Last chance to save on Digiday Publishing Summit passes is February 9

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday AI Marketing Summit this month in Santa Barbara, California, we spoke with leaders from 37 companies interested in applying artificial intelligence to marketing and learned about their plans for voice marketing. Check out our earlier research on AI’s potential to replace media buyers here. Learn more about our upcoming events here.

Quick takeaways:

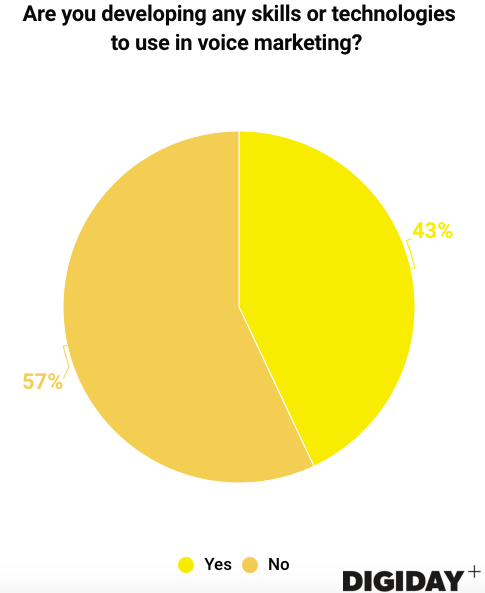

- Forty-three percent of companies in Digiday’s survey from the event are investing in technology to enable voice marketing.

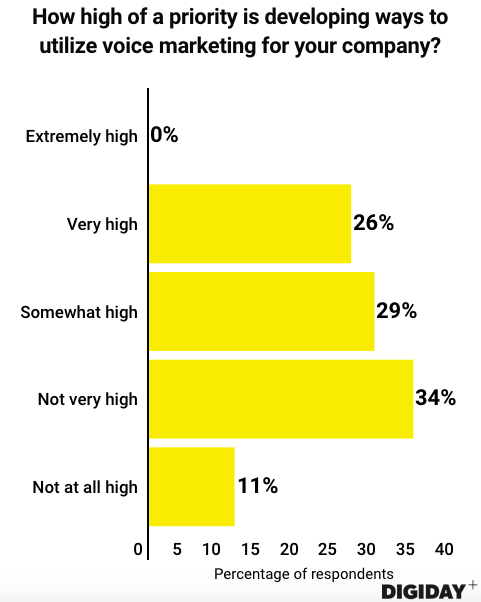

- Only 26 percent said developing voice marketing is a priority.

- Forty-four percent believe collecting consumer data will be the most important function of voice devices.

Marketers venture into voice marketing

Americans are becoming more comfortable with voice assistants from smart speakers to those in smartphones, with nearly half of Americans using one, according to Pew Research Center, and Juniper Research estimating the number of voice devices in the U.S. to be approximately 450 million. Research from NPR and Edison Research found that 16 percent of Americans own a smart speaker, and Juniper Research expects that number to grow to 50 percent by 2022.

Given the rapid proliferation of voice devices and consumers’ willingness to use them, companies are examining ways to include voice devices in their marketing strategies. Of the companies Digiday surveyed, which mostly identified themselves as brands, 43 percent said they are developing technologies to use in voice marketing.

Brands have begun exploring voice search capabilities, and a 2017 BrightEdge survey of Fortune 500 digital marketers found that 31 percent believe voice search is the “next big thing.” Agencies have also realized voice’s marketing potential and started positioning themselves to be advertisers’ “voice agency of record.”

Despite growth, voice marketing is a low priority

Voice marketing excites marketers, but it’s not a top priority for most. Only 26 percent of respondents to Digiday’s survey said developing voice technologies is a very high priority for their company, and none said it is an extremely high priority. Companies could be worried about pushback from ads that consumers object to. A poll from retail search marketing agency NetElixir found that 62 percent of Americans object to voice ads.

Companies’ low prioritization of voice marketing could be more about the cautious approach platforms like Google and Amazon are taking with advertising on their devices and less about advertisers’ desire to develop voice marketing capabilities. Amazon went so far as to shut down an ad network that skill developers could use to run sponsored messages.

Marketers expect voice devices to collect consumer data

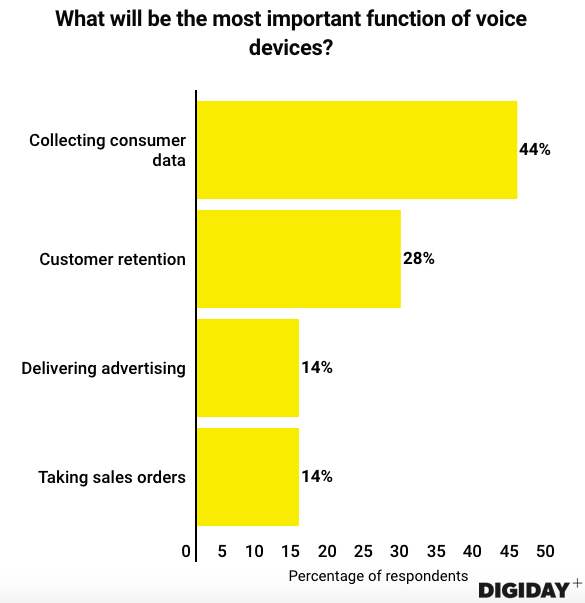

Despite the potential of voice devices like Amazon Alexa or Google Home as new marketing platforms, marketers don’t believe their most important function will be serving ads. In fact, running ads tied taking sales orders as these devices’ least important functions in Digiday’s survey. Only 14 percent of respondents said serving ads or taking orders were the most important functions of voice devices.

Domino’s got people to order from voice devices, but it found that voice ordering didn’t reverse declining sales — it just simplified the ordering process for consumers. Outside of special cases like Domino’s, research shows that people don’t use voice searches to make purchases. A different NetElixir study found that 71 percent of voice searches don’t lead to a purchase.

Instead, marketers believe voice devices’ value lies in their ability to collect consumer data such as search behavior, path to purchase and general interests, according to Digiday’s survey. Nikko Strom, one of the founding members on the team behind Alexa, said as much at an AI conference last year. Adobe has already added voice data to its analytics platform, so companies can use the data collected from their apps to determine consumer intent and potential value. But marketers shouldn’t expect information collected from voice devices to be instantly actionable. Right now, competing voice products differ in what information they provide to third parties. That means marketers lack standard metrics they can apply to the data if their same app or skill runs on different companies’ devices.

More in Marketing

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.