Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Pitch deck: Why Amazon believes its premium streaming inventory is worth the money

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

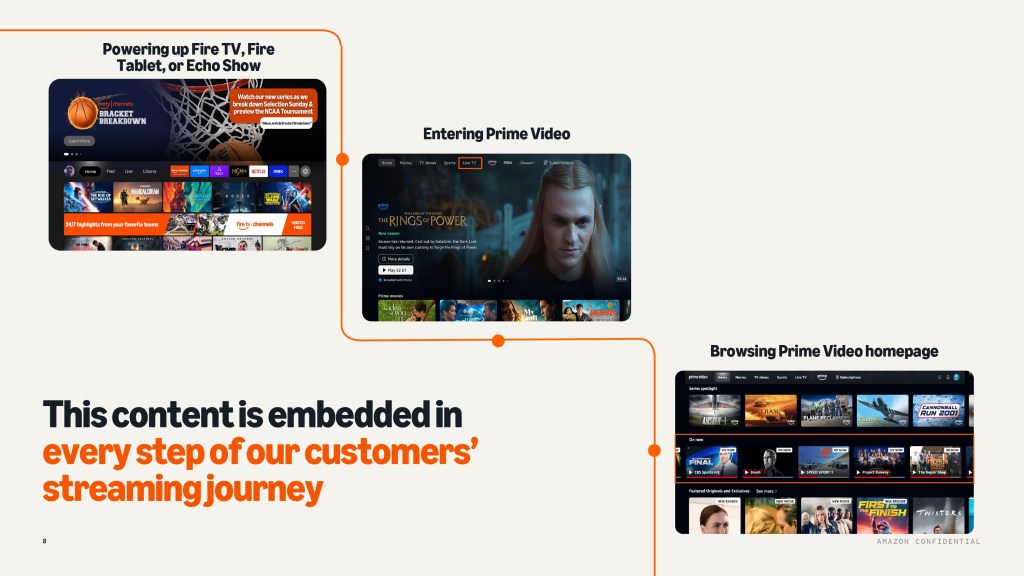

In 2025, Amazon quietly cornered premium streaming inventory. This year, it’s touring the market, pitching advertisers on why that access is worth the check.

The latest pitch deck for Amazon DSP — the tech platform’s programmatic buying platform — makes that case plain.

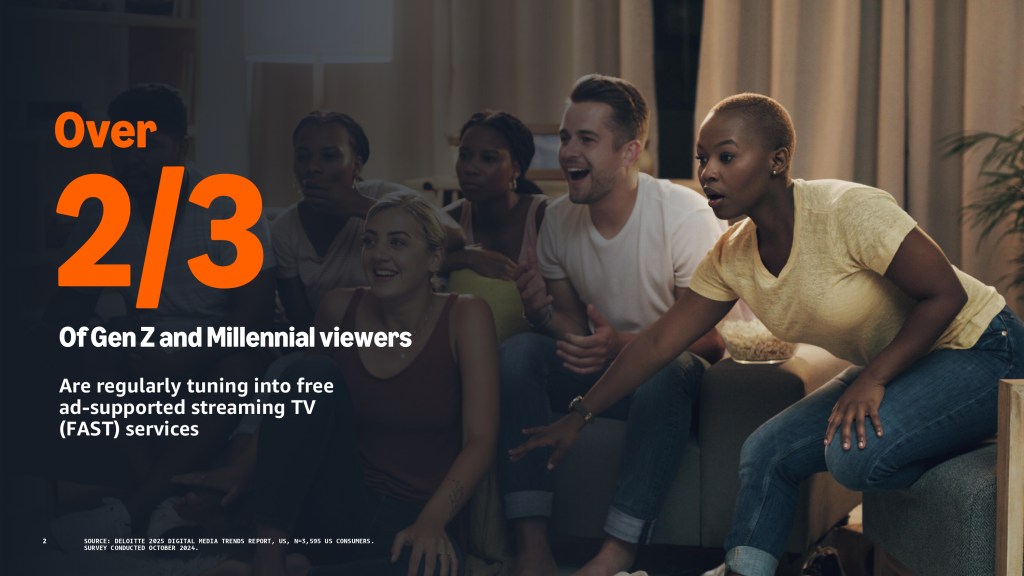

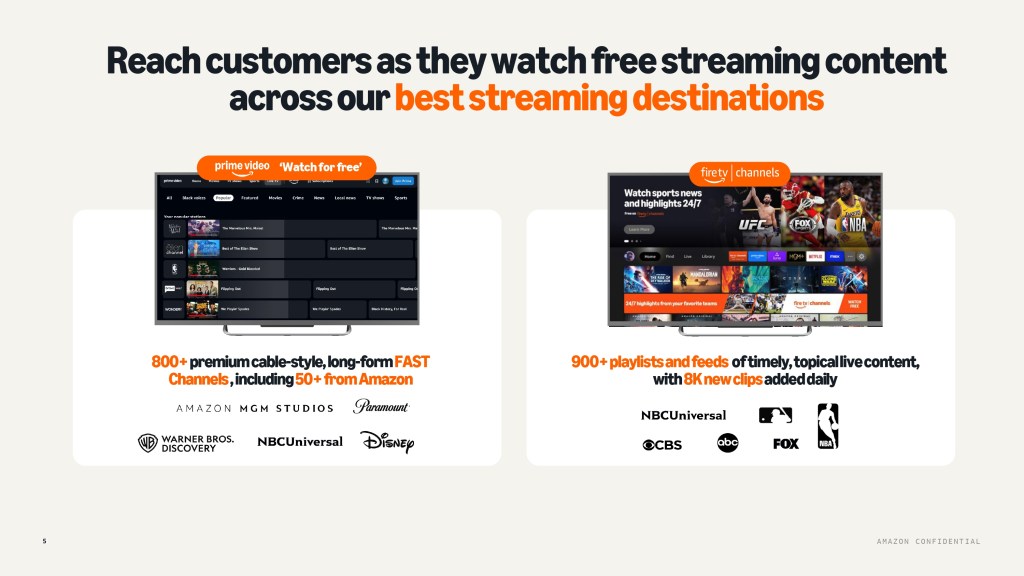

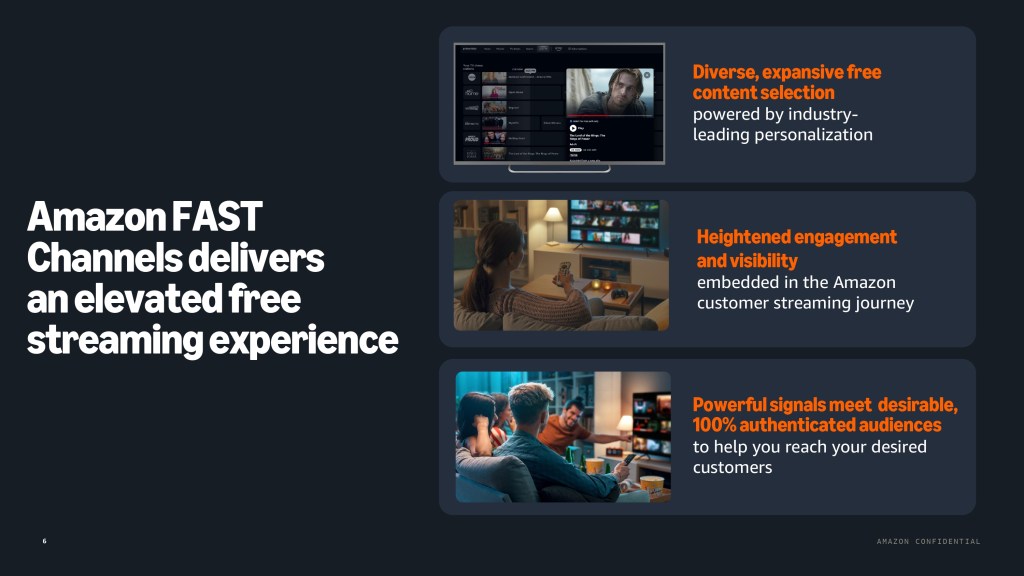

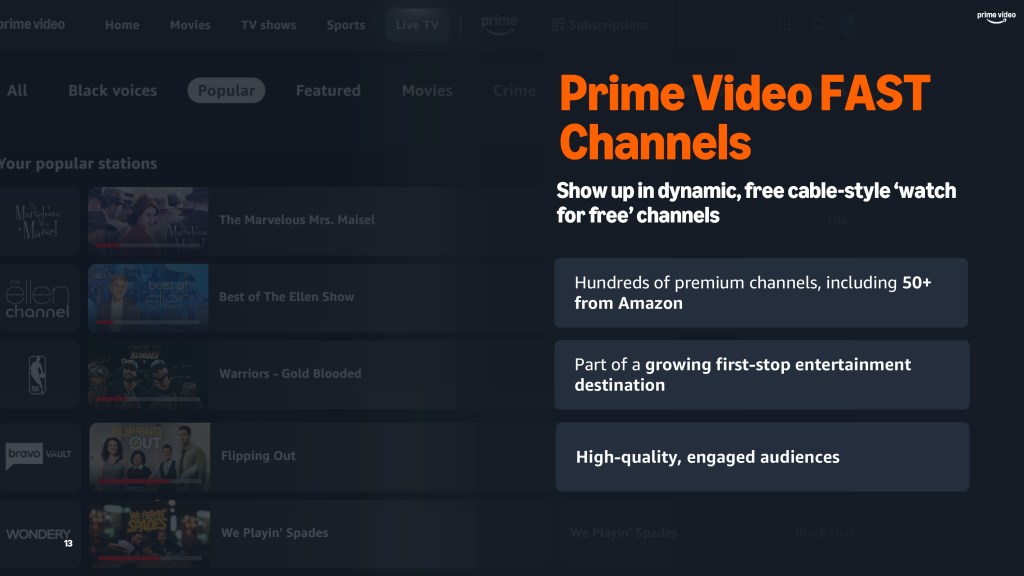

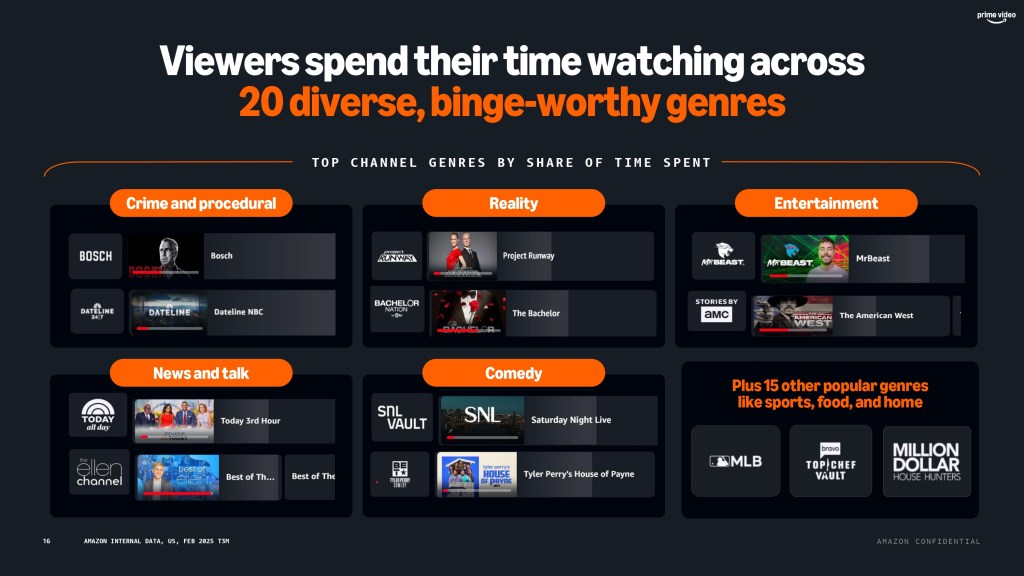

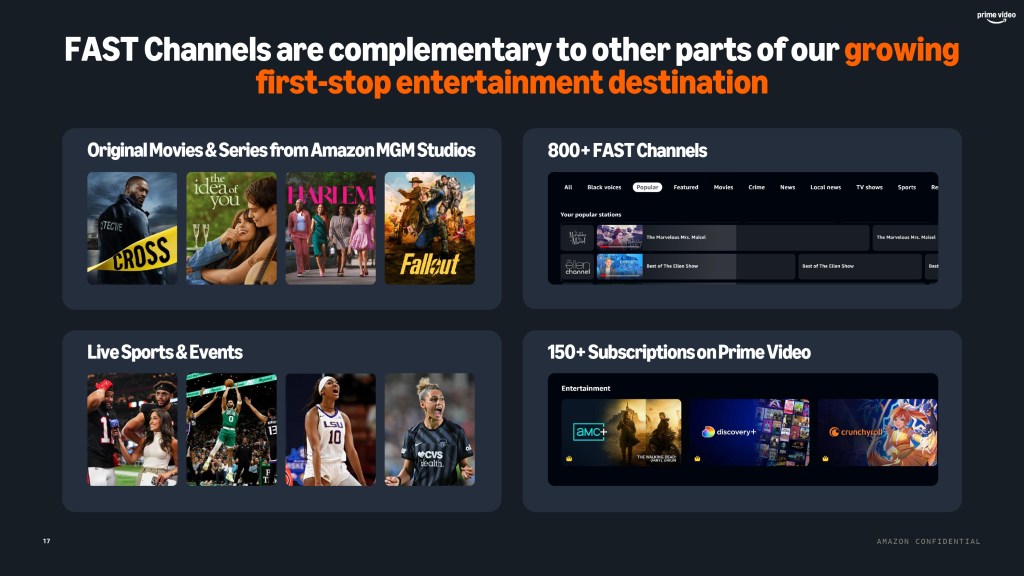

Amazon talks up its more than 800 free ad-supported streaming television (FAST) channels as a notable reach play through Prime Video and supplemented with FireTV channels, noting that advertisers can reach more than 55 million monthly viewers.

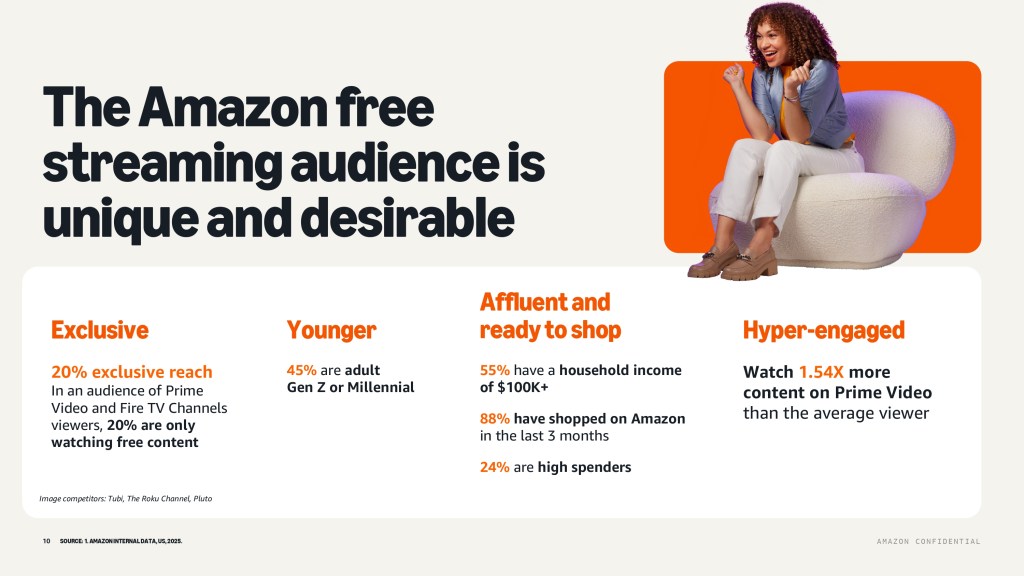

Taking a closer look at that audience, 20% exclusively watch free content, 45% of the audience are adult Gen Z or millennial, while the deck positions them as “ready to shop.”

Further breakdowns for Prime Video and Fire TV audience profiles and growing engagement levels:

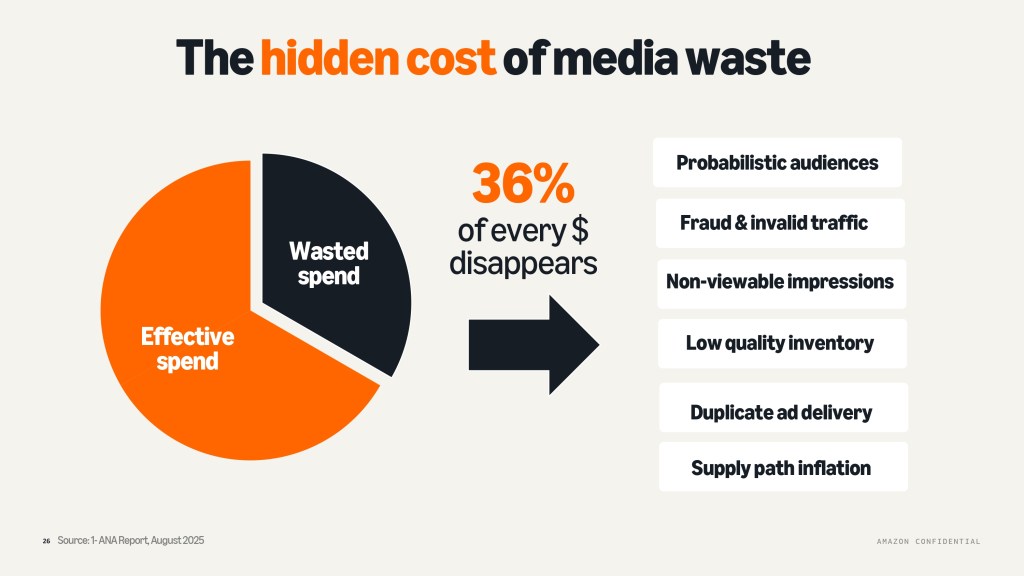

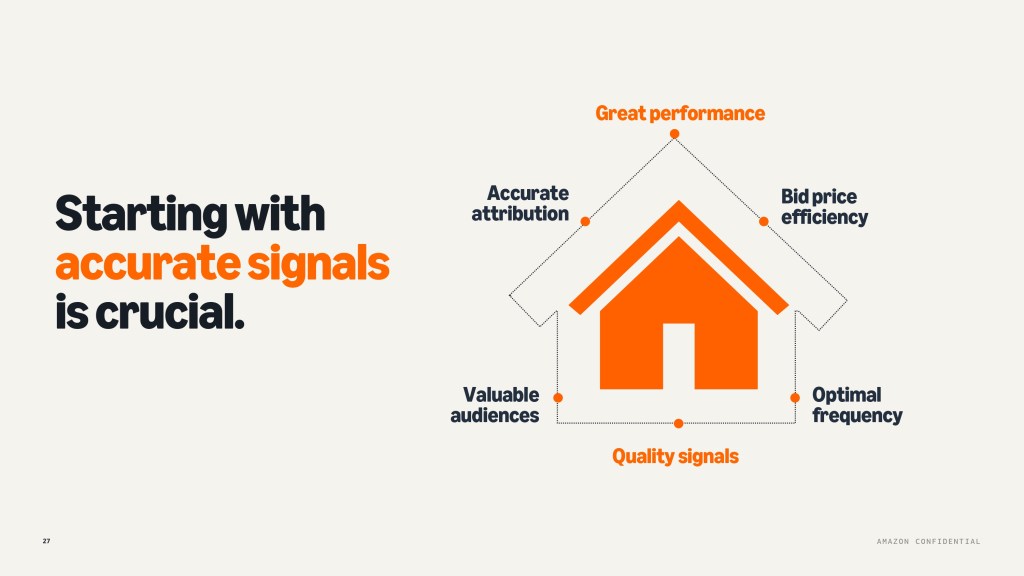

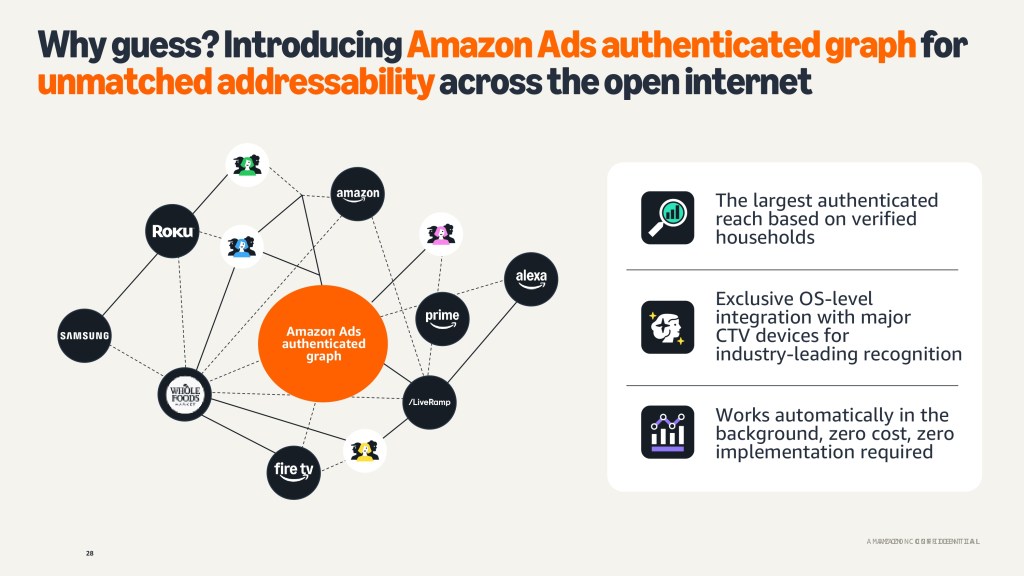

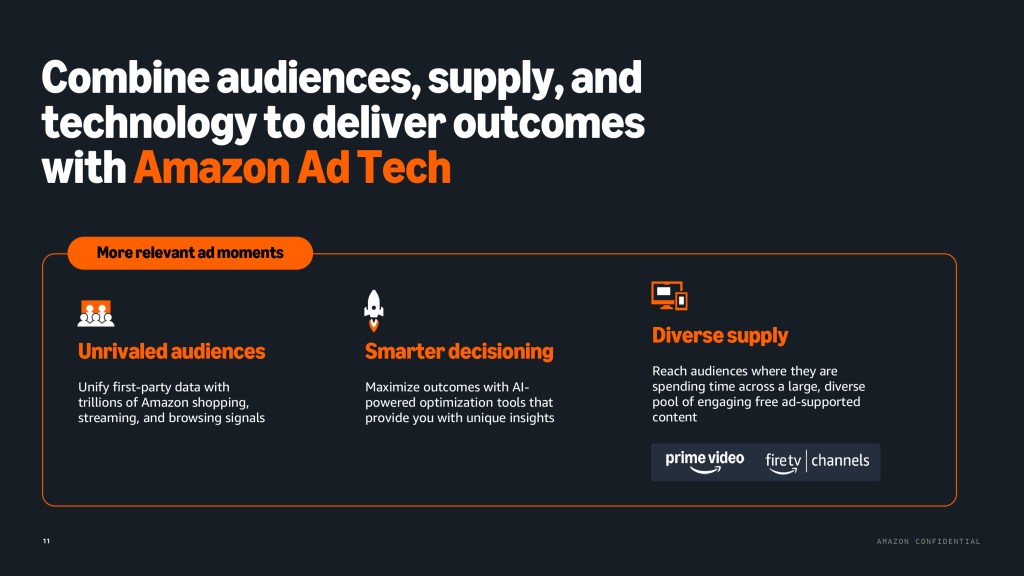

The deck moves on to talk through streaming TV more broadly, stating that 36% of every ad dollar is wasted through ineffective targeting, low quality inventory duplicate ad delivery among other hidden costs. Unsurprisingly, Amazon frames its DSP as a riposte to all of that, pitching it as a place advertisers can go to reduce waste by allowing them to target using accurate, authenticated signals. This is achieved via Amazon Ads authenticated graph for what the tech platform claims is unmatched addressability across the open web.

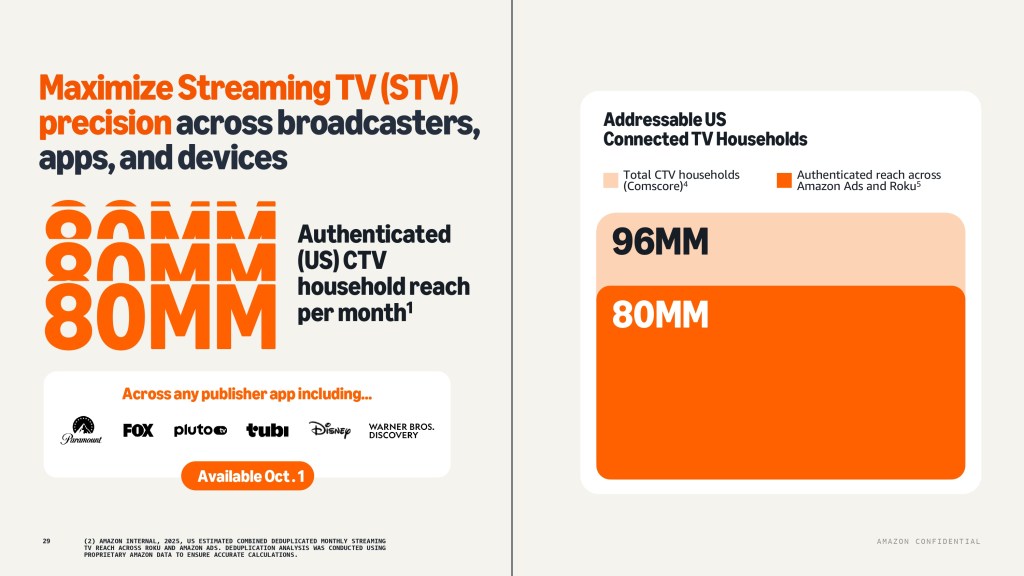

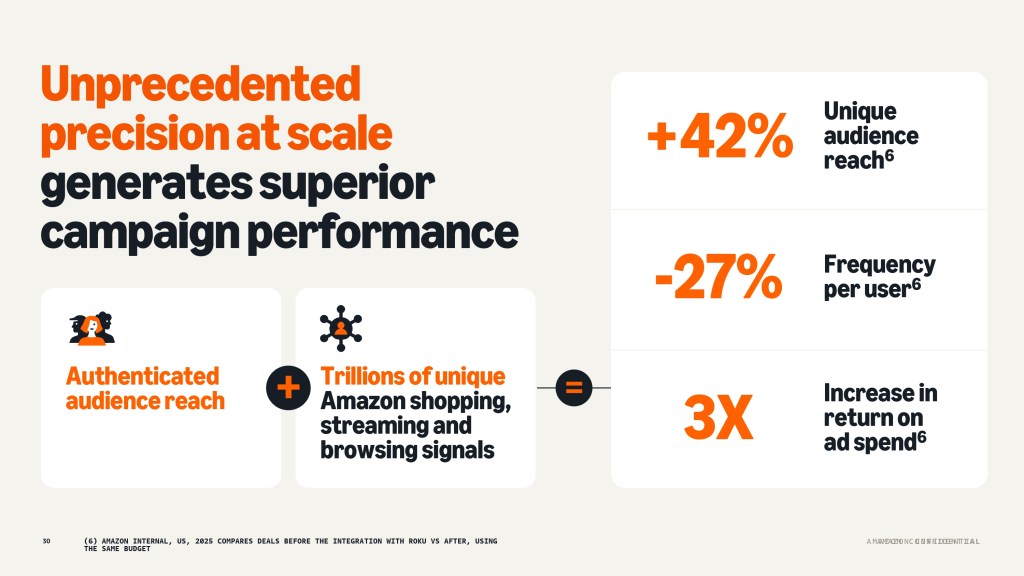

For instance, advertisers can target 80 million deduplicated U.S. CTV households across Amazon Ads and Roku, according to the company’s internal data, with much more precision across broadcasters, apps and devices, including Paramount, Fox, PlutoTV, Tubi, Disney and Warner Bros. Discovery (all since Oct. 1), using Amazon’s DSP.

The result: at least a 42% of unique reach, and a three times increase in return on ad spend, per the deck.

“The ability to activate across other CTV partners like Roku in a single buy allows for better reach and frequency management,” said Spencer Lian-Thornton, vp of growth and partnerships at Mindgruve, when speaking about the platform. “If you’re [advertisers] flexible on supply, can allow for cost-effective access to streaming audiences.”

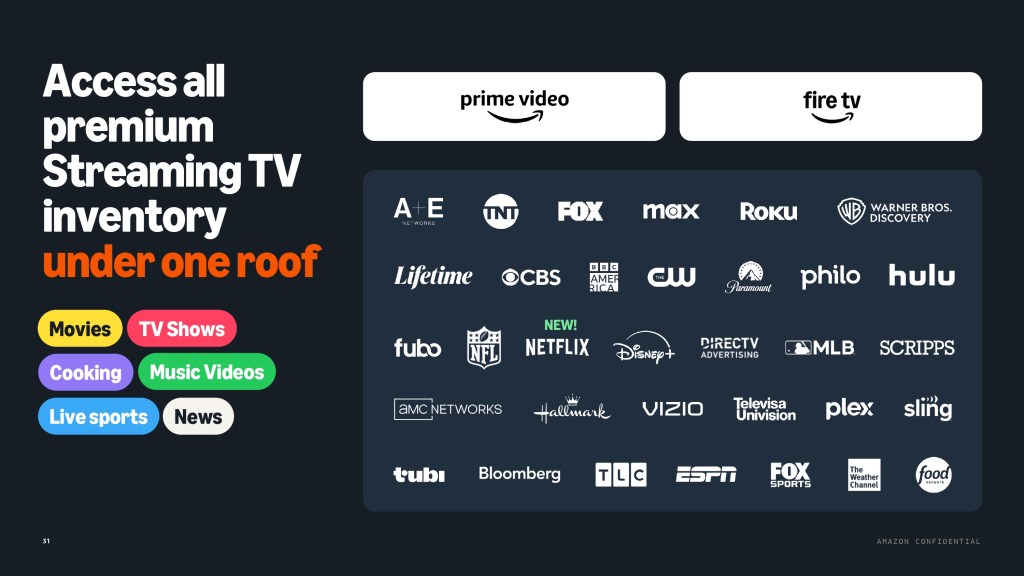

Toward the back of the deck, Amazon focuses on the bigger picture of its open web takeover by talking up its recent partnerships with Netflix and Microsoft.

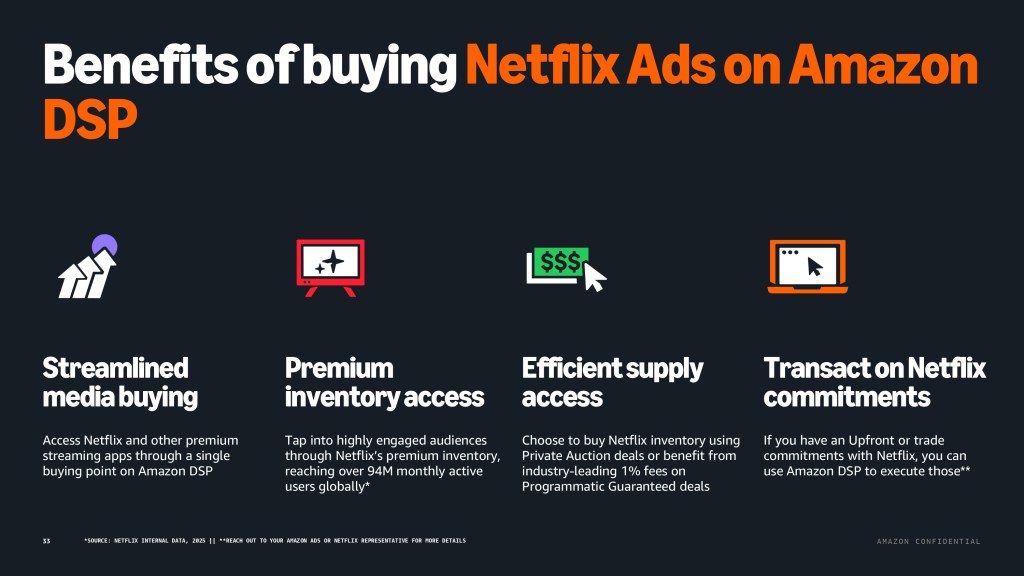

Netflix partnered with Amazon last September to make its ads more accessible via the platform’s DSP. And Amazon is using the partnership to position itself as a “one-stop-shop for premium Streaming TV inventory,” per the deck.

Slide 34 talks through the benefits:

- Advertisers can access not just Netflix, but a wider pool of premium streaming apps via its DSP

- The platform enables advertisers to reach Netflix’s more than 94 million global monthly active users

- Not to mention, upfront or trade commitments with Netflix can still be used via Amazon’s DSP

Interestingly, while Amazon DSP fees have typically ranged between 4% and 8%, and, in some cases, have been known to drop as low as 1%. Also, this deck emphasizes the platform’s 1% fees on programmatic guaranteed deals.

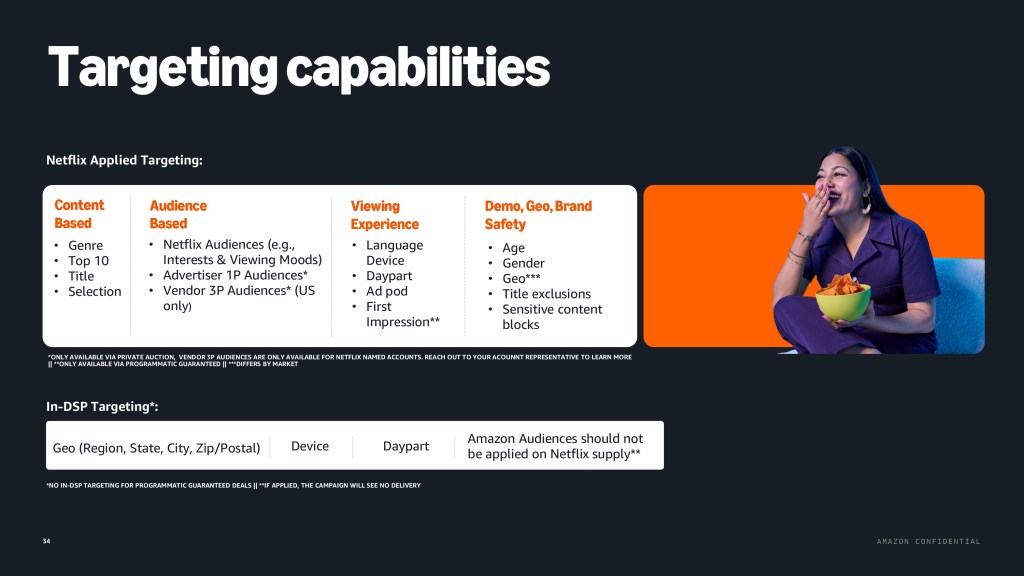

And if advertisers still need convincing as to why they’d choose to purchase Netflix via Amazon’s DSP versus directly, the deck includes a comprehensive list of targeting capabilities.

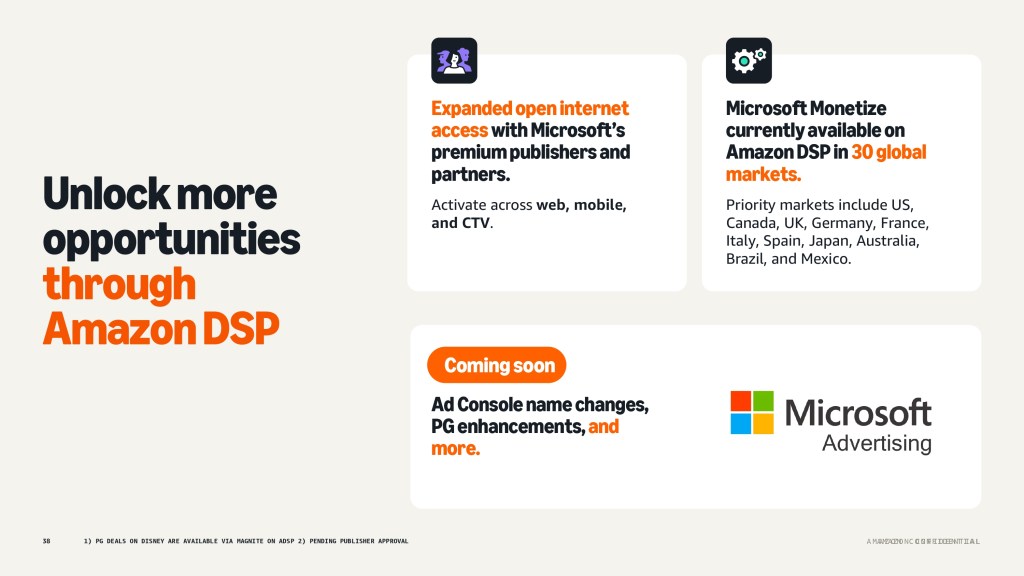

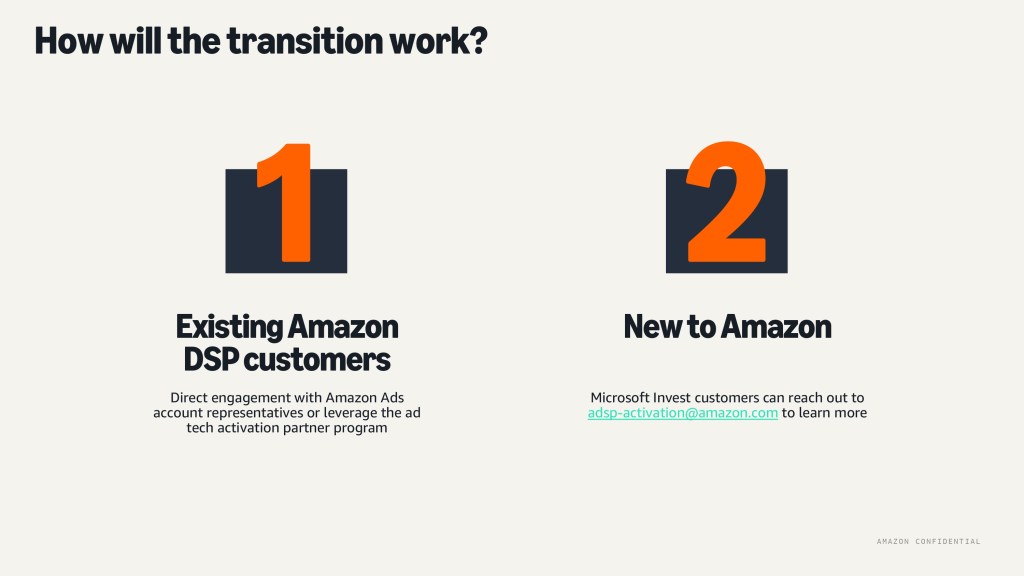

Microsoft’s partnership, however, comes off the back of the platform winding down its own ad buying platform, which saw Amazon not only inherit its advertisers, but also gain preferential access to its inventory.

The deck aims to point out exactly why it’s the right transitional partner for advertisers: the ability to activate on the open web.

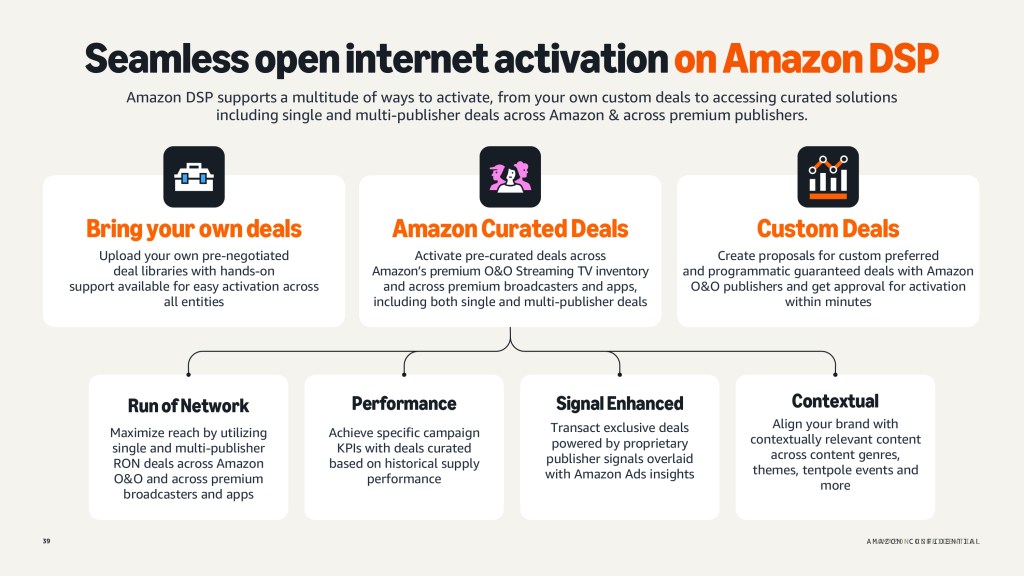

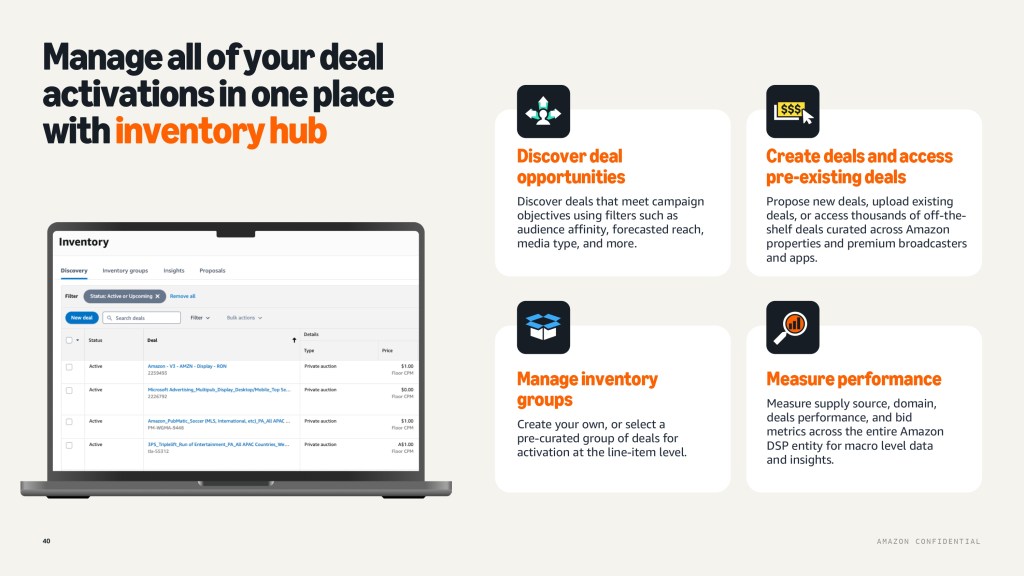

Advertisers can upload their own pre-negotiated deal libraries, access pre-curated deals or even create proposals for custom preferred and programmatic guaranteed deals — whether these are for single or multi-publisher deals. Whether they’re an existing Amazon DSP client, or a Microsoft Invest customer, advertisers will be provided with whatever help they need to ensure the transition is smooth, through Amazon’s DSP platform.

“The Microsoft SSP partnership is another strategic lever. It meaningfully strengthens Amazon’s access to premium programmatic supply and positions it as a more credible alternative to The Trade Desk,” said Whitney Robins, vp media systems and partnerships at Agility, about the platform’s Amazon partnership. “If performance proves out, advertisers could reduce reliance on TTD while gaining access to one of the most powerful retail 1P datasets in the market.”

Amazon did not respond to Digiday’s request for comment.

Click through the below to view the full pitch deck.

More in Marketing

In Graphic Detail: The state of the marketing agency sector

Revenue figures from Omnicom, Publicis and Havas, and new employment stats, offer a snapshot on a quickly evolving industry.

Future of Marketing Briefing: The mental gymnastics of principal media

Welcome to the psychological CrossFit class of modern marketing. Here’s how marketers are learning to move through it.

Amazon surpasses Walmart in annual revenue for the first time

Amazon has eclipsed Walmart in annual revenue for the first time ever.