Secure your place at the Digiday Publishing Summit in Vail, March 23-25

How Discover’s ‘College Football 25’ integration demonstrates EA’s advertising dreams

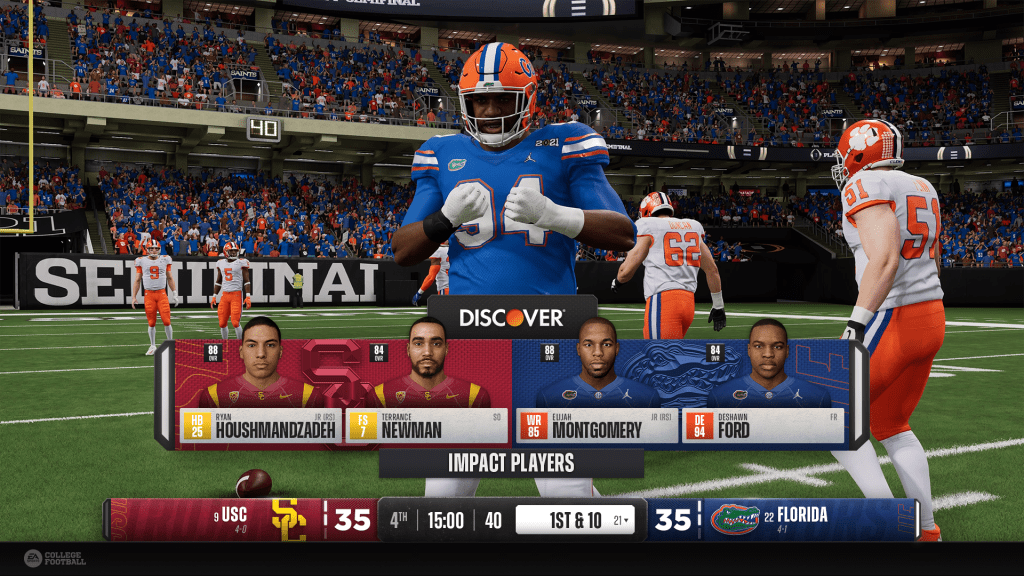

As Electronic Arts continues its push into advertising, the launch of “EA Sports College Football 25” represents a chance for the publisher to flex its inventory — and Discover is taking advantage.

Released last month, “EA Sports College Football 25” is Electronic Arts’ first college football game since 2013, following a long drought caused by legal issues surrounding the use of college athletes’ likenesses. So far, over 5 million gamers have purchased “EA Sports College Football 25,” which sells for a base price of $69.99, reportedly accounting for over $500 million in revenue for Electronic Arts.

“EA Sports College Football 25” is Electronic Arts’ first major release since the publisher’s Q4 2024 earnings call, during which CEO Andrew Wilson flagged that EA would be exploring more options for in-game ads in the coming year. As the company hires more ad tech staff, “College Football 25” is an opportunity for EA to demonstrate its advertising power to interested brands.

Discover is one such brand. The credit card company has partnered with EA to integrate its branding directly into natural gameplay moments ranging from lists of impact players to halftime stat graphics.

“If you’re watching a college football game, you would expect to see that; it’s very natural to have a brand associated with it,” said Discover CMO Jennifer Murillo, who declined to share the financial terms or duration of the agreement.

To learn more about Discover’s advertising goals within “EA Sports College Football 25,” Digiday spoke to Murillo for an annotated Q&A.

This conversation has been edited and condensed for length and clarity.

On Discover’s motivation to advertise inside ‘College Football 25’

Jennifer Murillo: “We’ve been part of the fabric of college football for a while. We’re the official credit card sponsor of the Big 10 [athletic conference]. We certainly run advertising during the games, but we also show up at the games; we bring fan experiences onsite, or interactive games that fans can play. So when EA brought their college football game back, there was so much excitement, and it really was a very easy decision to make, because it was a natural extension of something we know people care about.”

Digiday: Murillo’s answer focuses on Discover’s connection to college football, which was the primary motivation behind its partnership with EA. But it’s worth noting that Discover has also made efforts to reach out to the gaming community, and that the “College Football 25” partnership dovetails with these efforts as well. For the last three years, for example, Discover has partnered with Cxmmunity Media to host the Discover Bowl, an esports tournament for students at historically Black colleges in the United States.

On how Discover gauges the success of an in-game brand integration

Jennifer Murillo: “Millions of players and multi-millions of hours have been spent on the game, even just in the first week. So, sure, we look at the audience that it’s drawing, and we look at how much time they’re spending with it, and how much exposure we’re getting. But, really, we’re looking at this as part of a much bigger play that we’re looking at over the course of a longer period of time.”

Digiday: Murillo’s answer demonstrates that the greatest value of “College Football 25” for advertisers is not its traffic numbers or engagement metrics, but rather the intangible hold it has on the college football audience. For a company that has spent years working itself into the culture of college football, showing up inside a college football video game just makes sense. Electronic Arts’ wide portfolio of sports games is arguably its greatest asset as the publisher looks to build out its advertising business.

On the nuances of showing up inside a video game

Jennifer Murillo: “The goal here is to have a presence, to have that visibility, but to do it in a really additive way. As soon as you start pushing that boundary to a place where it starts to feel intrusive or disruptive, I think that’s the place we don’t want to go.

I have two sons who are both high school football players, and I think the real litmus test for me was at home. About a week after the game came out, my boys had been playing it a ton, and I said, ‘Hey, did you guys notice anything interesting in the game?’ And my older son, who’s going to be a senior, was like, ‘Oh yeah, Discover’s in the game. You showed up, just like you always do.’ He noticed it, and it was relevant, but completely what he would have expected.”

Digiday: While EA’s sports game portfolio allows for relatively seamless brand integrations, as demonstrated by Murillo’s anecdote above, the publisher could come up against some difficulties as it works to expand its advertising offerings to other types of games. While sports games often emulate television broadcasts, which are already full of ads, it’s harder to imagine Murillo’s sons responding as positively to advertisements inside other popular EA series such as “The Sims,” “Battlefield” or “Apex Legends.”

More in Marketing

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.

Yahoo pauses IAB membership amid a series of quiet cost-saving measures

Yahoo pulls IAB board memberships, following job cuts as PE-owner reportedly reconsiders ad tech investments.

Target looks to e-commerce, advertising investments to help grow the business

Technology is one of the most important areas in which Target will invest with the hopes of returning to profit growth.