Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Pitch deck: Here’s how Amazon has been selling its DSP so far this year

For years, Amazon’s advertising playbook was all about keeping advertisers in-house — using its data to target shoppers within its own ecosystem. Now, it’s shifting gears, urging advertisers to take that data on the road to reach those same people, or ones just like them, elsewhere.

The shift isn’t exactly a surprise. Its ad chief has been signaling the suggested strategy for a while, and advertisers have been reading the tea leaves. Still, without something concrete, it’s been tough for marketers to plan around. That’s what makes the latest pitch deck for its demand-side platform so telling: it puts Amazon’s off-Amazon’s ambitions in black and white.

True to form, it starts with the setup. The opening slides dwell on the challenges advertisers face, before positioning Amazon, predictably, as the answer to all of them. Slides three and four hit the familiar notes.

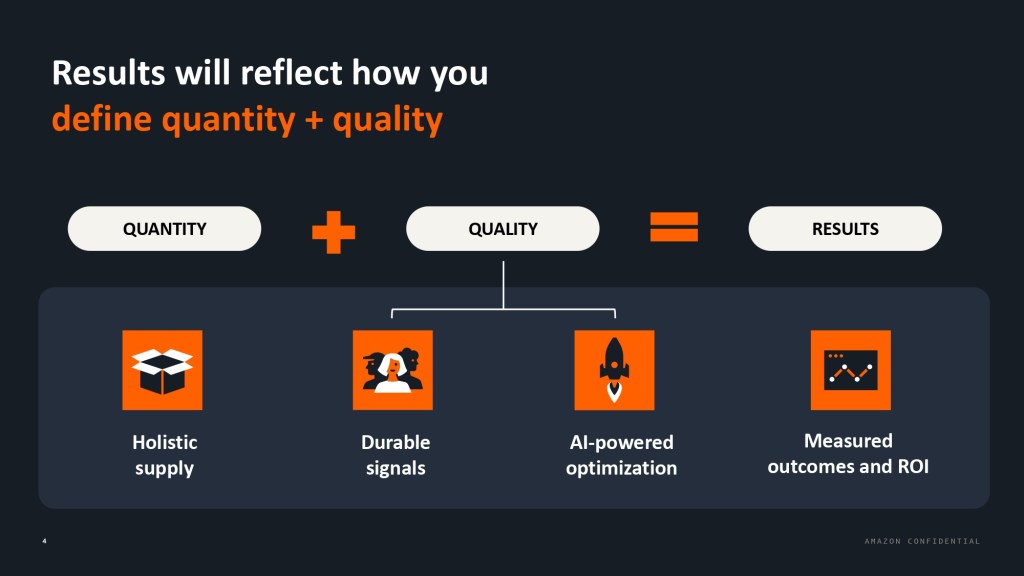

Next, comes a greatest-hits reel of marketing headaches: limited inventory, shaky audience signals, clunky optimization and the ever elusive promise of sharper measurement. Amazon wants marketers to know it’s got answers for all of them, as per slide six.

But the real story is between the lines.

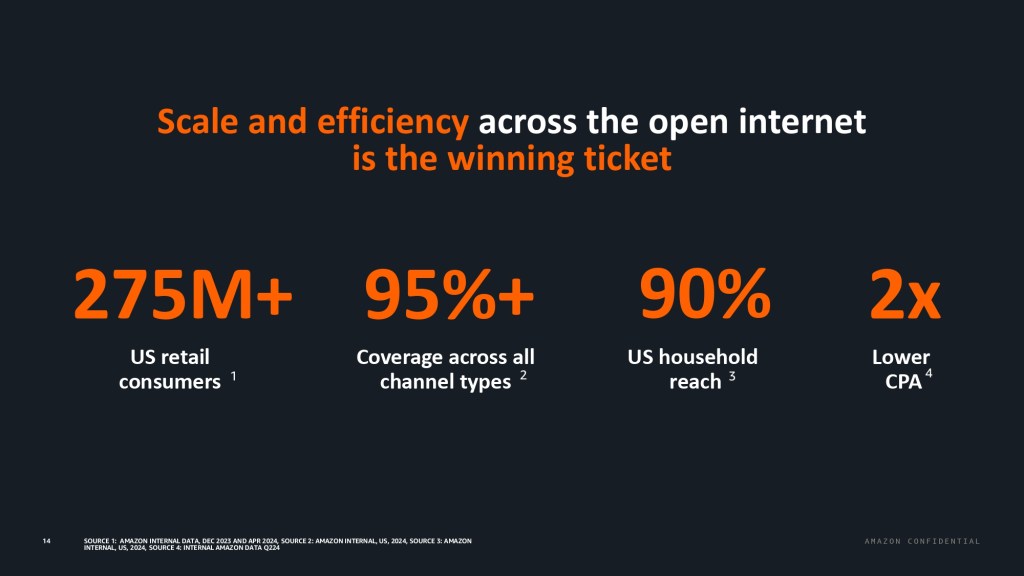

Amazon wants its DSP to be seen not as a tool for buying ads on Amazon but as a top tier gateway to the open web. It even dedicates an entire slide (slide seven) to show just how far that reach goes — apparently up to 90% of the U.S. population. And yes, that puts The Trade Desk directly in the crosshairs, especially in the light of Amazon’s recent moves to undercut the ad tech rival.

But as bold as this all sounds, a CMO is hardly likely to abandon The Trade Desk based on what they’ve been pitched so far. The reach is too good, the price too palatable. Amazon knows that, which is why it leans hard into a familiar playbook: promise the same capabilities, offer more control and do it all for less. Classic Amazon — turn the rival’s margin into its own opportunity.

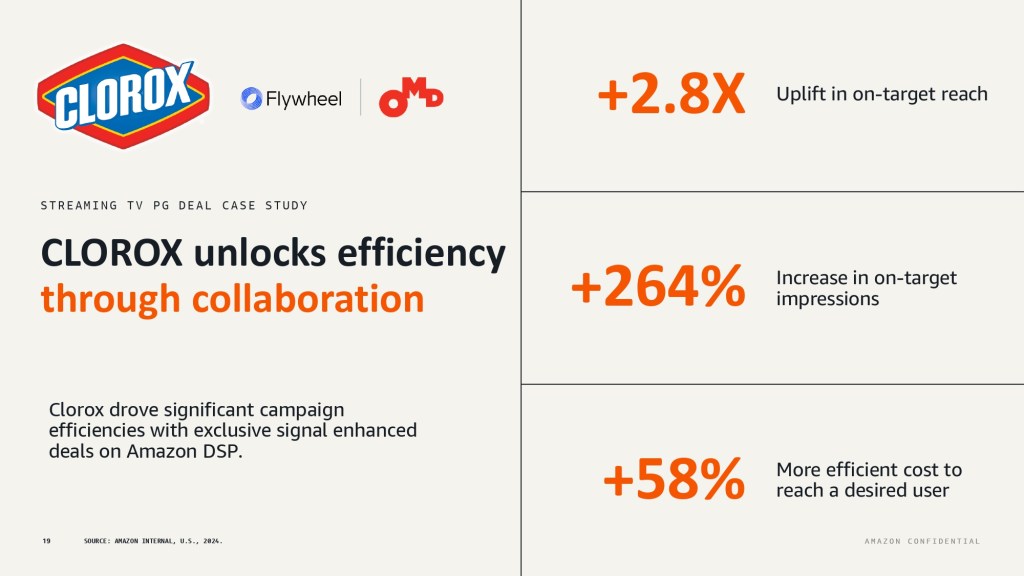

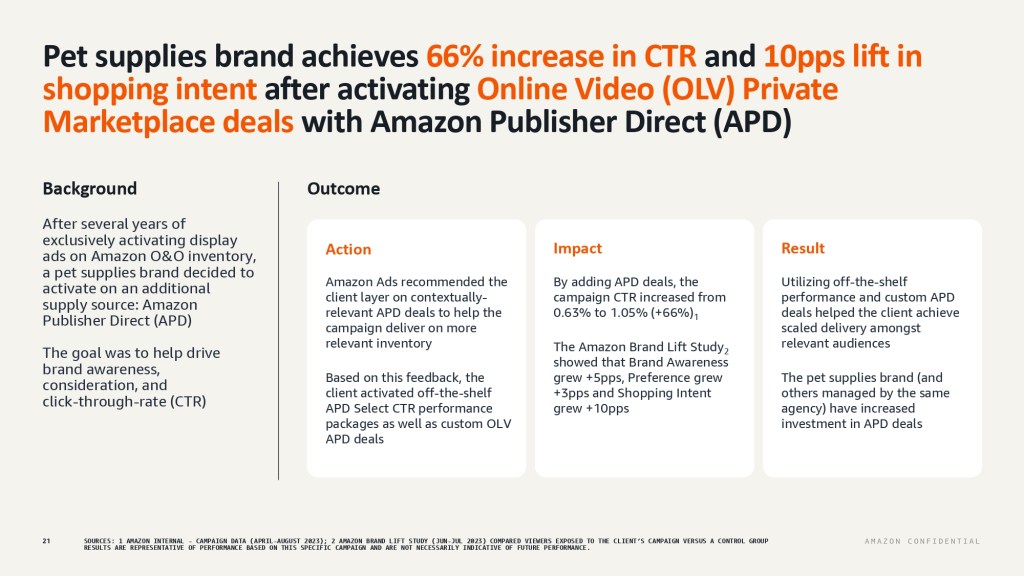

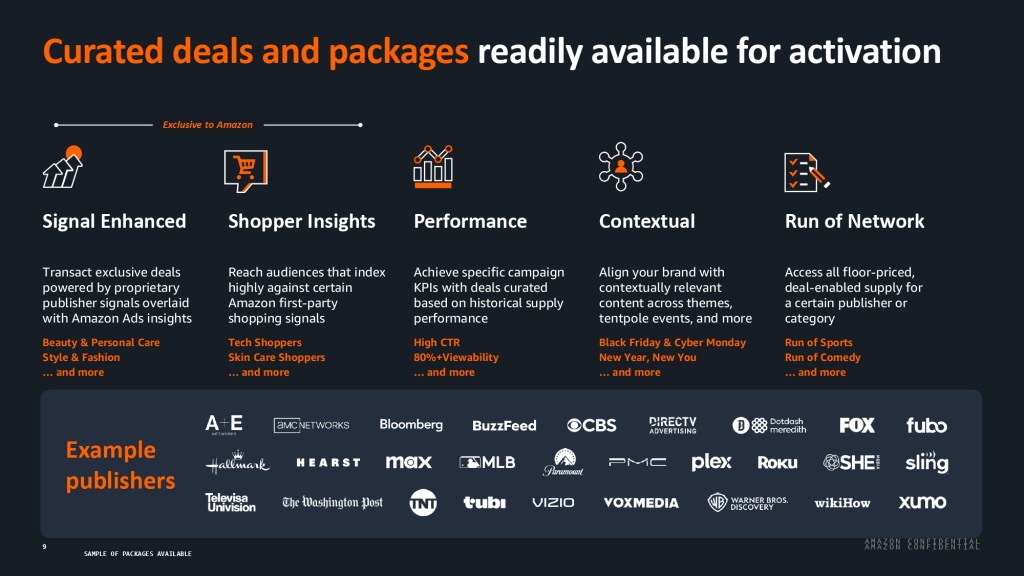

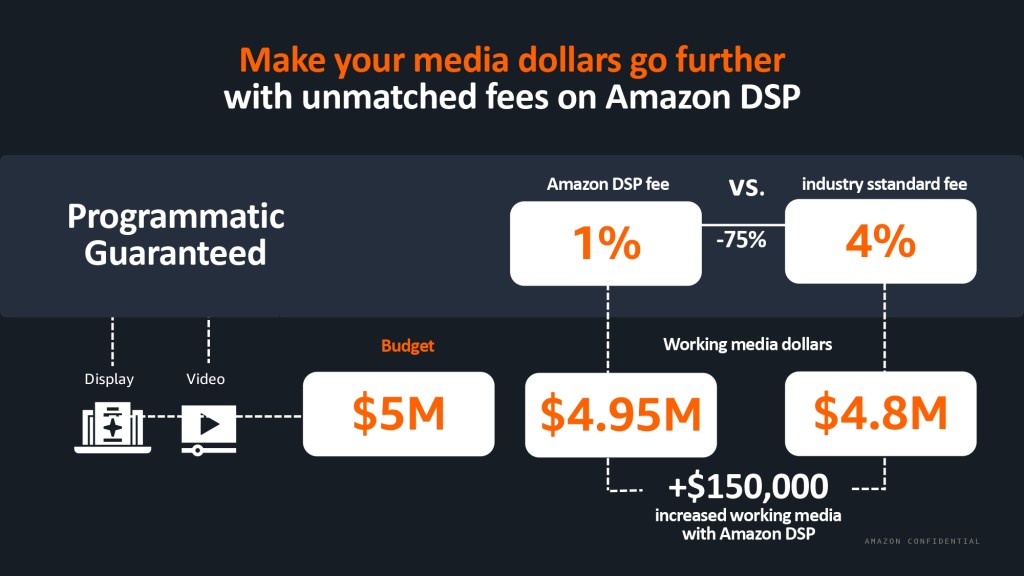

Slide nine reiterates that point. It touts a 1% tech fee for programmatic guaranteed deals on premium open web inventory — a clear swipe at pricier competitors. Beyond that, advertisers can choose from other deal types like curated or run of network with partners like Vox Media, CBS and Bloomberg.

Leah Lam, associate director, brand media at Collective Measures can attest to Amazon’s lower fees.

“We have seen Amazon DSP is much lower than other DSPs,” she said. “Ours seem higher than the numbers presented with DSP closer to 5% and other DSPs 2-3x that. Recently, we did reach out to multiple DSPs about programmatic guarantee rates and that seemed to be where Amazon DSP really outdid the rest – coming in at 1% whereas others were 10% plus.”

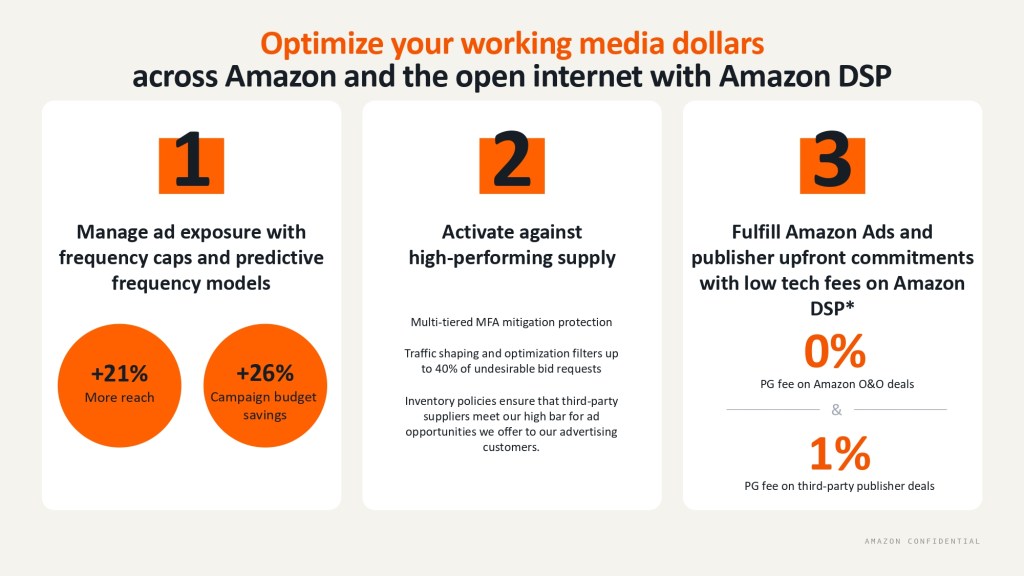

Slide 10 picks up where that one leaves off, offering marketers a visual flex on just how little Amazon takes from those guaranteed deals. It’s a calculated move. These deals remain a preferred buying method for advertisers looking to lock in premium inventory at scale, thanks to the predictability of pre-negotiated impressions and pricing. The message isn’t exactly subtle: Amazon is banking on lower fees particularly for advertisers already transacting heavily on its owned and operated properties to tip more of their budgets into its DSP.

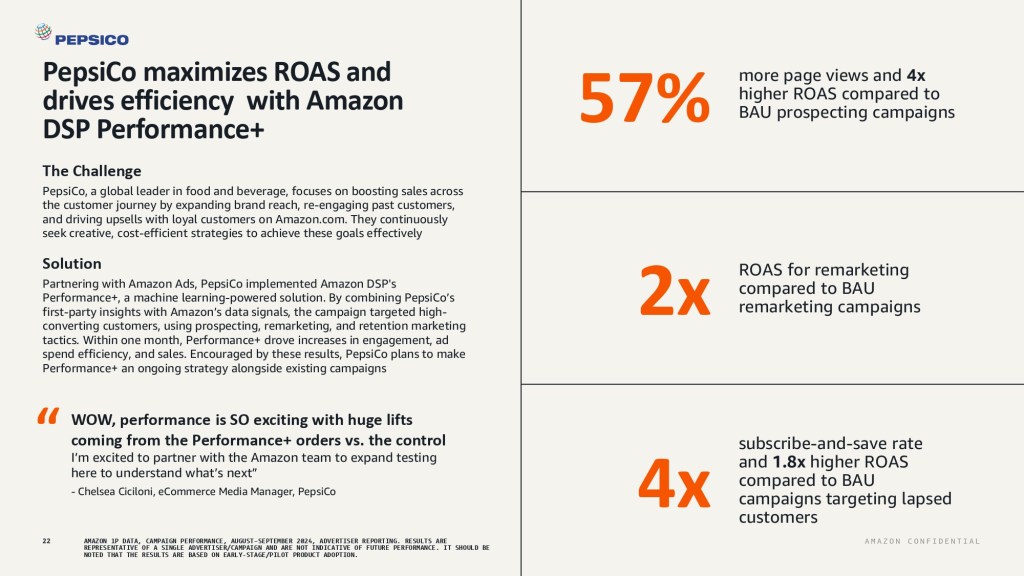

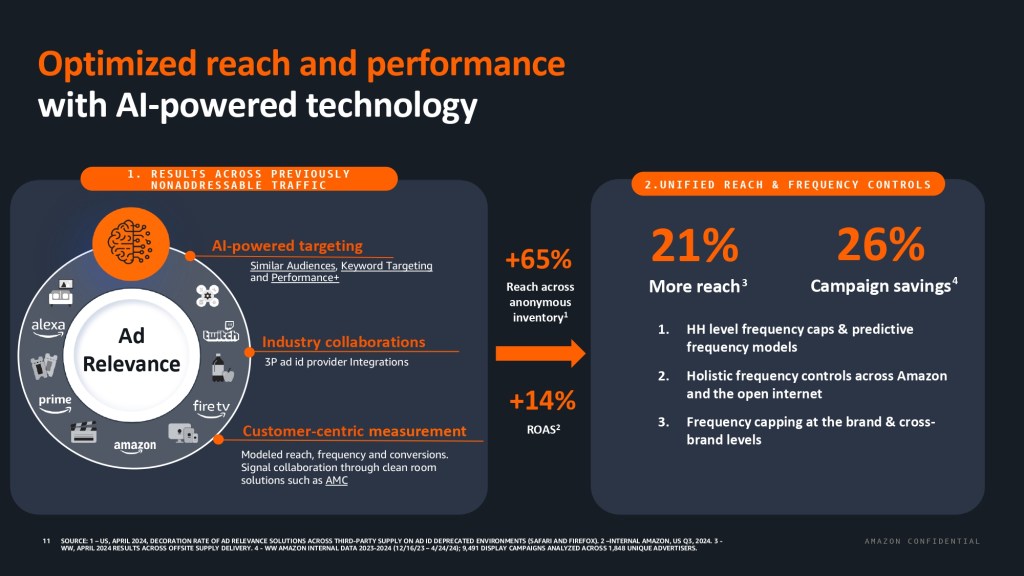

No platform pitch these days is complete without a nod to AI, and Slide 11 delivers. It lays out how advertisers can use Amazon’s DSP to reach audiences without relying on third-party cookies, or any other ID solution at all. Consider it Amazon’s AI-flavored answer to the identity crisis.

“What perhaps the AI ‘black box’ can guarantee is a certain level of performance from advertisers who otherwise aren’t savvy about more manual campaign management,” said Jamie MacEwan, senior research analyst at Enders Analysis. “And Amazon has to offer this solution competitively with Google and Meta’s equivalents to ensure it’s offering the full suite of expected services, as more advertisers get used to buying this way.”

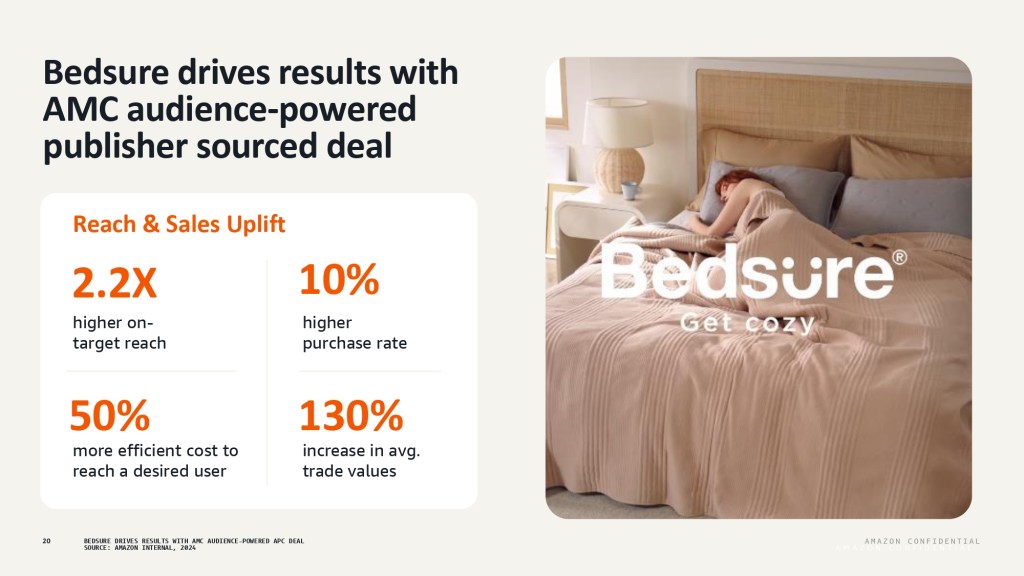

For the skeptics, Slide 12 aims to prove the point. It maps out the audience signals advertisers can tap into over the course of a week-long, full-funnel campaign — showing how Amazon’s data powers targeting both inside its walled garden and beyond it.

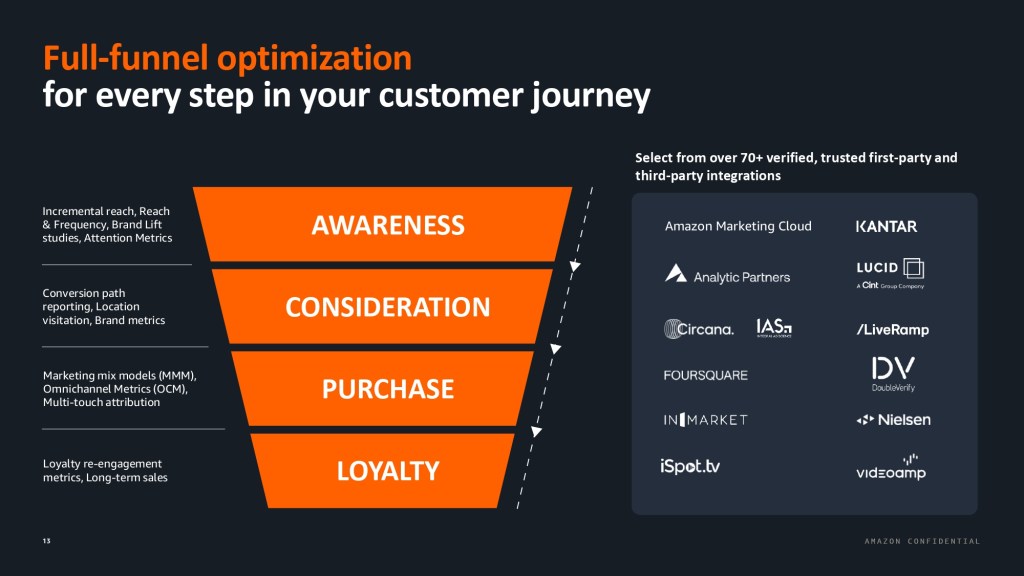

The next slide walks through how advertisers can optimize their buys as a campaign progresses, shifting spend from awareness to consideration, purchase to loyalty. Once again, Amazon’ making its case clear to: this isn’t just a DSSP for some online media spend. It’s aiming to be the DSP for all of it.

“All of our audience and measurement capabilities work for the ads we deliver across premium third party publishers through Amazon DSP, and our secure clean rooms provide advertisers the ability to analyze data, produce core marketing metrics, and understand how their marketing performs across various channels,” said Andy Jassy, CEO of Amazon on the company’s earnings call earlier this month (May 1). “We continue to see a lot of opportunity to further expand our full funnel capabilities for brands.”

The final stretch of the deck reiterates Amazon’s core message to advertisers of scale and efficiency, backed by a few parting stats. Then comes the close: a quick how-to for advertisers ready to take the plunge, assuming the pitch has done its job.

“At Amazon Ads, we intentionally design our AI-powered capabilities with traditional controls and transparent reporting that advertisers expect and need,” an Amazon Ads spokesperson said.

Click below to view the full deck:

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.