Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: Marketers and publishers boost podcast investment

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

As podcast listening in the U.S. continues to grow, marketers and publishers are racing to capitalize on the opportunity.

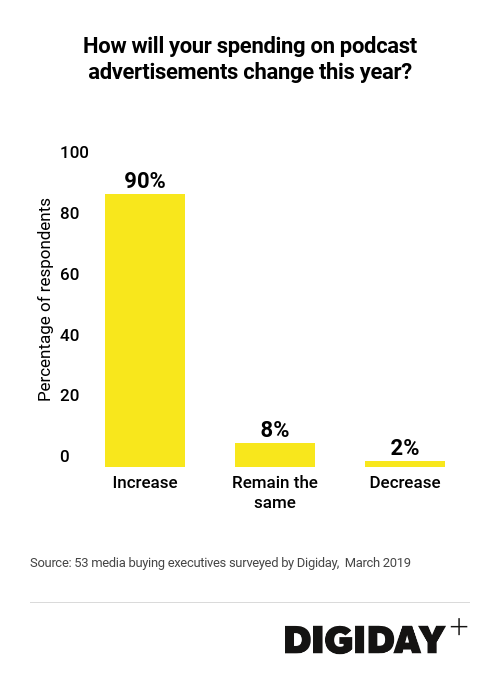

Ninety percent of marketers currently buying podcast advertising plan to grow their investment in the medium this year, according to a Digiday poll of media buyers conducted last week.

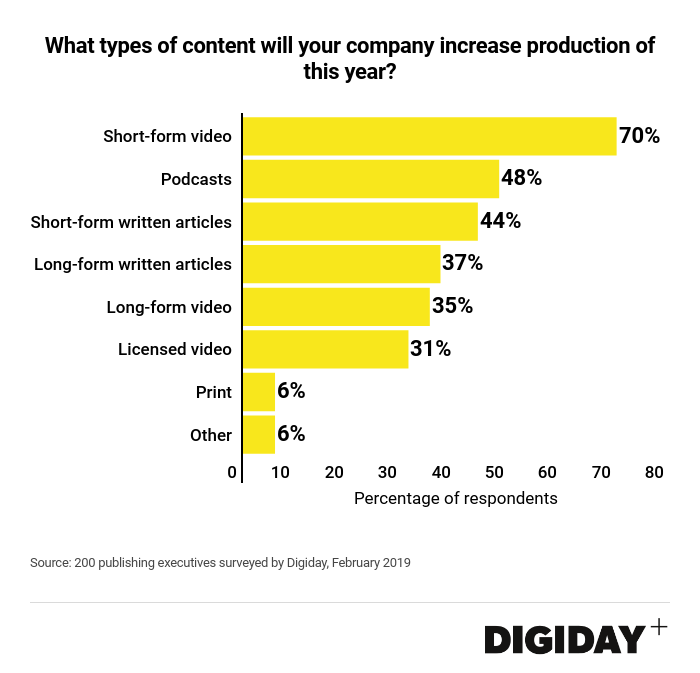

Meanwhile, forty-eight percent of 200 publishers surveyed by Digiday in February said they planned to produce more podcasts in 2019 than they did in 2018.

Marketer spending on podcasts remains a fraction of the billions of dollars spent annually on digital advertising, but marketers say they’re increasingly attracted to the medium for two key reasons: their performance, and their ability to reach highly-valuably audiences that are getting harder to reach through channels such as TV.

“Marketers are seeing strong results and better breakthrough,” said Marcus Pratt, vice president of insights and technology at Mediasmith Inc, whose clients are spending more on podcast ads now than ever before.

Part of the appeal for podcast advertisers is the share of voice they can offer marketers compared with formats such as online display advertising, which often results in ads appearing on cluttered webpages alongside those for multiple other brands.

“Podcasts offer an incredibly intimate and engaging environment for brands,” said Sam Appelbaum, general manager, at YellowHammer Media Group. If marketers wanted to achieve a similar level of isolation on a publisher site, “they would have to be willing to spend north of $100,000 with a publisher,” said Gylije Veljic, media director at ForwardPMX.

There’s an influencer element, too. When a podcast host reads an ad it can come across as them “endorsing your product,” Veljic said.

Beyond the nature of the formats themselves, marketers say another key lure of podcasts is the quality of the audiences they can reach.

“Marketers are spending more as users, especially higher value listeners who can be harder to reach through more traditional channels, listen more,” said Pratt. A study conducted by Edison Research in 2018 found that 26 percent of Americans aged 12 years and older, are now monthly podcast listeners.

But the key factor holding back further marketer investment in podcasts remains measurement challenges. While a slew of attribution and retargeting tools are being introduced, the lack of an established measurement system is “making it challenging to make the case to continue to shift more budget into podcasts,” said Anna Rudnick, group director at The Media Kitchen.

Part of the issue for measuring podcast ads is an absence of commonly accepted metrics. Without standardized and consistent metrics across platforms, “marketers are left with reports from multiple data sources that each use their own definition of a download or play,” Rudnick said. Due to the lack of standardization, podcast campaign performance reporting can be more of an art than a science.

Aside from platforms, publishers also contribute to podcast measurement troubles. “Publishers don’t have full-funnel measurement capabilities that tell you if someone actually bought the product after hearing about it,” said Veljic.

Given that marketers are under greater pressure to prove their spending is leading to tangible results, podcasts could be a tough sell to marketers who want a clear view into the results of their spend.

However, there are alternative solutions to some, but not all, of the podcast’s measurement woes. Promo-codes are an obvious method for marketers to track how direct-response campaigns are working. “We’re also increasingly seeing marketers push listeners to subdomains through podcast ads rather than use promo-codes,” noted Appelbaum. “If a consumer doesn’t buy the product, brands can develop a unique and discrete data asset,” he said.

In the end, marketers continuing to pour more dollars into podcast ads is proof that measurement issues aren’t a total roadblock to spending. In fact, marketers are actually now “including podcasts in their long-term planning,” said Pratt. Forecasting by the IAB predicts the amount spent on podcast ads will grow 28 percent next year from $514.5 million in 2019 to $659 million in 2020.

Meanwhile, publishers increasing podcast production will provide increased supply and an ability to reach more granular audiences. More podcasts mean more advertising opportunities and more chances for marketers to spend their money.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.