Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Pitch deck: How Amazon is selling ad buyers on its growing advertising business

Amazon is ramping up its advertising pitch to agencies and brands. The company recently expanded its self-serve programmatic advertising offering so agencies can now buy ads on their own through Amazon Media Group. It also extended some of the AMG offerings to third-party sellers on the platform, going as far as to offer them discounts and incentives to advertise on the platform.

The e-commerce giant has, according to agency executives, also been growing its sales team. Chief financial officer Brian Olsavsky confirmed this during the company’s most recent quarterly earnings call, saying the growth rate for the ad sales team is faster than the head-count growth at Amazon’s other myriad business units, which averages 42 percent annually. “What we’re seeing is an accelerated growth rate in software engineers and also sales teams to support primarily [Amazon Web Services] and advertising. So, yes, the growth rate of those two job categories actually exceeded the company growth rate,” he said on the call.

Amazon’s pitch to agencies focuses on Amazon’s own power as a shopping behemoth, according to a pitch deck obtained by Digiday. Its pitch emphasizes that its data reflects how people research, consider and purchase things, not only on Amazon but also elsewhere. It’s a clear shot at other platforms like Google and Facebook — the wealth of the data Amazon has on its customers is beyond what those behemoths have. Essentially, Google has search data and Facebook knows interest levels, but Amazon has real power because it knows what people are buying and how they’re doing it. “They are taking steps to make the ad program scalable,” said one executive.

It’s an approach that emphasizes targeting at scale, across behavioral, contextual, lookalike, remarketing and demographic and geographic targeting.

Amazon has 300 million users on Amazon.com and data on each user, from where they live to what they browse and buy. Amazon is able to create complete pictures of customer data potentially better than any other platform. And it’s all data it keeps close to its chest, retailers say.

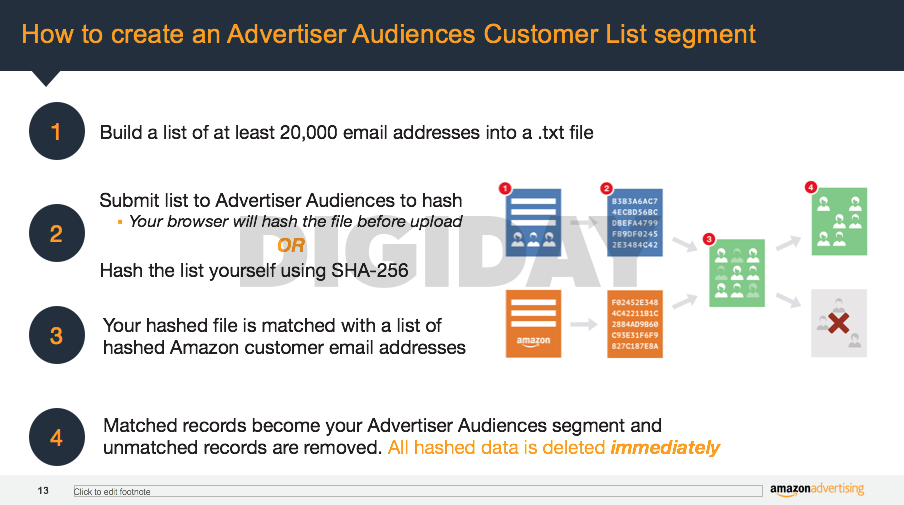

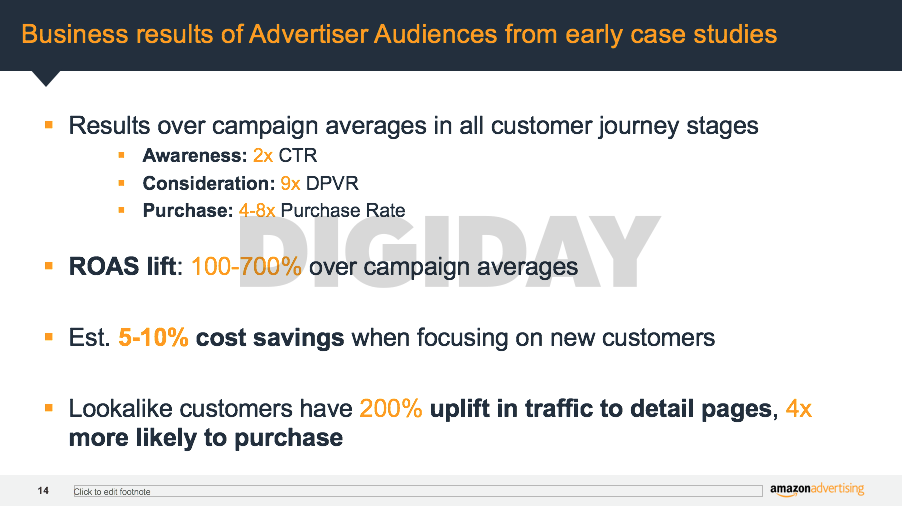

In June, Amazon also launched a self-serve platform called Advertiser Audiences, which lets brands upload CRM lists to let them audience match. The deck plays that up in a section on lookalike and remarketing targeting, telling brands that Advertiser Audience segments can reach all types of new, existing and lookalike customers.

Evidence from early case studies, according to the deck, shows that lookalike customers are four times likelier to purchase.

Here’s the full deck.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.