Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Envious of Amazon’s swelling ad business, which accounted for $3.4 billion in fourth-quarter revenue in 2018, leading retailers have been eager to develop digital ad offerings of their own. Those offerings continue to trail significantly in the eyes of most media buyers, however.

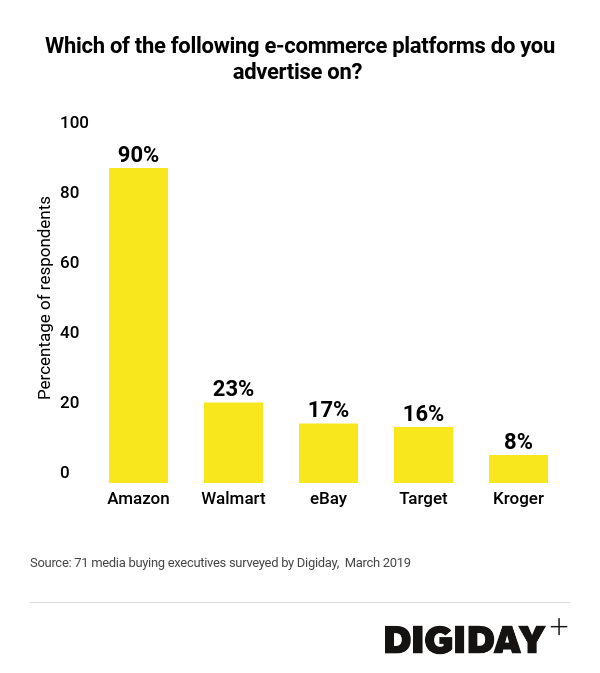

In a survey of 71 media buyers by Digiday this March, a relatively small number said they currently advertise on platforms outside of Amazon. Whereas 90 percent of marketers spent money with Amazon, only 23 percent did so on Walmart. Roughly the same number of media buyers utilized eBay and Target, 17 percent and 16 percent respectively. Meanwhile, just 8 percent of media buyers advertised on Kroger.

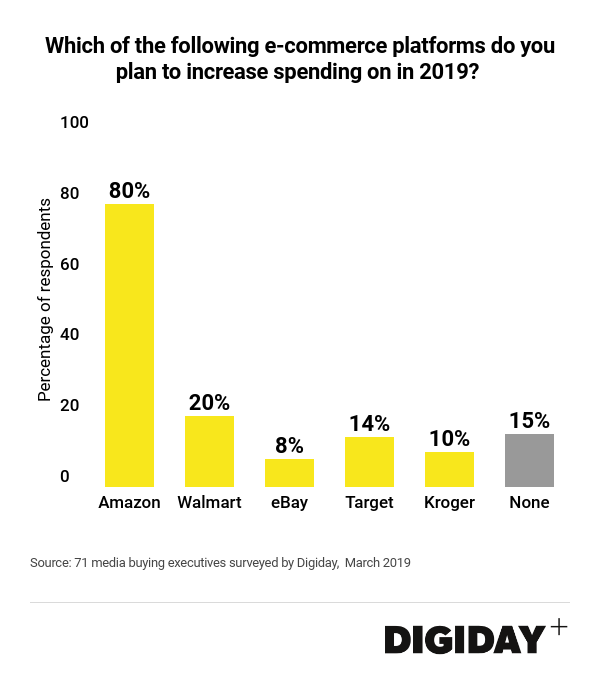

Additionally, media buyers’ plans to increase spending on retail media platforms closely mirror their existing spending habits. Eighty percent of buyers in the Digiday survey said their Amazon budgets will grow this year while 20 percent will spend more on Walmart. Fifteen percent of media buyers said they would not increase their spending on any retail-media platform.

Unlike Amazon, which has invested heavily in a self-service system and simplifying its ad products, other retail media platforms can be “daunting for brands to figure out,” said Todd Bowman, senior director of Amazon and eRetail at Merkle. “Companies like Walmart or Target might have 50 to 100 ad units for marketers to pick from,” he said.

In the past, companies like Target and Walmart also had multiple overlapping teams marketers could work with that added to the confusion and hesitation by marketers. Until Walmart decided to bring all of its media capabilities in-house, buyers could either coordinate campaigns with Triad Retail Media or directly with an internal Walmart media team. Meanwhile on Target, buyers were working with either a national media group or a specific shopper-marketing team.

Amazon’s ad products are also notoriously confusing, but buyers are committed to figuring them out because of its sheer scale and performance. Smaller players may not have the same luxury.

Advertising performance is also an obvious consideration for many. “Outside of Amazon, it’s hard to demonstrate a ROI on any of these platforms,” said Jason Goldberg, chief commerce officer at Publicis. Rather than try performance-driven campaigns that produce meager results, he noticed that many of the clients are currently using e-commerce retail platforms as brand awareness platforms. But as spending by marketers is increasingly scrutinized to lead to measurable outcomes, advertising on alternative e-commerce retail platforms with less hard data on outcomes will continue to prove difficult to justify.

Instead, most of the money being spent on the likes of Walmart, Target, eBay or Kroger is experimental spending. “It’s not meaningful spending at the moment. The spending that is happening is about relationship building,” added Goldberg. Companies advertising on these retail e-commerce platforms may be doing so because of larger retail agreements, similar to Amazon, which requires them to commit to certain spending levels. As a result, money allocated to these platforms is often being repositioned in small amounts from other areas like trade budgets.

Lastly, the data component is keeping potential clients away from e-commerce retailers. Part of that gets back to how e-commerce retailers are selling media. Because Amazon is a self-service platform, companies can see results and optimize campaigns in real-time. Additionally, years of advertising on Google and Facebook has conditioned many marketers to expect instant access to campaign results and optimization tools.

When marketers start work with other e-commerce retailers, it’s an adjustment because most are operating a managed-service system. Because it’s through a managed service and not a self-service “the reporting for clients can come halfway through a campaign or even after it’s over,” said Bowman. He added that a company may wait for weeks until after the campaign has run to send the results because retailers will want to wait until in-store transactions come through.

Until companies like eBay, Walmart, Target or Kroger are able to offer companies similar advertising experiences to the ones they’ve become accustomed to on Facebook, Google and Amazon, marketers will walk, not run, to advertise with them.

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.