Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing tracks how ad dollars were doled out on connected TV screens in the third quarter as traditional TV ad spending shrunk.

- CTV seizes spend

- 3 questions about Bob Iger’s plans for Disney

- Streaming keeps viewership lead as broadcast TV regains ground

- TV new networks’ cost-cuting, Paramount’s corporate changes, NBCUniversal’s measurement currency council and more

- CTV ad spending increased year over year in Q3 2022, while traditional TV ad spending dipped.

- The number of advertisers buying CTV ads also increased year over year.

- Direct sales is ceding share to programmatic sales for CTV impressions.

- Creators are unconvinced that they can depend on Snapchat as a reliable revenue stream.

- They also feel the platform does not adequately support creators.

- The NBCUniversal-owned TV network owns the U.S. Spanish-language rights to air the 2022 World Cup.

- Telemundo will stream all 64 World Cup matches on NBCUniversal’s Peacock.

- Everly Health ran a recent campaign across Hulu and Tubi.

- The fertility brand is prioritizing reach to boost brand awareness.

- DatafuelX aims to help traditional TV ad sellers to manage their inventory and dealings with multiple measurement providers.

- Supply-side platform Clypd had played a similar role but has been shut down since being acquired by Microsoft-owned Xandr.

CTV seizes spend

The key hits:

The third quarter of 2022 wasn’t a great period for the TV advertising business. But it wasn’t such a bad one for the connected TV advertising business.

Sure, Roku reported a further slowdown in advertising revenue, but the CTV platform owner’s ad revenue still grew. Meanwhile, Disney, NBCUniversal and Paramount each reported year-over-year declines in ad revenue for their traditional TV businesses but increases on the streaming side.

In fact, traditional TV ad spending fell by 23% year-over-year in Q3 — and overall ad spending across media types dropped by 5% — whereas CTV ad spending rose by 39%, according to Standard Media Index, a research firm that compiles advertiser spending and pricing data from agencies.

“CTV across the board was up. Every [advertiser] category that we report on showed an increase in ad spend,” said Darrick Li, vp of sales, North America, media owners at SMI.

Not only did advertisers increase their CTV ad spend in Q3, but the number of advertisers spending on CTV ads also increased. Ad tech vendor Beachfront tracked a 25% year-over-year increase in the number of brands advertising on CTV in the period.

“In general, [that new advertiser growth rate] is pretty in line quarter over quarter,” said Amit Nigam, vp of product at Beachfront.

In other words, the CTV ad spending increase in Q3 shouldn’t be all that surprising. While the economic downturn has led to an advertising slowdown, CTV remains in a pubescent period and stands to benefit from many advertisers only starting to shift dollars to the channel within the past couple years and increasing that amount as CTV matures and more streaming inventory opens up. Furthermore, CTV typically provides advertisers with greater control and flexibility than traditional TV while still offering an ability to reach a large audience on a big screen, all of which have become important to brand advertisers that are tightening their belts at the moment.

“We are seeing clients be very conservative, potentially shifting to channels that have increased flexibility where they can cancel things if they need to,” UM Worldwide’s U.S. chief marketplace officer Stacey Stewart said on the Digiday Podcast last month.

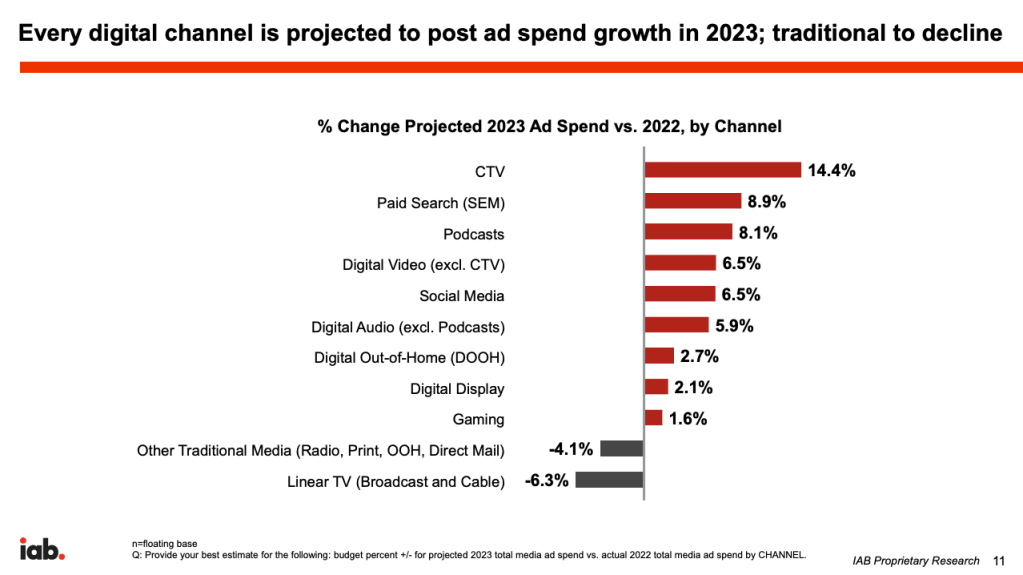

The still-emergent state of CTV shows in the Interactive Advertising Bureau’s 2023 Outlook Survey with brand and agency respondents pegging CTV ad spending to increase by 23% year over year in 2023, more than any other channel.

Nonetheless, while CTV’s ad spend growth may not be a shock despite the broader advertising slowdown, there are some surprises in the money going to CTV at the moment.

For starters, automotive advertisers were big spenders on CTV in Q3 despite the category cutting TV ad budgets earlier in the year amid supply-chain issues. Auto advertisers nearly doubled their CTV ad spending year over year and were the second-largest advertiser category by spend level in the period, per SMI. CTV remains a small share of auto brands’ overall ad budgets, though, said Li. That being said, “automotive of course has been decreasing their ad spend across all media,” he added. Case in point: TV ad spending among auto advertisers in Q3 was down 17% year over year.

“The fact that we found that they’ve grown in CTV and not only grown but grown by double is pretty significant, but it is still a small share of their overall ad spending,” Li said.

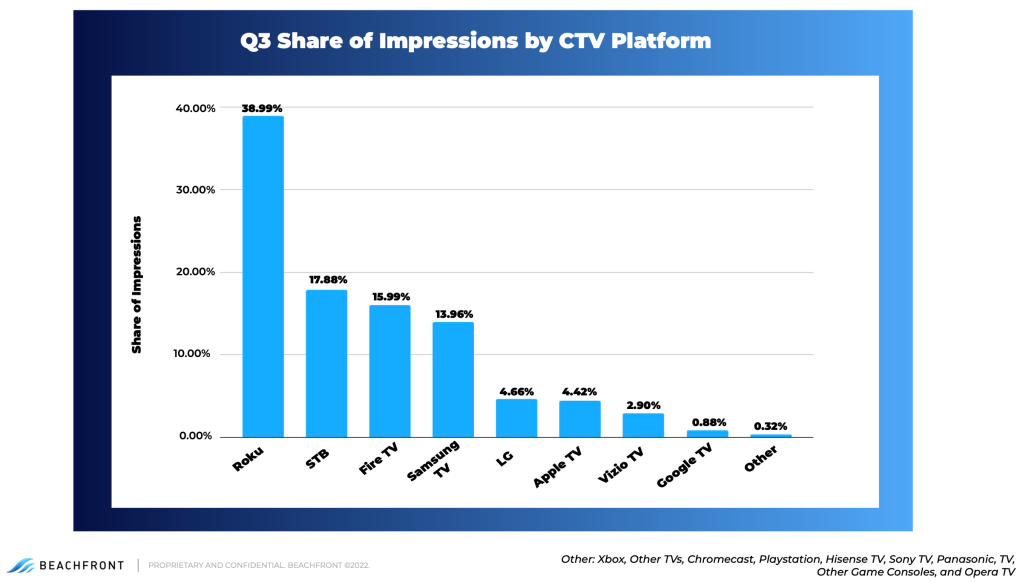

Meanwhile, on the sales side, Roku’s CTV platform accounted for the largest share of CTV ad impressions in Q3 and by a pretty wide margin. Nigam attributed Roku’s dominant share to its CTV platform being built into third-party smart TVs in addition to the company’s own CTV devices.

Surprisingly, it wasn’t a traditional CTV platform that followed Roku in the second slot for impression share. It was set-top boxes, referring to pay-TV providers’ on-demand programming that people can access via their cable and satellite boxes. This category isn’t usually considered CTV, but Nigam made the case for its inclusion.

“The traditional definition of CTV is: Are you able to access it through the internet? And in a lot of these scenarios [for cable and satellite VOD], the answer is yes. Secondarily, the way that we’re transacting on it, it’s more in a programmatic marketplace,” Nigam said.

Speaking of CTV’s programmatic marketplace, the share of CTV ad dollars being spent directly versus programmatically is coming closer to parity.

Historically, 70% of CTV ads were purchased directly from streaming ad sellers through old-school insertion orders, and the remaining 30% were purchased programmatically through third parties, such as via demand-side platforms. But in Q3, the split was 60-40. So while direct still represents the bulk of CTV ad sales, “over time it has gone more third party,” said Li.

What we’ve heard

“Most places are just not as organized and cohesive as you’d think, but the dust has settled a little bit because of consolidation. There is no HBO Max anymore; there is only one Turner team. You pitch to anyone, and they can pitch it in-house to any Turner platform. Peacock is still two teams, but we just pitch everything to both teams and use it to get two bites at the apple.”

— Production executive on how show buyers are organized

3 questions about Bob Iger’s plans for Disney

Bob Iger has plenty on his plate as Disney’s new-old CEO. He’s got to repair relations with the creative community, likely including a call to Scarlett Johansson. Same goes for the park-going crowd who have been repeatedly price-gouged over the past year. Same goes for the investor set wary of Disney’s slumping stock price.

One way to address the last task is for Iger to sort out how to plug Disney’s streaming profitability gap. Undoing Disney’s two-year-old reorg and showing the division’s overseer Kareem Daniel the door appears to have been Iger’s first step to this end and his first order of business after returning to the company.

So what will he do next? Good question. I have no idea. But I have some more specific questions.

What will he do about ESPN?

ESPN’s linear TV network and standalone streaming service pose a catch-22. As people continue to cut the cord, it’s important for the dominant TV sports network to have a streaming-only option, but that option risks undercutting ESPN’s profitable linear TV business. But diluting ESPN+ with limited live sports broadcasts to protect those linear profits compromises the streamer’s allure to potential subscribers. But simulcasting live sports on ESPN+ risks pay-TV providers cutting the fees they pay to carry ESPN, and these fees are vital for Disney to offset the exorbitant amounts of money it pays for live sports rights.

It’s a hell of a predicament. Disney investor Dan Loeb may or may not prefer Disney not deal with it and simply sell or spin off ESPN.

But I dunno. Considering Amazon and Apple now own live sports rights and Netflix is looking to get in the game, it seems misguided for Disney to give up that edge just as streaming seems on the verge (finally) of its live sports era.

If anything — as someone who pretty much pays for cable just to watch ESPN — I’d rather him pump up ESPN+ with the full suite of ESPN’s live sports. The pay-TV providers won’t like it, but they can’t really afford to lose ESPN altogether, so Disney would still have that bargaining chip.

The bigger issue would be finding some new revenue stream to offset the rights fees. Subscriptions and advertising alone likely won’t cut it, at least not in the short term. Connected TV doesn’t have the equivalent of pay-TV’s carriage fees, but ever the deal maker, perhaps Iger could haggle some new streaming distribution model that would be a big missing piece in Disney’s streaming profitability puzzle.

What company could he buy?

This seems to be the first question on people’s minds after hearing the Iger announcement. And the first answer seems to often be Netflix.

Sure, why not? Antitrust alarm bells aside, the merger would match Disney’s intellectual property library — Marvel, Star Wars, NBA and college football rights, etc. — with Netflix’s subscriber base and profitable streaming operation. And — sorry, I can’t hear myself think with those alarm bells.

As for acquisition alternatives, my mind went to Roku before Netflix for some reason. I think I’m still in that Android-induced, 2010s tech reporting mindset thinking software companies need to own hardware businesses. But Roku’s hardware business is struggling. Besides, owning a connected TV platform could create headaches when negotiating distribution deals for Disney+ et al. with rival CTV platforms and trigger its own regulatory concerns a la Google giving its own apps preferential treatment on its Android platform.

I don’t buy the thinking that Disney should acquire a digital platform like Snapchat or see if ByteDance would sell off TikTok’s U.S. operation. Snap continues to lose money, and I don’t know if TikTok’s revenue would be worth the drama of dealing with user-generated content and its corresponding moderation issues.

Still, I’d be surprised if Iger didn’t make some splashy M&A deal during this tenure. Acquisitions are kind of his thing: Pixar, Lucasfilm, Marvel *cough* Maker Studios. So maybe he buys Sony’s studio plus Lionsgate or goes after Paramount.

Or maybe he grabs a gaming company. Not just any gaming company, though. Epic Games. Not only would Disney then own the maker of Fortnite and have a pillar in place for its eventual metaverse strategy, but also Epic Games would give Disney ownership of Unreal Engine, which provides cost-saving virtual production technology for movies and TV shows like Disney’s own “The Mandalorian.” In a way, buying Epic Games would be akin to the future-looking strategy Iger implemented in buying BAMTech to power its eventual streaming business as well as his IP-driven purchases of Lucasfilm, Marvel and Pixar.

Or maybe he opts for an entirely other kind of M&A deal.

Would he sell Disney?

The idea of Disney being acquired feels pretty outlandish. And yet, a certain sale could settle the streaming profitability problem. Know who really doesn’t have a profitability problem and is in the streaming business? Apple. Which just so happens to be a company that Iger has dreamed of combining Disney with if Steve Jobs were still alive.

Jobs is gone, but the fantasy may still be at play.

Apple has a hardware profit machine and continues to demonstrate a commitment to streaming, including acquiring Major League Baseball and Major League Soccer rights and investing in family-friendly, star-laden fare like “Spirited” (I tapped out at the 12-minute mark).

Meanwhile, Iger has only signed up for a two-year stint at Disney and has shown his struggle with lining up a successor. Taking a year to secure a sale and another to integrate the company (or run through the regulatory rigamarole) could fill that calendar. And while selling Disney rather than securing its independent future isn’t an obvious success story, it would settle the succession question.

Numbers to know

200: Number of U.S. employees that Roku is laying off, equating to 7% of its total employee base.

$14.99: Monthly price for Apple’s MLS Season Pass streaming subscription, though Apple TV+ subscribers will receive a $2 monthly discount.

<100: Number of U.S. employees that Paramount is laying off.

$1 billion: Annual revenue generated by Hasbro’s Entertainment One division, which the toy maker is looking to sell off.

112 million: Number of YouTube subscribers that Jimmy “MrBeast” Donaldson has accrued to become the most-subscribed creator on the platform.

Streaming keeps viewership lead as broadcast TV regains ground

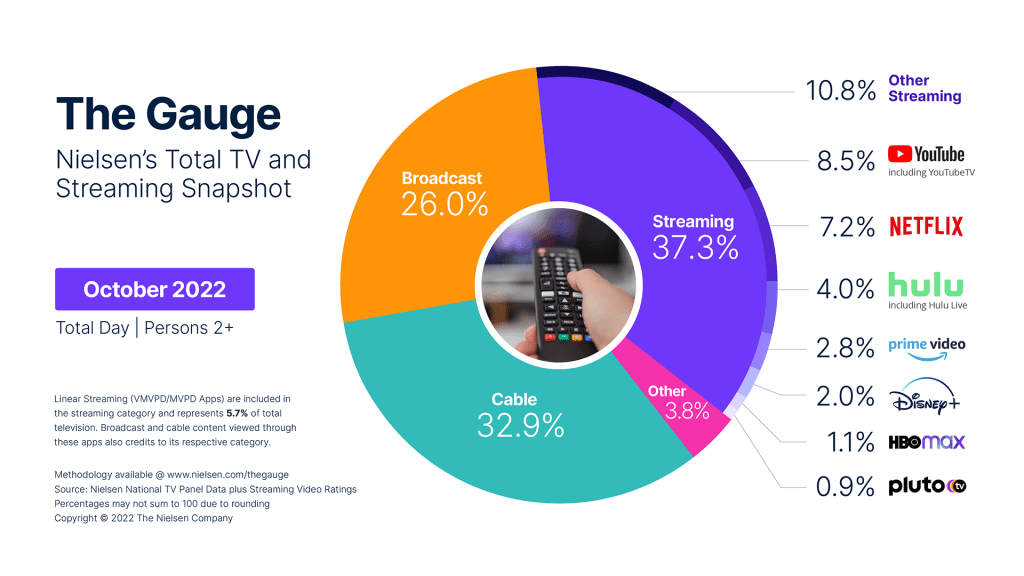

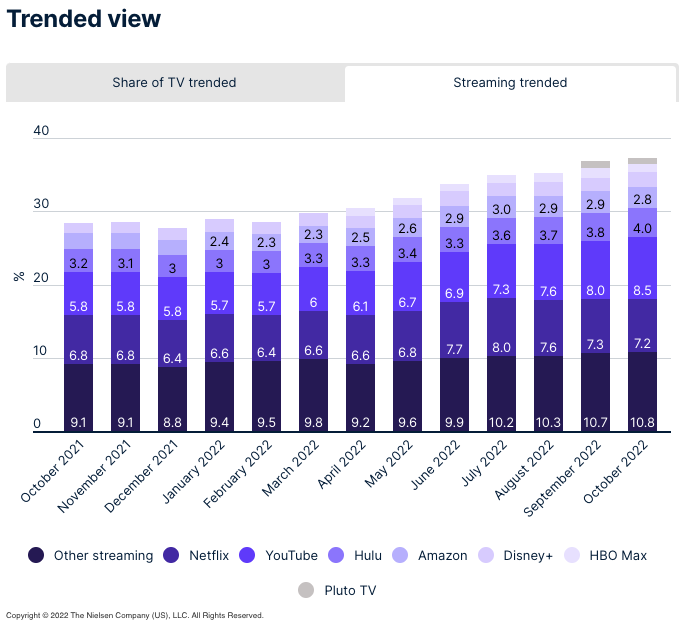

Broadcast TV networks increased their share of U.S. audiences’ TV watch time in October, but so did streaming services. Instead, broadcast TV’s gain appears to have come at a cost to cable TV networks and gaming consoles, according to Nielsen’s latest The Gauge viewership report.

The first full month of the new broadcast TV season appears to have been the biggest factor behind broadcast TV’s watch time share increased by nearly two percentage points from September. The general drama category saw a 42% increase in watch time month over month, compared to 19% for sports. Nonetheless, broadcast TV watch time actually dropped by 6.2% year over year.

Meanwhile, cable TV lost share despite news viewership ahead of the U.S. midterm elections generating a 3.3% month-over-month increased in watch time and cable sports viewership increasing by 25%. As with broadcast TV, cable TV’s viewership fell by 8.6% year over year.

By contrast, streaming watch time increased by 35.1% year over year, with YouTube, Hulu and Disney+ gaining share month over month. That sequential share increase led YouTube to further build its watch time lead among streamers after seizing that spot in September. In October, the Google-owned video platform held a 1.3 percentage point gap over Netflix in the runner-up spot.

However, not all streamers saw such gains. Netflix, Amazon Prime Video and Paramount’s Pluto TV each ceded 0.1 percentage points from their September marks, and Warner Bros. Discovery’s HBO Max shed 0.2 percentage points month over month.

What we’ve covered

Despite Snapchat’s efforts, creators still don’t see it as a priority:

Read more about Snapchat here.

Inside Telemundo’s marketing strategy for the World Cup:

Read more about Telemundo here.

DTC reproductive brand ups video ad investment to get in front of more eyeballs:

Read more about CTV advertising here.

A new entrant in the data-driven linear TV measurement space aims to fill a gap left by Microsoft’s Xandr:

Read more about linear TV measurement here.

What we’re reading

Disney’s CEO ouster:

Disney has replaced Bob Iger’s successor as CEO with Iger after Bob Chapek’s tumultuous, tone-deaf tenure that was capped by the company’s rough recent quarterly earnings report and senior executives, including CFO Christine McCarthy, expressing a lack of confidence in Chapek’s management, according to CNBC.

TV news networks’ cost-cutting:

ABC News and CNN are among the TV news organizations preparing for budget cuts and layoffs following this year’s midterm elections and ahead of a potential recession in 2023, according to The Hollywood Reporter.

Paramount’s corporate changes:

As Paramount-owned CBS sheds two top entertainment executives, the parent company is preparing to cut costs as its profitability shrinks, according to The Wall Street Journal.

NBCUniversal’s measurement currency council:

The Comcast-owned conglomerate has been the most vocal media organization calling for a change to TV advertising’s measurement system and now has formed a council with a dozen advertisers to catalyze the measurement currency changeover, according to Broadcasting & Cable.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.