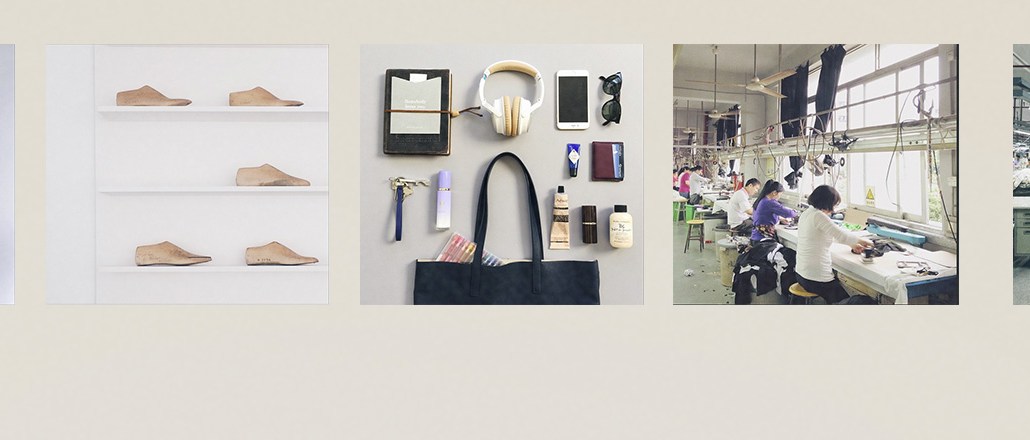

Take a tour of clothing retailer Everlane’s popular Instagram page, and amidst artistic shots of shoes sitting on white shelves and a Breton-striped sweater arranged just so, you’ll find photos of something most retailers usually hide: the factories in China that make its clothes.

It’s a transparency play that has worked well for the retailer, which has amassed a cult following for its simple, well-made clothes — and a stance that people should know where their clothes come from. The online-only shop prides itself on fair labor practices and a sustainable manufacturing approach. And when people go shopping for clothes on Everlane.com, they can see exactly the cost of the raw materials that went into making this silk tunic or that cashmere sweater.

It’s a smart tactic considering how much grief retailers like Gap, Tommy and Joe Fresh have gotten for the working conditions in their manufacturing facilities in countries like Bangladesh and China.

But Everlane’s social media approach isn’t just a gimmick: it’s one of the cornerstones of the retailer’s brand, said founder Michael Preysman. “It’s a way for us to get insight into the brand,” he told Digiday. “Social has really guided our company.”

While supply chain transparency was core to Everlane’s brand from the very outset, bringing it to social media was a bit of a fluke. One month into founding the company, Preysman posted an infographic to Facebook explaining price markups at retail companies. “It was so popular,” he said. That experience made social a priority at the company.

The actual costs behind making a T-shirt.

Posted by Everlane on Friday, 16 December 2011

The brand has only two people leading its social media efforts, although Preysman says many parts of the company play a part in helping decide what to spotlight. Everlane is also very quick to try, and then discard an approach if it doesn’t work. It started off very active on Facebook and Tumblr, for example. But Tumblr “fell by the wayside” because its customers weren’t there, and Preysman says he “got fed up” of Facebook and its constant algorithm tweaks.

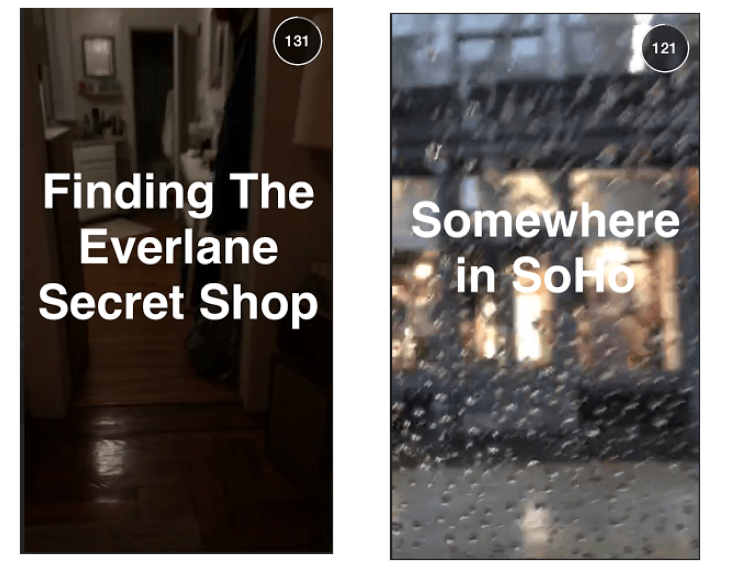

Because it’s a visual brand, Instagram has become a venue to showcase its products. But Preysman is also excited about Snapchat, where the brand uses the “Stories” feature for factory tours. On Monday, it tried something even newer: it used Stories to create a treasure hunt of sorts for customers in New York so they could find, via video clues, a secret pop-up store. “Social is important to us because it’s naturally transparent, and we push that part of our brand,” said Preysman.

Less successful was Everlane’s experiment with live streaming app Meerkat. Preysman thought it would be a great way to bring consumers behind the scenes into their design and manufacturing process. “That didn’t work,” said Preysman. “So we kind of pushed back on it.” It’s now figuring out its Periscope strategy.

The one point the retailer is clear on is a bit counterintuitive: it doesn’t want to use social media to actually, directly sell products. So you won’t find “links to buy” on most of its posts. “This works for engagement. It’s hard to prove dollars for social. So we know our objective,” said Preysman.

The brand even used social media to hire: Just a few weeks ago, it posted a picture of a desk and asked its social fans to think of questions to ask potential candidates for a social media coordinator job.

“The problem with a large company is that the CEO doesn’t get social so he’s constantly looking for justification from the team on why they’re spending dollars and time there,” said Preysman. “We don’t try to quantify these things, the only metrics we look at is engagement.”

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.