Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: 53% of publishers offered new ad products this year

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

For proof that necessity is the mother of invention, look no further than the sales teams’ offerings across media and marketing in 2020.

Even in a year when planning cycles were shorter, brands were even more risk averse in their messaging, and advertisers retrenched around what works, close to half of all publishers and agencies increased the number of products and services they offered to clients this year, Digiday Research found.

Digiday surveyed 60 publisher professionals and 52 agency professionals in early December, asking them about everything from their outlook on 2021 to how coronavirus affected the headcounts at their organizations.

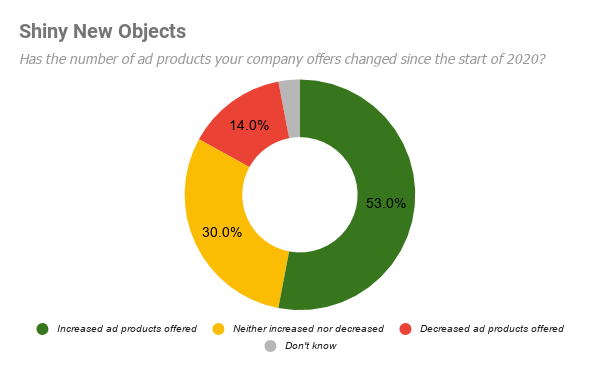

The survey found that more than half of publishers — 53% — said that they’d increased the number of ad products offered since the start of 2020. Slightly more than a third said that the number had not changed, and the rest said either that they’d decreased the number or weren’t sure.

Sample: 60 publisher respondents

Much of this innovation came from publisher scrambling. The coronavirus pandemic forced publishers to get creative in order to hold onto client budgets, especially those that had planned sponsorships around live events.

It also squeezed the amount of money that brands were willing to spend trying out non-traditional or experimental ad formats, especially those designed to help with branding objectives; new units designed to drive sales or other bottom-funnel metrics were less affected, agency sources said.

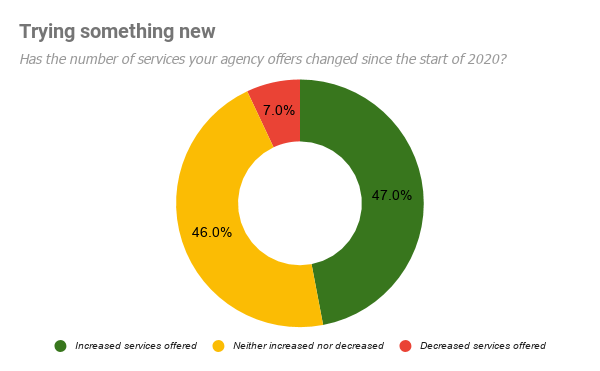

Among agencies, the share that increased the number of services offered was slightly lower, but still close to half: 47%. A nearly identical share said the number of services their agency offered had not changed. Notably, 12% of agencies said that the number of services they offered increased “significantly,” a higher percentage than the amount of agencies that decreased the services they offered.

Sample: 52 agency respondents

The addition of new services could by a byproduct of the consolidation squeezing the agency world. As the onset of the pandemic forced many marketers to cut costs, many responded by at least exploring the possibility of reducing the number of agencies they use. Creative agencies, in particular, appear poised for further consolidation.

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.