Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘It will be Google, Facebook and Amazon’: The year in Amazon advertising

Amazon’s advertising business is a brewing industry force, and ad buyers and competing retailers and platforms are only starting to come to terms with its weight in the industry.

Now worth $2.5 billion as of Amazon’s third-quarter earnings in October, an increase of 123 percent, Amazon advertising’s growth has turned the company into a soon-to-be rival of the duopoly, Google and Facebook. According to eMarketer, advertisers are forecasted to spend $4.6 billion on Amazon’s platform this year, which would give it 7 percent of market share. That’s a sliver compared to the market share of Google, at 37 percent, and Facebook, at 20 percent, but Amazon’s business is growing at a much faster rate. In the third quarter of 2018, brands’ ad spend on Amazon increased by 250 percent over the third quarter of 2017.

Industry analysts aren’t underestimating its potential, either. Citi Research predicted in January that in the next 10 years, Amazon advertising would hit $50 billion.

“Amazon has become pay-to-play, so advertising isn’t going to go away. Their market share will increase. It will be Google, Facebook and Amazon — this year was the ramp up to that development, next year it will be reality,” said Chad Rubin, the CEO of platform management system Skubana who also is a third-party seller on Amazon. “More budgets will increasingly be dedicated to Amazon.”

Even Google is breaking a sweat. The soon-to-launch Google Shopping Actions will compete directly with Amazon to drive purchases within Google, rather than sending potential customers off to other e-commerce sites.

“Google knows Amazon is encroaching on its space and it’s trying to fight that,” said Rubin. Google Shopping Actions is expected to go live first in France in early 2019.

As competition heats up — and Amazon’s ad business comes into its own — here’s a breakdown of what happened in the world of Amazon advertising this year.

Amazon consolidated its ad business to one platform.

In August, Amazon merged its sprawling ad divisions — Amazon Media Group, Amazon Marketing Services and Amazon Advertising Platform — into one platform. The move, as reported by Digiday reporter Seb Joseph, came on the heels of complaints that Amazon’s ad business was difficult to navigate thanks to different experiences and customer services. For example, third-party sellers and Amazon wholesale vendors bought ad products through entirely separate processes, previously.

“Amazon’s business is manageable once you know how the platform works, but there are more brands who sit on both sides now, which makes having such a disparate offering harder for them to manage,” one media executive told Digiday at the time.

Up next, Amazon is said to be merging its selling divisions into one unit, a forthcoming product called One Vendor that would mean third-party merchants and wholesale vendors operate through the same back-end system.

Amazon announced that New York City would be home to one location of HQ2.

Amazon’s announcement to open two locations of HQ2, one in Virginia and one in Long Island City in New York, drew attention to its advertising business. As Digiday’s Shareen Pathak wrote on the heels of the announcement, the move signifies how serious Amazon is about scaling its ad business.

“We see first-hand how they’re evolving their products. We see they’re getting traction from a budget-growth perspective. It’s the highest growth channel they have,” Jeremy Cornfeldt, president of the Amazon-certified agency iProspect U.S., said at the time. “Coming here is an interesting promise Amazon is making in a way.”

This could spell trouble for ad agencies. Already, Amazon has been bypassing agency middlemen and working with brands directly to grow its ad business and have a hands-on relationship with brand marketers. Ad buyers, meanwhile, are struggling to bulk up their Amazon expertise thanks to a lack of talent specializing in the platform’s nuances.

Brands continued to pour more money into Amazon, while Amazon private-label brands got a boost.

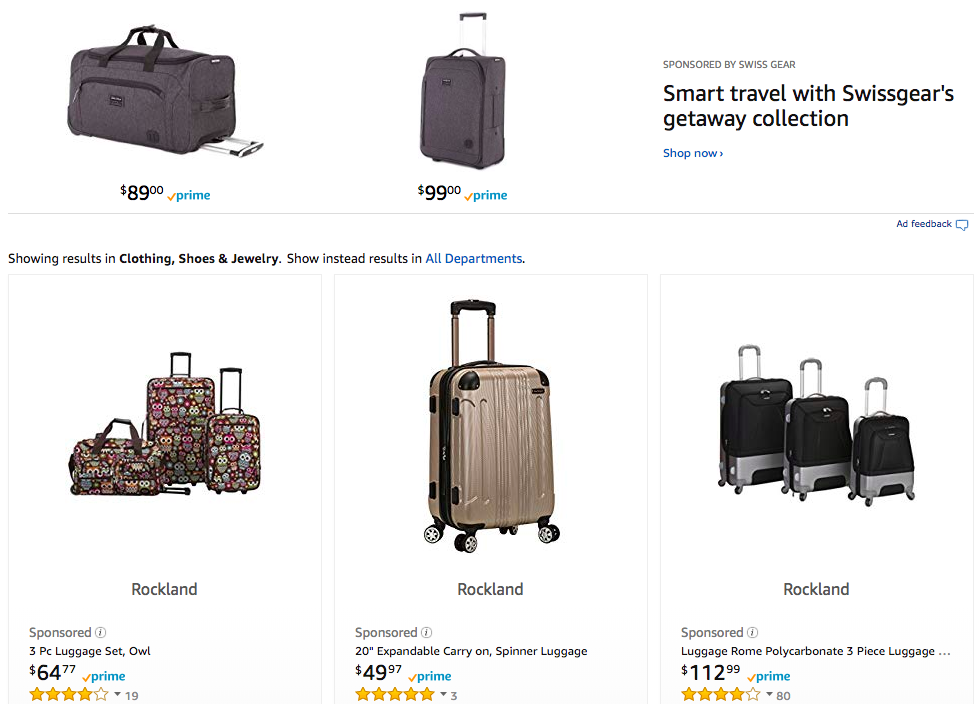

Type in “luggage” in an Amazon search and there are a number of different promoted products in the results. Swissgear has taken over the featured “headline” search result at the top of the page, and Rockland has put money behind four products for the top results in the product feed. These ad products are growing fast: According to Merkle’s Q3 Digital Marketing Report, ad spend on sponsored brands (Swissgears’ placement) was up 87 percent over last year, while ad spend on sponsored products (Rockland’s placement) was up 62 percent year over year.

Amazon results once favored organic traction metrics like most positive reviews and highest conversion rates, and now, to Rubin’s point, it’s pay-to-play. If brands want to get discovered, they have to pay up, and ad spend on keywords is becoming table stakes. Per Merkle’s report, Brand keywords accounted for 62 percent of sponsored brands sales and 42 percent of sponsored product sales in the third quarter.

But no amount of ad budgets can stave off Amazon’s own competitor brands. On high-traffic consumer holidays like Black Friday and Cyber Monday, as well as Amazon’s own version, Prime Day, private-label brands appear prominently in search results and in recommended product feeds, giving Amazon products the upper hand and every other brand a bigger hill to climb. And in regular search results — like the one for luggage — Amazon sponsors its own brands. One row of sponsored products in the luggage search feed are all AmazonBasics bags, which is essentially money going back into its own pockets.

Amazon’s next task: Find a way to continue to scale its ad business without ruining the utilitarian, search-click-buy customer experience it wins at. For sellers, it’s not so nuanced. All this ad movement means that Amazon is eating more of its profit. According to one Amazon merchant, Amazon takes 15 percent of third-party sales. Fulfilled by Amazon takes another 17 percent. Now, 20 percent of the sale also goes to advertising. It’s a tight squeeze.

“My prediction next year: Sellers need to get smarter with their spend or else. And there will be a lot of companies going out of business,” said Rubin.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.