Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Why YouTube and TikTok are/aren’t being left out of TV’s measurement makeover

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the dividing line that digital video platforms represent as the TV ad measurement ecosystem undergoes its overhaul.

- The cross-platform measurement complication

- Streaming holds lead as traditional TV season starts

- Nielsen’s measurement costs, Hollywood’s production load and more

The cross-platform measurement complication

The key hits:

- TV ad buyers and sellers are divided on to what extent the industry’s measurement overhaul should include digital video platforms.

- TV networks want to protect their programming from being equated with user-generated content, while agency executives want all video content types to be accounted for.

- The importance of planning tools may play a major factor in how the situation pans out.

For as complex as the TV ad industry’s measurement makeover is proving to be, the biggest complication yet may be deciding to what extent to extend the overhaul beyond traditional TV.

At issue is, well, the definition of TV. The updates being made to the TV ad measurement ecosystem are designed to extend that ecosystem beyond traditional TV. But how far? To streaming services like Netflix and NBCUniversal’s Peacock? Sure. To digital video platforms like YouTube and TikTok? Hmm, unclear.

The line on the last seems to be drawn between the buy side and sell side. Advertisers and agencies want the new TV ad measurement ecosystem to span across traditional TV, streaming and digital video platforms because brands have come around to recognize that, for some audiences, YouTube and TikTok are akin to TV. Meanwhile, TV network owners want the new ecosystem to encompass their streaming services, but not so much the platforms carrying cat videos and owned by tech companies that have already eaten the digital ad market.

“Clients want everything measured, including YouTube and TikTok. The networks do not,” said an agency executive.

“To us that delineation is premium professional content and those platforms that have premium professional-type content and don’t have a [user-generated content] long tail associated with it,” said Sean Cunningham, CEO of VAB, a trade organization that represents TV network owners.

The sell side’s rationale is somewhat reasonable. TV network owners pay a lot of money to produce shows like “Yellowstone” and “Abbott Elementary” and don’t want the ads airing against those shows — whether on traditional TV or streaming — to be measured on the same level as ads attached to a video clip someone shot on their phone while on their lunch break.

“Long-form advertising wrapped by long-form content is the gold standard in awareness marketing,” said Paramount’s president of advertising John Halley during an Advertising Week session on Oct. 17. Asked about equivalizing ad impressions across traditional TV and digital video platforms — i.e. weighing their value based on ad duration in proportion to a 30-second spot, as opposed to factors like the adjoining content quality — he said, “It is about engagement. These things are not created equally. Measurement systems that do not appropriately distinguish between those things and conflate everything — we don’t agree with that. Context matters.”

The buy side does not necessarily disagree with that take, though.

“We’re not saying, ‘I want to equivalize impressions.’ But in order to not equivalize impressions, I actually need to understand the context where those impressions appear. And I am not getting that in streaming,” said Kelly Metz, managing director of advanced TV activation at Omnicom Media Group.

The latter point is not a tangent but the heart of the matter among the buy side: Measurement is a data source — and advertisers and agencies want more data to inform their ad buys. The data demands stretch across axes. They want deeper data, like information about the specific shows that carried an advertiser’s ad on a given streaming service. And they want broader data, like the number of people a campaign reached across traditional TV, streaming and digital video.

This gets at another foundational aspect of the measurement shift — perhaps the fundamental one: It’s not only about measuring campaigns’ performance, but also about planning future campaigns.

As advertisers and agencies assess the various measurement providers vying to become the new currencies, they are evaluating which provide planning tools and which inventory sources are covered by those planning tools. That’s because their ultimate concern is which measurement providers can serve as the most accurate gauge by which to allocate ad dollars, in a way irrespective of currency considerations.

“The fundamental truth is we’re going to transact on whatever makes sense to achieve the advertiser objective. Period,” said Metz.

In light of that, rival measurement providers like Comscore, iSpot.TV and VideoAmp are not only competing against Nielsen to provide measurement capabilities, but also planning tools. Those measurement and planning capabilities are very much intertwined.

“If I’m not subscribing to the Nielsen ratings data, I can’t use the planner. If I can’t use the planner, how is my planning team supposed to allocate budgets?” said the first agency executive.

And to bring the matter full circle, the planning tools are only as valuable as what they can measure, so it matters whether they are able to measure traditional TV and streaming and digital video platforms.

“At the end of the day, if they’re trying to be a currency, then you need a planning component. If you’re not part of the planning discussion, you’re not going to be transacted on,” said a second agency executive. “Nielsen has had a planning foothold for decades. They’re the leader in planning tools. So if you want to compete at that level and start taking share, you have to play in that game, which means you do actually have to represent Snapchat, Twitter, TikTok, YouTube — all of it.”

What we’ve heard

“The Netflix CPM has come down so far in negotiation. It’s not quite $65 anymore.”

— UM Worldwide’s Stacey Stewart on the Digiday Podcast

Streaming holds lead as traditional TV season starts

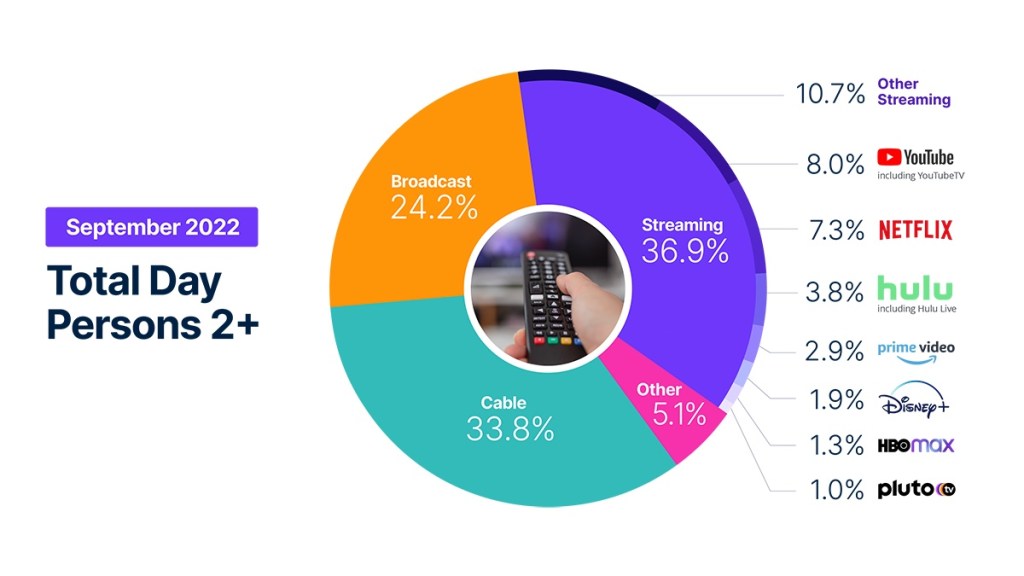

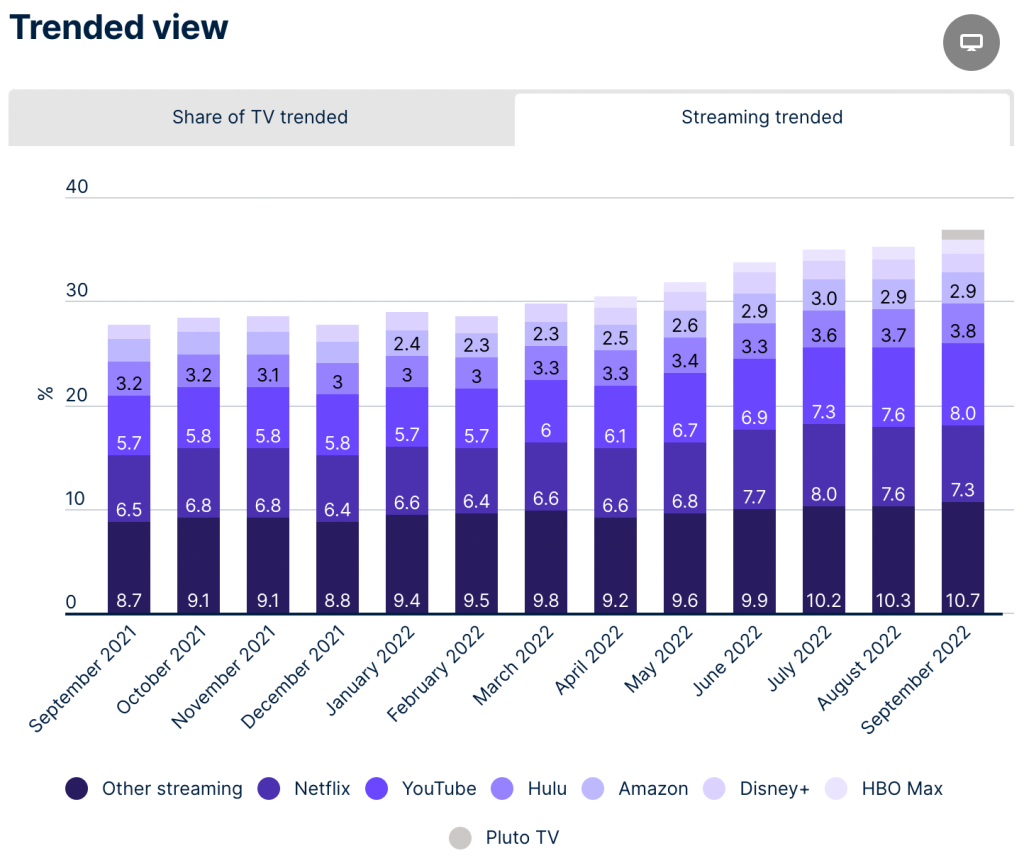

Streaming services seem to have sloughed off their slump. After overtaking cable TV’s share of TV watch time over the summer, streaming maintained its position as traditional TV’s top-tier programming — NFL and college football games as well as broadcast networks’ fall programming slates — returned in September, according to Nielsen’s latest The Gauge viewership report.

While streaming’s lead remained status quo in September, Nielsen’s latest viewership report did score a couple shakeups within the streaming market.

- YouTube surpassed Netflix to have the largest viewership share among streamers after tying the latter service in August.

- Paramount’s Pluto TV became the first free, ad-supported streaming TV service to accrue at least 1% share of TV watch time.

Numbers to know

-2%: Percentage decline year over year in YouTube’s ad revenue in the third quarter of 2022.

80%: Percentage share of Amazon’s and Roku’s combined share of the U.S. connected TV hardware market.

$6.99: New monthly subscription price for Apple’s Apple TV+, a $2 increase.

50%: Percentage share of major characters on streaming shows who were women in the 2021-22 season, compared to 48% on traditional TV shows.

$22.99: New monthly subscription price for YouTube Premium family plan.

-5%: Percentage year-over-year decline in national TV ad spending in the third quarter of 2022.

363 million: Number of people worldwide who use Snapchat each day.

What we’ve covered

UM Worldwide’s Stacey Stewart assesses the state of the advertising market:

- Advertisers are cutting budgets from deals that provide less flexibility, like traditional TV.

- The 2023 budget planning process has featured more revisions and changes than normal.

Listen to the latest Digiday Podcast episode here.

Prioritizing TikTok, agencies move away from creating content for Instagram, YouTube:

- Agencies like Rank Secure are crafting video concepts around TikTok versus other channels.

- Turnaround times are shrinking in connection with the priority shift toward TikTok.

Read more about agencies’ TikTok prioritization here.

Here is how much TikTok, Meta and other social platforms are paying creators:

- TikTok, YouTube, Meta, Snap and Twitch share revenue with creators, though the splits vary.

- This income’s instability has driven creators to diversify their revenue streams.

Read more about platforms’ creator payments here.

What we’re reading

Nielsen’s measurement costs:

Nielsen costs the biggest TV network owners as much as $200 million per year, which is a reason why TV networks are angling to bolster competition against the dominant measurement provider, according to Ad Age.

Warner Bros. Discovery’s DE&I investment:

Amid a broader cost-cutting effort, Warner Bros. Discovery initially opted to eliminate a couple workshops that provided a pipeline for writers and directors from underrepresented groups to break into the industry, which resulted in an industrywide outcry and the company reversing course, according to The Hollywood Reporter.

Hollywood’s production load:

The surge in movie, TV and commercial production in Los Angeles has begun to abate some as the backlog of projects eases and the number of projects in production normalizes following the pandemic-induced hiatus, according to Variety.

More in Future of TV

Long-form creators eye taking over TVs – and chasing bigger brand budgets

Long-form episodic creator content is drawing in large numbers of highly engaged viewers, but ad budges are lagging behind. We explore why.

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.