Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: Why interactive ads occupy the streaming ad market’s mid-funnel

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the role that interactive ads play in today’s streaming ad buys.

- Click to play

- Football kicks up TV and streaming watch time

- Amazon’s Apple TV+ deal, Skydance’s Paramount plans, faceless creators and more

Click to play

When was the last time you came across an online banner ad that wasn’t clickable? The same future could await interactive ads on streaming services, with QR codes and shoppable formats becoming ubiquitous add-ons to the standard mid-roll spot. Emphasis on “could.”

“I see these eventually becoming a fixture in media plans. I feel like this is an evolution that has been enabled by streaming that is going to set streaming apart in some ways from linear TV in terms of capabilities and maybe even [key performance indicators],” said Shasta Cafarelli, svp of media investment at Tinuiti.

“They’re useful, but I think they should be thought of in the right sort of businesses vs. an evergreen campaign or something that’s always on,” said David Dweck, svp of paid media at Wpromote.

Whether interactive streaming ads become “need to have” or “nice to have” depends on a few main factors.

The first is whether enough people would get in the habit of interacting with them, be that by scanning a QR code, partaking in an ad-based trivia game or clicking into a TV-based shoppable experience. One of Wpromote’s clients ran a QR code-based interactive streaming campaign that averaged a 0.4% clickthrough rate, Dweck said. Despite being less than half of a percentage point, that’s actually not horrible. “Even the best display campaigns I’ve ever run might have like a 0.5% clickthrough rate,” Dweck said.

Performance is one thing, though; pricing is another. Interactive streaming ads can cost twice to three times as much as a standard streaming ad, according to agency executives.

“That’s for a really premium unit. There’s so many different kinds of interactive ads. A pause ad might not be the same [price] as something that takes a great deal to build from customizing the types of products that show up and all that. But it’s material,” said one agency executive.

As indicated, the pricing premium isn’t only for the inventory. There’s also the financial and time costs of creating the interactive experience. Depending on the creative needs, a shoppable interactive ad can add an extra 30 to 60 days to a campaign’s development, Dweck said. “So yeah, the duration to get some of this in place is definitely an impediment to getting things live,” he added.

And then there’s the added friction of streaming services sometimes having proprietary interactive ad formats, which can require advertisers and agencies to effectively recreate a shoppable campaign to run across multiple streamers.

However, for all the aforementioned points of friction, progress is being made.

Companies like BrightLine and Sharethrough are making it easier for advertisers to run interactive ads across streaming services. Disney, for example, has worked with BrightLine to make interactive ad formats available programmatically across its streaming inventory. “Once we finally were able to enable them, within six weeks the spend was eight times the spend than the year before,” Disney svp of addressable sales Jamie Power said in a recent Digiday Podcast episode.

And while ad buyers will always angle for bargains, interactive ads are proving performant – in a way. Multiple agency executives interviewed for this story said interactive ads have succeeded in driving brand awareness, brand recall, brand lift and brand salience metrics.

Now, you may have noticed those are all upper-funnel brand metrics, not the lower-funnel performance stats you might expect of an ostensibly direct-response ad. And that’s kind of the point. The role of interactive ads in streaming campaigns sits mid-funnel.

“To expect to have an objective of awareness and bring forward something that’s super performance-based, that’s clearly conflicting, right? But if you’re recommending a whole bunch of stuff that will get you awareness and, by the way, as part of this we’re going to be able to show you some performance metrics based on this unit? I don’t hate that,” said Lisa Herdman, svp and executive director of strategic investments at RPA.

Which is why you won’t really hear ad buyers angling to buy interactive streaming ads on a cost-per-action basis. Sure, the CPA model would ensure advertisers only pay for people actually interacting with their ads. But it could incentivize streamers to only serve those ads to people likely to click, which could be a subset of their broader audience and curtail the campaign’s reach.

“Tonnage still matters. Being able to get the message out to a broader group is still our imperative,” said Wpromote’s Dweck.

What we’ve heard

“The biggest shift or change this year is it was really a reset year from a digital video standpoint in terms of pricing.”

— UM Worldwide’s Marcy Greenberger on the Digiday Podcast

Football kicks up TV and streaming watch time

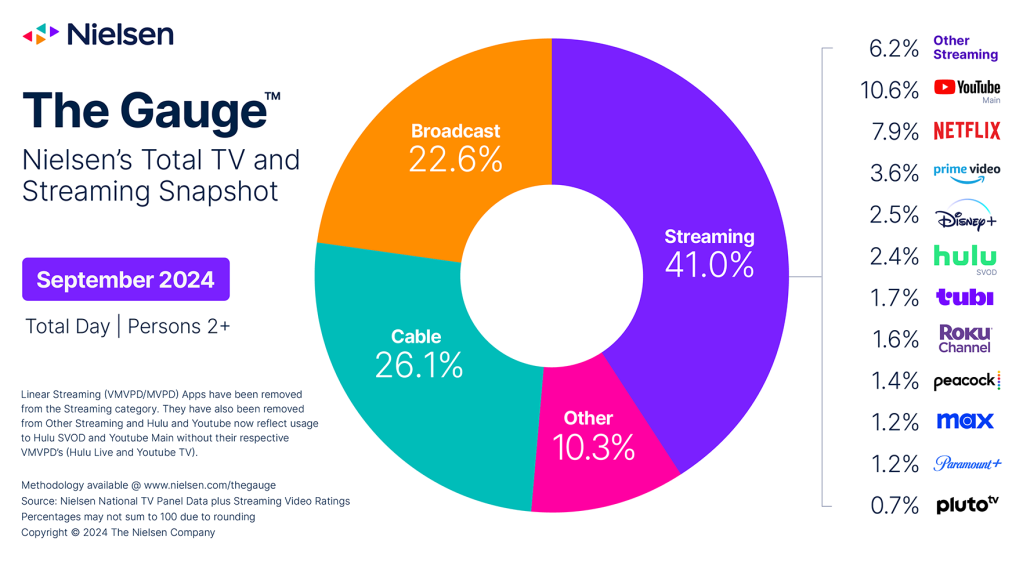

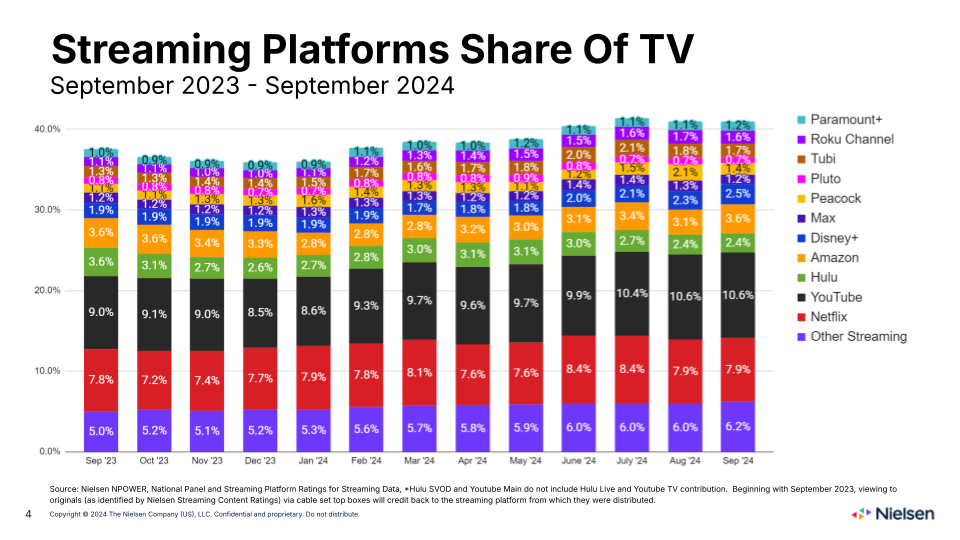

The recent spate of humdrum TV watch time trends livened up in September. The kickoffs of the NFL and college football seasons kicked up the amount of time people spent tuning into both broadcast TV and streaming, according to Nielsen’s latest The Gauge viewership report.

Admittedly, the watch time upticks may not be obvious from the chart above. When it comes to share splits among the different first-order categories, the pie chart looks pretty much the same as it’s been (especially with the Olympics and Democratic National Convention having boosted the August figures).

In fact, streaming’s watch time share didn’t change from August to September. But the shares of watch time among individual streamers did seem some shifts. “The most notable gain this month was a 12% uptick in [watch time share for Amazon’s] Prime Video,” said Nielsen svp and The Gauge engineer Brian Fuhrer in a video announcing the latest report.

Beyond Prime Video’s boost, Disney+ notched a 5.2% increase in viewership, which Nielsen attributed in part to the addition of Hulu programming on Disney’s flagship streamer. And with the exception of Peacock’s share coming down from its Olympics-driven high in August, the rest of the streaming watch time breakdown stayed pretty status quo.

Numbers to know

-20%: Percentage decline in film-and-TV shooting days in the Greater Los Angeles area in strike-affected 2023 compared to 2022.

$14.99: Monthly price for a subscription to a combined Starz-BritBox streaming bundle.

6: Number of “Monday Night Football” games that Disney will simulcast across ESPN and ABC this year.

What we’ve covered

A postmortem on this year’s TV and streaming upfront ad market with UM Worldwide’s Marcy Greenberger:

- The biggest shift in this year’s upfront market was the reset in streaming ad prices, the agency’s investment chief said on the Digiday Podcast.

- A trend toward agency-level upfront deals also emerged.

Listen to the latest Digiday Podcast episode here.

As TikTok rolls out Smart+, marketers grapple with AI’s advertising puzzle:

- TikTok’s AI-based ad tool is designed to make advertising on the platform easier.

- Advertisers are willing to cede control of their campaigns to platforms in exchange for better returns on ad spend.

Read more about TikTok’s Smart+ here.

Meet YouTuber Brandon B, who believes agencies shouldn’t worry about AI:

- The largest European VFX creator on YouTube has more than 14 million subscribers and 10 billion video views.

- He launched his own production company, which has worked with brands including Marks & Spencer.

Read more about Brandon B here.

What we’re reading

In the latest sign of how the streaming war has ebbed, Amazon has signed a deal to resell subscriptions to Apple TV+ through its Prime Video Channels program, according to Bloomberg.

The head of CBS’s parent company’s incoming parent company David Ellison seems unlikely to spin off Paramount+ or Pluto TV and instead reportedly sees the latter streamer as having been “held back” by the previous regime, according to Puck.

The costs of MrBeast’s controversies:

From allegations over unsafe working conditions on his upcoming Amazon Prime Video show to accusations of inappropriate behavior by members of his team, YouTube’s most popular creator has seen his viewcounts dip (relatively speaking) and his fans call him out, according to Polygon.

An increasing number of creators are building video audiences and attracting brand deals without showing their faces on camera, according to The Hollywood Reporter.

Fox & Telemundo’s Super Bowl split:

Fox Deportes will share rights to air the Super Bowl’s Spanish-language broadcast with NBCUniversal’s Telemundo, according to Deadline.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.