Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

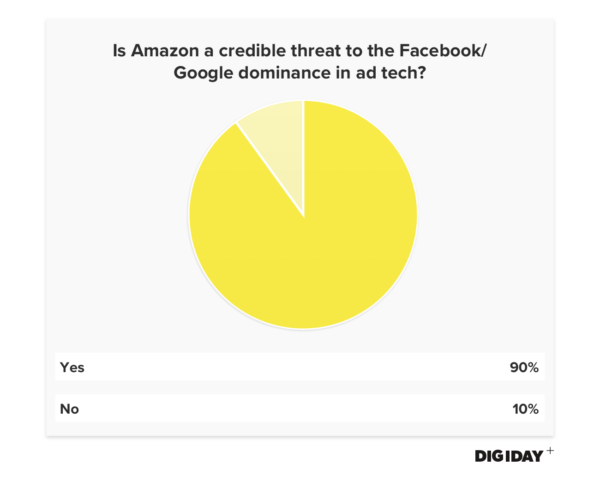

Digiday Research: 90 percent of media execs think Amazon can threaten the duopoly

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers.

Amazon is eating the world. Just about everyone is saying it these days. The Amazon avalanche is coming to ad tech, too. In its third-quarter earnings call, Amazon announced that its advertising business grew 58 percent year over year to $1.12 billion.

At the Digiday Programmatic Media Summit in November, we surveyed 78 leading media executives to see if they think Amazon has the potential to threaten the Facebook-Google duopoly. Ninety percent responded that Facebook and Google should be nervously looking over their shoulders.

But perhaps it’s not time to panic yet. Despite Amazon’s ascent, almost all new spending — 99 percent — of the total $72.5 billion in U.S. digital ad revenues went to the duopoly last year, according to Pivotal Research analyst Brian Wieser.

Based on eMarketer’s 2017 ad revenue projections, Amazon’s ad business would need to achieve 100 percent year-over-year growth over the next four years to reach Facebook’s projected ad revenues for 2017. It would then take another year to match Google’s projected ad revenues for 2017. Amazon’s projected ad revenue growth from 2017 to 2018 is 42 percent.

In the short term, Amazon may not threaten Facebook’s and Google’s grip on advertising. However, Amazon’s tech is quickly laying the foundation for such a change.

A recent study by ServerBid found that Amazon’s Transparent Ad Marketplace is the most popular server-to-server wrapper. Amazon’s header-bidding solution was also the third most popular among the Header Bidding Industry Index top 100 publishers. Additionally, Amazon’s demand-side platform tied Google for having the highest adoption rate among agencies in a survey from research firm Advertiser Perceptions and grew its brand adoption by over 50 percent this year. Amazon’s brand-focused application programming interface for Amazon Marketing Services should help address existing data issues.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.