Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In the U.S., you may pay for your coffee from the Starbucks app, book a car on Uber and place orders with the Amazon shopping app. But in China, you can do all of these through WeChat Wallet alone.

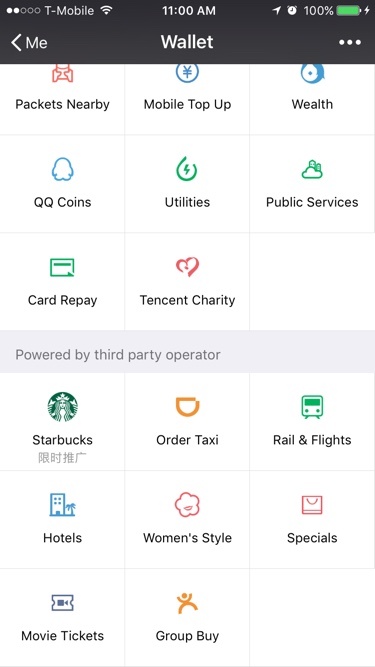

WeChat Wallet functions like Apple Pay, which allows users to purchase products and services with select credit or debit cards (mostly from Asian banks; Chase and Bank of America are not available, for instance.) Unlike Apple Pay, WeChat Wallet has integrated its parent company Tencent-owned services to let its 800 million-plus monthly users do things like pay for utilities and manage personal finance, within WeChat. It has also partnered with a limited number of third-party companies to make them more discoverable on the platform.

Many stores in China take WeChat payments. But for the time being, only eight — outside of Tencent — have their own digital portal on the platform. Here is how three brands — Starbucks, JD and Didi — utilize WeChat Wallet.

Starbucks

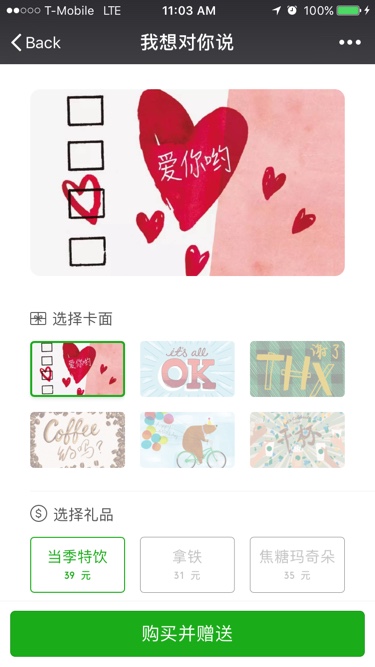

The coffee chain is the only international brand on WeChat Wallet, for now. Its 2,500 stores in China started taking WeChat payments back in December of last year. As part of this partnership, Starbucks introduced digital coffee gifts on WeChat Wallet this month.

When users enter into Wallet, they will see a Starbucks logo under “Powered by third-party operator.” Clicking on the square directs users to a branded microsite where they have the option to send a coffee drink or a gift card to a friend. Users can also choose different themes like Valentine’s Day, birthday and friendship for your gift and customize a message upon purchase.

Recipients can redeem the digital coffee gift in store.

Having spent many years in China, Saul Gitlin, principal for Gitlin Global Consulting, thinks that Starbucks’ integration with WeChat Wallet can help the brand drive in-store traffic and incremental revenue. “Without availability on Wallet, people may not even think of gifting a Starbucks coffee,” said Gitlin.

JD

E-commerce giant JD is one of Alibaba’s biggest competitors in China, and Tencent holds more than 20 percent of stake in JD.com. A click on “Specials” takes users to the JD site where they can adjust their shopping cart or make a purchase.

Josh Gartner, vp of international corporate affairs for JD, explained that WeChat has been critical for the company since 2014. In general, 25-30 percent of first-time site visitors to JD.com come from WeChat, and that number can go up to 50 percent during major shopping events like Singles’ Day, noted Gartner.

There is also a data play. Under a strategic advertising partnership, Tencent shares data on user demographics and which public accounts people follow on WeChat. JD, meanwhile, has transaction data. When the two companies combine their data, they can help advertisers target specific demographics on WeChat, explained Gartner.

“We can help a brand narrow down its target audience on WeChat from 800 million people to 1 or 2 million, for instance,” he said.

Didi

Like JD, Didi is backed by Tencent and was integrated with WeChat Wallet back in 2014. A presence on WeChat Wallet allows users to hail a cab without downloading the Didi app, and gives Didi a competitive edge over Uber.

Uber sold its China operations to Didi last August.

While WeChat Wallet provides convenience to the end user by adding the above brands and services, Gitlin thinks that its expansion outside of China faces many hurdles. A big one: WeChat needs to grow its users overseas and convince international brands to transact on the platform. And its biggest rival, Alipay, an Alibaba-affiliated mobile wallet, started expanding its vendor relationships with European processors in August of last year to make it easier for Chinese tourists to use Alipay when they are abroad.

“Outside of China, there is little understanding about Alipay or WeChat Wallet,” said Gitlin.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.