves as optimistic compared to 30 percent of European publishers.

Monetizing short-form video content purely through advertising has proven untenable for most publishers, and only more difficult in the wake of changes made to Facebook’s news feed.

Just as demoralizing has been the demise of several video services that were once prolific buyers of publishers short-form video series. Comcast-funded Watchable operated on a revenue sharing model with as many as 30 publishers and had previously funded exclusive content with Refinery29 and PopSugar, for example. However, with views per video reported to be in the thousands it was clear that short-form video programming was not working.

Go90 now faces a similar fate after Verizon announced its closing the platform on July 31st, shortly after the Digiday survey was conducted. Like Watchable, G090 had spent heavily on acquiring content from publishers for the platform only to fail to find an audience. Both platforms’ respective collapse highlights the declining market for short-form video.

There is some small cause for publishers to be optimistic about the market for short-form video. Both Netflix and Amazon are looking at acquiring the rights from publishers to host their short series. Meanwhile Facebook has also opened up its Watch platform to all publisher’s videos. Facebook’s announcement gives publishers another destination for their content beyond their owned sites and YouTube, even if it’s too early to tell whether Facebook’s bet will successfully attract an audience.

More in Media

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.