Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Best of the week: Publishers’ ad revenue woes heighten as platforms move to police ads

Our top stories this week delve into Breitbart’s slide and fresh fears regarding tech giants. As always, a full list of these articles appears at the bottom.

Breitbart tumbles …

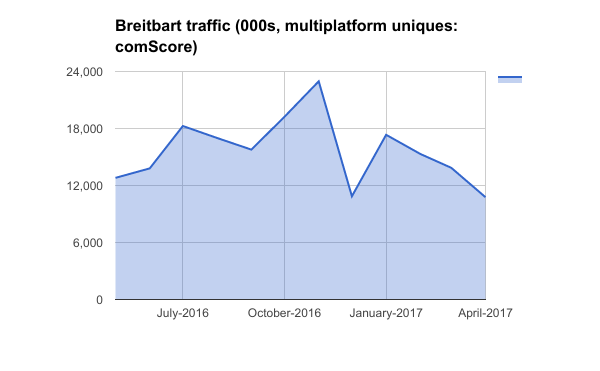

After the U.S. presidential election, Breitbart was plotting an expansion to spread far-right, populist views in Europe. But today, Breitbart faces traffic declines, advertiser blacklists, campaigns for marketers to steer clear and even a petition within Amazon for it to stop providing ad services.

Key numbers:

- Breitbart featured 26 brands in May, down from a high of 242 in March. (source: MediaRadar)

- From January to March, Breitbart had 20 categories of advertisers, many from media/entertainment and retail. This dwindled by April to mostly targeted, conservative brands buying programmatically. (source: MediaRadar)

- Breitbart had 10.8 million uniques in April, down 13 percent from last year. But many news sites peaked after Donald Trump’s inauguration and have seen audience decline since; Breitbart ranked 67th among news/information sites in April, compared to 62nd a year ago. (source: comScore)

… while other publishers worry about ad revenue

More details have emerged about Google’s plans to filter out invasive ads, and Apple announced an update to its Safari browser would block autoplay video and end the tracking of people’s online browsing.

Consumers, driven by annoying and repetitive ads and privacy concerns to install ad blockers in growing numbers, should benefit from these moves. But publishers are concerned, seeing two tech giants trying to protect their market share — Apple by positioning itself as the guardian of customer privacy and Google by trying to consume as much of the digital advertising pie from rival Facebook.

“Companies that have a vested interest in controlling the consumer experience should not be setting industry policy,” said a publishing executive, speaking anonymously, for fear of upsetting a platform partner. “The doomsday scenario is, it could lead to ad formats that favor the oligopoly.

All eyes on Amazon

Ad buyers, brands, telecom companies and media owners are uneasily watching Amazon, believing the online behemoth could change the duopoly into a triopoly.

“[Telcom companies] now face intense competition from technology giants, such as Amazon and Google, which operate at an entirely different level,” WPP CEO Martin Sorrell said. It’s why Amazon, for Vodafone CEO Vittorio Colao, is the “one to watch.”

Colao said Amazon has the “money, the shareholders, the data and the investment allowing [it] to do everything,” whether that’s producing content, providing OTT services, opening brick-and-mortar bookstores or even, according to Forrester analyst Collin Colburn, taking over search — a market Google almost wholly controls.

Retailers are troubled by what they describe as a two-way relationship with Amazon.

“They buy from us, but they want to sell advertising to us as well,” said one brand marketer. “When you talk to them, you don’t know what their interest is.”

Interesting takes elsewhere:

- Mashable Asia’s Yvette Tan describes a vending machine in Moscow that sells fake Instagram likes.

- Kaitlin Ugolik defends theSkimm for the Columbia Journalism Review.

- Mel Magazine published an argument against using exclamation points in work emails. (Thanks, John McDermott!)

This week’s top Digiday stories:

- Breitbart ads plummet nearly 90 percent in three months as Trump’s troubles mount

- As Apple and Google take aim at ads, publishers tremble

- For retailers, Amazon is a true frenemy

- Amazon is set to turn the duopoly into a troika

- What online fashion brands can learn from Amazon’s stores

- What influencer marketing really costs

- Publishers are starting to see money from Facebook’s mid-roll ads

- How Zenith’s Tom Goodwin became a LinkedIn superstar

- Confessions of an influencer marketing exec

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.