Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: 88% of publishers say they will miss forecasts this year

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

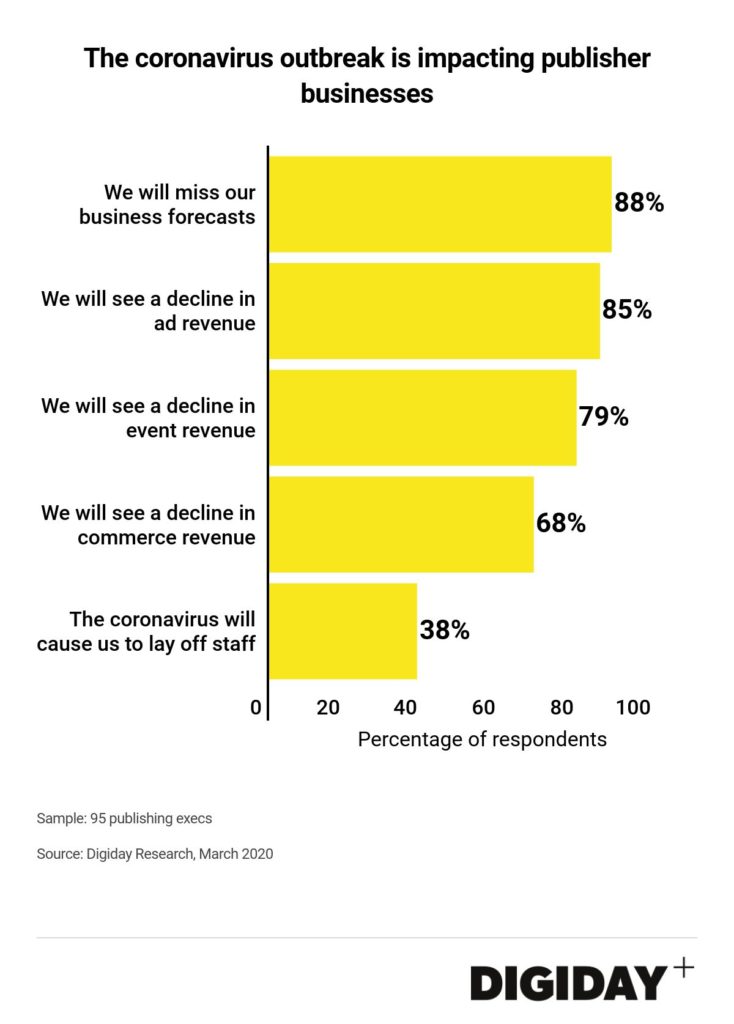

In a new survey examining business confidence, Digiday Research found that 88% of publishing executives surveyed expect to miss their business goals this year due to the outbreak.

Ninety-five executive-level publishers were surveyed this week in a snap poll to understand the effects of the outbreak on their business. Of them, 85% said also that they expect to see a decline in ad revenue due to the pandemic.

That problem is an exceptionally difficult one. Coronavirus dominates news coverage, and with levels of worry skyrocketing, plus a lot more people working from home, means more people are consuming news. But publishers have found it difficult to monetize this coverage with advertising: Many big brands are staying away from spending adjacent to coronavirus coverage, and throwing associated keywords into their block lists.

About 79% of publishers surveyed said they also expect, unsurprisingly, to see a decline in event revenue due to the outbreak. Events have been a particularly important source of revenue for publishers across B-to-B and consumer media. With large gatherings effectively banned, this important source of revenue is essentially decimated.

Right now, only 38% of publishers say they expect to lay off staff due to the outbreak.

More in Media

WTF is a creator capital market?

What is a creator capital market, what does it mean for creators looking to diversify revenue, and why is it so closely tied to crypto?

Media Briefing: Publishers explore selling AI visibility know-how to brands

Publishers are seeing an opportunity to sell their AI citation playbooks as a product to brand clients, to monetize their GEO insights.

Creators eye Snapchat as a reliable income alternative to TikTok and YouTube

Figuring out the Snapchat formula has been very lucrative for creators looking for more consistent revenue on a less-saturated platform.