Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

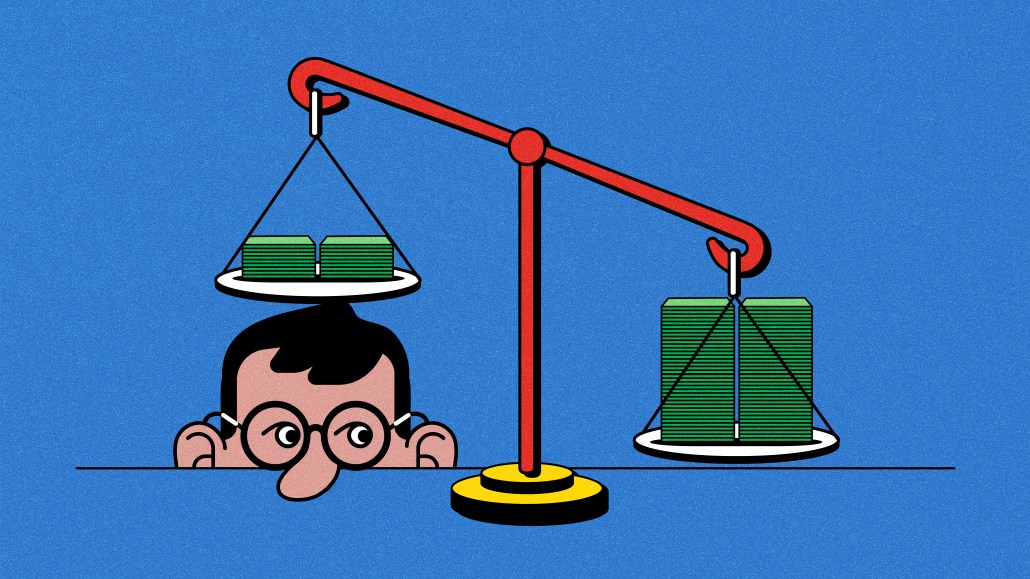

Ad tech’s cash crunch: Rising interest rates, late payments and financial uncertainty

In the world of ad tech, delayed payment terms are as ubiquitous as empty buzzwords, and they seem to be stretching even further these days. What’s more, when payments do come through on time, they often fall short of the full amount.

While it’s not unusual for companies to penny-pinch like this when cash is scarce, the current surge in extending payment terms and underpaying feels like a throwback to the early days of the pandemic — a sense of desperation ad execs haven’t seen in a while.

Blame it on interest rates hikes — aside from the ad slowdown, of course. When it costs more to borrow money, businesses really focus on managing their cash because their credit lines get more expensive. This means the people in charge of that money tend to try to keep it for as long as they can. The longer they can do this, the more cash they have available to pay off those inflated debts before taking care of ad tech vendors and publishers.

“I don’t see this issue with our company so much as I see it with the companies that did some sort of financial engineering, whether that was by taking on a major credit line or doing a SPAC,” said Harry Kargman, CEO of ad tech firm Kargo. “Those companies are looking at their debt line and asking ‘how do we reduce our carrying costs of that capital?’, and often that means holding on to their cash for as long as possible. Today we’re also looking at an interest rate that is 3 times what it was a few years ago, which is another major driver of high capital costs. ”

For many ad tech execs, these concerns are more than just troubling — they’re downright nerve-wracking. It’s increasingly likely that they’ll find themselves in a situation where late payments are more common than on-time ones.

In fact, invoice factoring company OAREX’s analysis of hundreds of payments from the most recent financial quarter found that nearly half (46%) of all payments owed to them were already overdue. That’s nearly peak pandemic levels of tardiness, which were around 52%. The same goes for underpayments, where the payment falls short of the full amount owed. These are inching toward a fifth (15%) of all payments, OAREX monitored in the last quarter. To put it bluntly, these trends don’t bode well for the health of cash flow in the market.

“History tells us that when liquidity becomes an issue in a market, payment timing is one of the first things to go,” said Nick Carrabbia, evp at OAREX.

And when those payments get stretched it’s normally the publishers that feel the strain the hardest. The slower those payments get the harder it is for ad tech businesses to collect money every 60 to 90 days to meet their own obligations to publishers and other commercial partners. In the past, this was manageable because money was readily accessible, and borrowing costs were lower. However, those days are long gone.

“It’s true that late payments in ad tech are endemic in the space but they’re definitely a larger concern nowadays,” said Carrabbia.

These concerns haven’t reached a critical point, at least not yet. While ad tech financial leaders are waiting longer for their dues, sometimes up to 90 days, but typically around 60, they’re maintaining their composure for now.

“When I talk to my CFO all he cares about is how fast we get paid and how fast we pay others,” said an ad tech executive who spoke to Digiday on condition of anonymity because they were not authorized to speak to the press. “If we have to pay out faster, then everything goes red and they [the CFO] starts collecting the money that’s owed to us immediately.”

Few ad tech companies think they’re going to have to resort to such measures in the near future. Still, it’s always prudent to be prepared for all eventualities. The sudden flameouts of Silicon Valley Bank as well as the expected but still surprising demise of EMX and MediaMath show how quickly circumstances can take a sudden and unfavorable turn. And when they do, cash is king as everyone tries to hold onto it for as long as possible. After all, the capital required to run an ad tech business is nothing short of staggering.

“We’re choosing to be more cautious with smaller, newer or unknown demand-side platforms because it can be hard to get a pulse on their financial stability and, oftentimes, the credit references come back with “unknown companies” that we can’t trust,” said GumGum’s evp Adam Schenkel. When that happens, it is not logical to extend someone a line of credit in this environment.”

It’s all because the programmatic supply chain expects ad tech SSPs and DSPs to act like a bank, lending its customers money for periods that are as long as, if not longer than, what they need to pay their partners downstream. Consequently, most ad tech vendors jump through hoops to secure credit facilities to pay off their downstream partners as quickly as possible while they wait to get paid upstream. But managing that mountain of credit isn’t a walk in the park, especially when the market’s already on shaky ground.

As Schenkel explained: “We’re removing any form of credit extension with some of these newer, unestablished players. If they want to access our inventory, then they’re going to need a bank to provide that credit or have an account there with the required money in it.”

Whether it’s tougher credit policies, extended payment terms or even refusals to work with financially uncertain businesses, ad tech vendors are clearly fortifying their balance sheets against further capital drains from the market. The question is whether that’s going to be enough to save them should there be another catastrophe.

“I wouldn’t say the situation with payment terms is really bad yet, but the risks are definitely becoming more acute because of high interest rates,” said the managing director of an ad tech vendor who spoke to Digiday on condition of anonymity because they had not been authorized by their communications team to discuss financial matters. “Everybody’s costs are rising and therefore holding onto money for longer as a cash flow in the bank is a way of negating those problems — well, to a degree.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.