Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Media buyers say Amazon is the hardest platform to advertise on

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

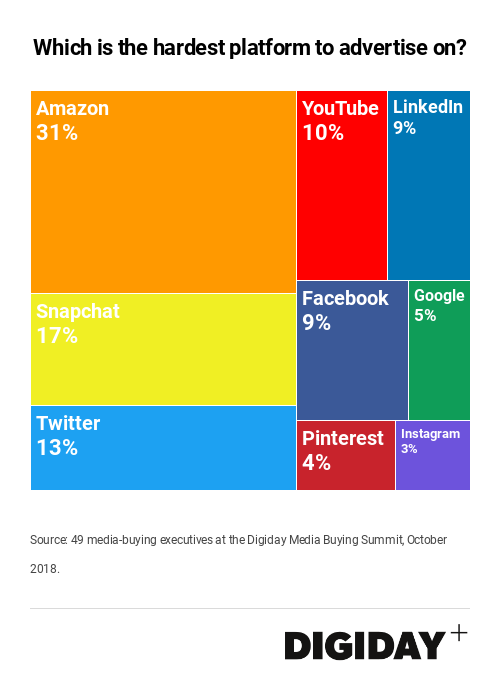

Of the media buyers surveyed at the recent Digiday Media Buying Summit this October, 31 percent said Amazon is the hardest platform to advertise on, more than any other platform.

Amazon now replaces Snapchat as the hardest platform to advertise on from a similar survey earlier this year. Compared to Google or Facebook, marketers are finding Amazon nascent and not as well equipped as its rivals Facebook or Google.

“There are a lot of tools that make everyone’s life easier,” said Dooley Tombras, president of the Tombras Group. “Amazon doesn’t have that yet.”

Said one ad exec: “Google is an adult and Amazon is still coming of age. Advertising isn’t their most important revenue stream, but they’re certainly doubling down on it.”

The improvements Amazon has made include a new attribution measurement tool and consolidating it’s confusing alphabet soup of advertising services to simply be called Amazon Advertising. However buyers still believe the e-commerce platform has a long way to go.

Part of the issue for buyers is that they rarely receive notice about new tools or tests from Amazon.

“Amazon will very rarely provide a heads up to advertisers about new updates,” said David Grill, ad manager at Orca Pacific, an Amazon focused agency. “It takes time to figure out how those changes are affecting all of your campaigns and you pretty much have to learn how to adjust on the fly.”

“Suddenly one person will have access to a graph or tool that wasn’t there before, but another person won’t. Amazon reps don’t know whether tests will be permanent or temporary either,” said Cassandra Stevens, global commerce director at Zenith.

While some reporting metrics have improved because buyers can now measure campaign attribution within Amazon, search and display reporting are siloed, which leaves it up to the advertiser to piece together according to Grill.

If advertisers had access to more of Amazon’s retail data, that would enable them to better target potential consumers.

“If we had more advanced solutions, we could help Amazon grow faster,” Stevens said. “If we had insights to prove Amazon is the more viable option, then we could recommend Amazon more to clients.”

However many buyers Digiday spoke to were also quick to note that Amazon is rapidly improving and often urged advertisers to be patience.

“For people who have been in industry less than 10 years, they often compare Amazon now to what Facebook and Google are now, which is a bit unfair,” said Tombras. “They’re making updates all the time. In 2020 it’ll be a Lamborghini.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.