For now, 3D body scans are a tool to help, not replace, tailors

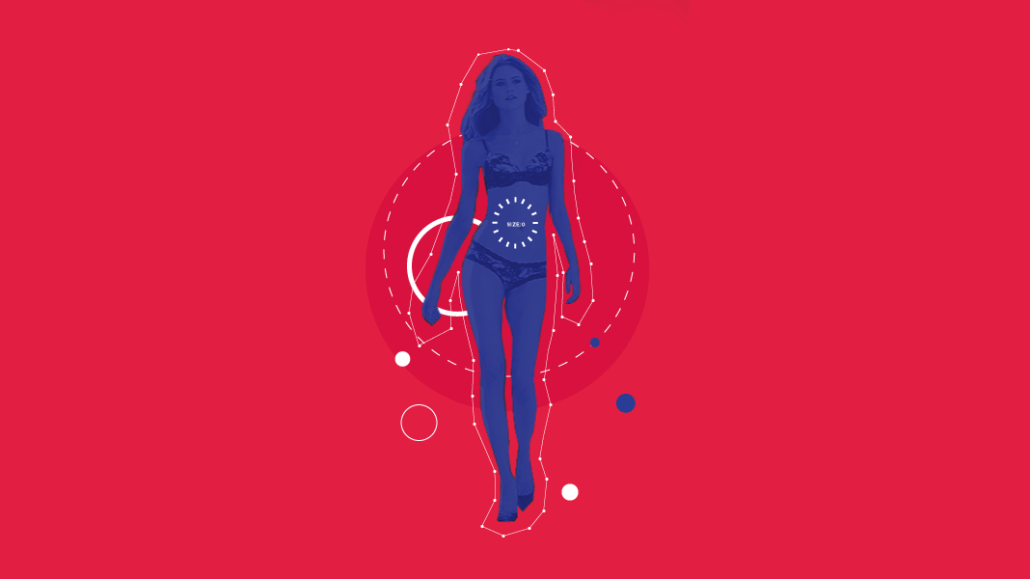

For apparel retailers, 3D body scans were once thought to be a cure-all for the customer fitting process. But they’re now coming to terms with the reality that these machines can’t do everything humans can. They’re good at acquiring data but not quite ready to make tough decisions yet. For now, they’re tools that allow humans to do their jobs better.

At Acustom Apparel, where customers can buy custom-designed suits with the help of a body scanner, CEO Dan Norcross acknowledged that the dream was an “airport-style walk through and you’re done.” But after years of practice, brands like Acustom are realizing that 3D body scanning can’t capture the entirety of the fitting experience — the subjective feel of the right fit, variations in posture and other customer preferences.

“We’re aware of how complicated and detailed it is,” Norcross said.

Custom menswear brands like Acustom Apparel, Alton Lane, and Hong Kong-based Gay Giano Tailor use 3D body scanning technology to collect data on body shape and fit that can create digital avatars to assist designers and producers to craft a tailored suit based on precise measurements. It’s meant to standardize an element of the measurement process, and avoid inconsistencies of tailor-determined measurements.

Norcross, who acquired Acustom Apparel two years ago from founder Jamal Motlagh, said the company was founded on the principle that 3D body scanning technology could potentially replace humans, but the company has adapted to the limitations of technology by deploying humans to figure out what “best fit” means for each customer.

“Over time, our experience was that it augments and facilitates the experience, but having good fitting clothes requires an expert eye,” he said.

After customers get scanned by the 3D device, which Norcross said has 14 cameras, another piece of software interprets the scan and, together with human input, the information is sent to design and production teams offsite, and the item is delivered to a customer’s home in 3 to 6 weeks. Beyond the hundreds of thousands of data points collected by the machine, a critical part of the fitting process is learning about the person, including their lifestyle, habits and posture patterns — information that can only be collected by observing them and interviewing them.

“[In the machine] the person is in a static pose, it’s a bit of a forced pose, so you get some posture out of it, but a lot of [information] you get comes from interacting with the person, watching how they walk and stand when they’re not in the scanner, what’s their [walking and sitting] position like?” he said.

Beyond the body-scanning machine, a critical part of making the process work is the software that interprets the data from the scan — technology that still has a ways to go before it replaces a human’s assessment.

Alton Lane, a nine-year-old custom menswear brand, also incorporates body scanning into a fitting ritual that includes a sit-down at a bar where customers can talk to associates about their apparel purchase. Founder Colin Hunter said after using scanners for a year (it’s used them since the company was founded), it offered sample garments to customers as part of the fitting process. Alton Lane also takes around 10 manual measurements, a way of assessing the subjective “right fit” according to the customer’s preferences.

“[The body scanner] is not a not a magic box; sometimes customers think it’s going to pop out perfect,” said Hunter, who added that education on the body-scanning machines’ capabilities is key because some customers may overestimate the scanner’s ability.

The scanner, however, does offer advantages over measuring tape, by standardizing certain measurements that often vary when they’re entirely left up to humans, he said. But the results from the scan are double-checked with in-person measurements, and customers have the option of coming to the store to assess fit issues post-production.

Norcross and Hunter said they see future evolutions of technology that interpret the scans to incorporate machine learning and personalized recommendations. Acustom is investing in developing proprietary technology aimed at doing this; for now, it’s focusing on offering human support where needed.

Indochino, which also specializes in custom fit menswear, said it doesn’t use body scanners because they can’t replace the human element. Instead, it uses a try-on program in its showroom where customers try on standard template sizes in three silhouettes to determine the closest fit; staff members apply a series of fit tools through a proprietary app to address any fit issues prior to construction.

“Body scanners can’t talk to the customer — they can’t ask how snug they want their garment to feel, their preferred length or if there is any discomfort at all,” said Drew Green, CEO of Indochino.

Scalability to a broader audience is also a major challenge. Bloomgindale’s, for example, phased them out after a couple of years. Costs alone, make it impractical for most retailers, said Forrester principal analyst Sucharita Kodali. Amazon, which recently acquired 3D body model startup, Body Labs, is experimenting with consumer applications of the technology, and recently rolled out its Echo Look Alexa fashion assistant that combines automated as well as human input to advise customers on fashion choices. Finding a way to put the technology into the hands of consumers could help grow its reach more broadly.

“Right now, we’re on the precipice of body scanning technology, but external hardware is clunky for retailers and consumers alike to install either in stores or at home, making it extremely difficult to scale this tech,” said Maya Mikhailov, founder of mobile commerce platform GPShopper. “However, as mobile phones are getting more sophisticated sensor technology and better optics, including depth sensors, the device itself can become a scanner, opening a wealth of opportunity for retailers.”

Subscribe to the Digiday Retail Briefing: A weekly email with news, analysis and research covering the modernization of retail and e-commerce.

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.