Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: Media Rating Council identifies ‘the problem of our time’ for measurement

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how the industry’s measurement arbiter is looking at ensuring measurement systems are able to reliably identify audiences across channels in a privacy-compliant manner.

- IDing measurement’s privacy era

- TV watch time slips in March (as usual)

- TikTok’s AI-generated ad plan, WSJ’s video layoffs, Disney+ plus FAST and more

IDing measurement’s privacy era

The advertising industry’s measurement arbiter, Media Rating Council, has turned its attention to a major concern for the future of measurement: how to identify audiences across media properties and channels in a privacy-safe manner.

“The key determinant nowadays in whether these measurement systems are good or not is how well the identity aspects work and how identity is assigned. It is the problem of our time right now to deal with this and deal with this in the construct of privacy protection,” MRC CEO and executive director George Ivie said during a webinar the organization hosted last Friday to discuss its cross-media measurement standards.

In the era of panel-based measurement, privacy wasn’t such a concern because a sample of people opted in to have their viewing behaviors be measured and projected across the broader population. But as the industry moves to advanced audience targeting and cross-channel measurement and attribution, measurement systems need to be able to better account for individual viewers in order to avoid duplicative counting and provide reliable unique reach measurements.

To make matters tricker, age-and-gender-based measurement alone no longer suffices, meaning measurement systems need to be able to carve up audiences based on more specific attributes, like interests and purchase behaviors. And the greatest complication of all is performing this measurement across not only different media companies’ properties but different media channels, which means being able to associate someone who saw an ad on one device with a person who made a purchase on another.

To be clear, none of this is necessarily new. What is newer is the growing drumbeat of privacy regulation. Which is why the MRC is not only drawing the industry’s attention to the intersection of identity, measurement and privacy regulation but also turning its own attention to how that coalesces with its own measurement standards.

In response to an audience question asking if the industry needs to reconsider the requirements for measurement and planning systems, MRC svp of digital research and standards Ron Pinelli said:

“Yes, I think, with everything that’s going on and all the challenges and changes, we’re seeing that as we’re evaluating these approaches, but we are planning subsequent phases And I do think one of the priority items is to revisit that particular identity section and requirements in today’s world.”

What specific updates that will result in remain to be seen. But the work to ensure the identity framework underpinning measurement can adapt to today’s privacy era is underway. MRC is auditing measurement companies’ identity methodologies in its audits, said Ivie, and it has been providing feedback to industry organizations — including World Federation of Advertisers, Incorporated Society of British Advertisers, Association of National Advertisers and the U.S. Joint Industry Committee — as those groups develop cross-media measurement systems, such as the JIC’s planned streaming data service that will provide measurement companies with streaming publishers’ first-party data.

“We have work that we’re doing in unpacking these issues for our members in audit reports. They’re being danced on and evaluated. And really, we’re obsessing over this,” said Ivie.

What we’ve heard

“There’s still too many impressions not served, too many ad calls that are failed ad calls right now in streaming.”

— Agency executive

TV watch time slips in March (as usual)

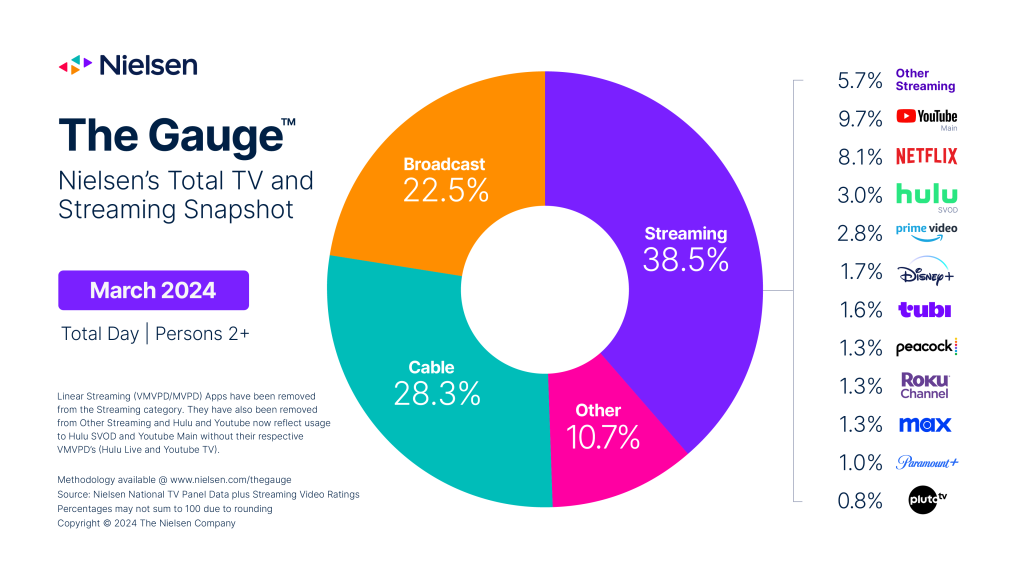

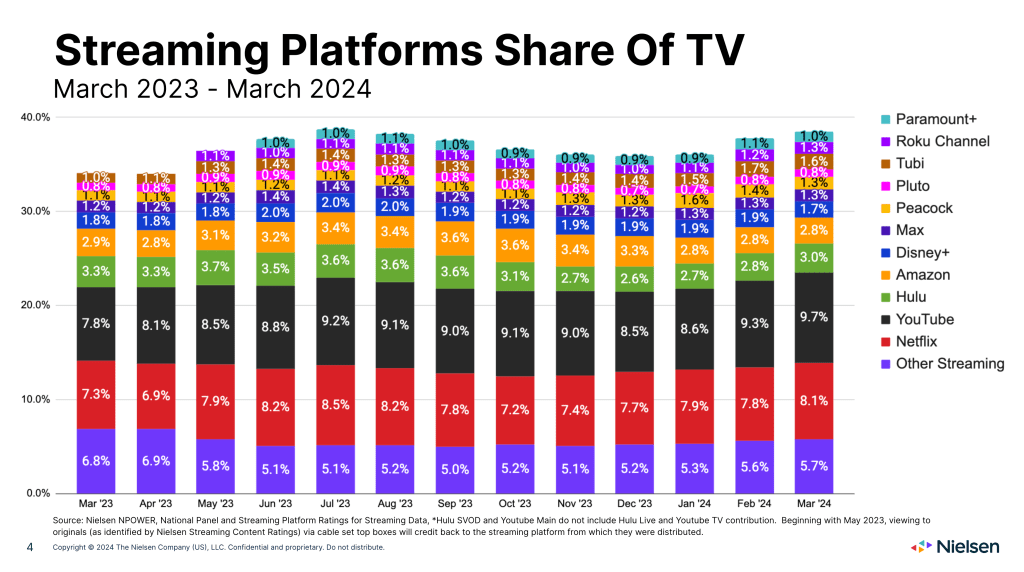

March is usually a down month for the amount of time people spend watching TV after Super Bowl-fueled February, and this year was no different. Total TV watch time fell by 3% from February, according to Nielsen’s latest The Gauge viewership report.

All viewing categories saw some level of watch time decline in March, but the dip was particularly acute for broadcast TV (-6%). That resulted in cable TV actually gaining 0.7 percentage points in share of total watch time, and streaming (-1%) increasing its lead by 0.8 percentage points.

The streaming picture above looks pretty similar to prior months: YouTube leads Netflix, Pluto TV lags under the 1% watch time threshold, etc. But in its press release announcing the latest The Gauge results, Nielsen called out something interesting.

Over the past three years, cable TV has surrendered 11.2 percentage points in watch time while streaming has gained more than 12 percentage points. As much as YouTube and Netflix are responsible for streaming’s gain, free, ad-supported streaming TV services — often described as streaming’s equivalent to cable TV — have also played a part.

“None of the now-reported FAST channel providers (PlutoTV, The Roku Channel and TubiTV [sic]) had yet exceeded the 1.0% reportability threshold at the time of the first report. Now those services combine for 3.7 share points, with a considerable portion of the titles being fueled by cable network content,” wrote Nielsen.

Numbers to know

4.1 million: How many more people watched this year’s NCAA women’s basketball championship game than the men’s game.

576,000: Number of Roku accounts that were accessed by hackers in the connected TV platform’s latest data breach.

79%: Percentage share of U.S. households that own a smart TV.

$3: How much Adobe is paying per minute of video for stock footage to teach its AI model.

>200 million: Number of subscribers that Amazon’s Prime Video — which is available for all Prime subscribers — has worldwide.

$13.7 billion: How much money creators are estimated to make from social platforms in 2024.

What we’ve covered

Indie agency Left Off Madison takes a right turn into live shopping:

- The year-old agency has formed a video production arm.

- Its specialty will be live shopping.

Read more about live shopping here.

How influencer agencies are adapting to TikTok’s SEO incentives:

- TikTok has started taking the search value of videos into account when paying creators.

- More than two in five Americans use TikTok as a search engine.

Read more about TikTok’s SEO incentives here.

Snapchat’s relationship with publishers is still pretty complicated:

- Snapchat’s recent layoffs have left publishers without key contacts at the platform.

- Platforms like Snapchat seem to be prioritizing creators over publishers.

Read more about Snapchat here.

Marketers seem unconvinced of looming TikTok ban but assemble contingency plans just in case:

- Senate Republican Leader Mitch McConnell’s endorsement of a TikTok ban has yet to faze brands.

- Brands have been reducing their reliance on TikTok by building up audiences on other short-form video platforms like Instagram Reels and YouTube Shorts.

Read more about marketers’ TikTok contingency plans here.

What we’re reading

TikTok’s AI-generated ad plan:

TikTok is developing a generative AI tool for advertisers to create scripts from a prompt and have an AI-generated influencer star in the resulting video ad, according to The Information.

The Wall Street Journal lays off video staffers:

The news publisher has let go of members of its video team after Google decided not to renew a deal that provided funding for WSJ’s Journalists as Creators program, according to The Daily Beast.

Disney plans to add 24/7 linear channels to its flagship streaming service that will be programmed based on Disney+’s content genres, such as Stars Wars and Marvel fare, according to The Information.

Amazon Prime Video’s content quality conundrum:

Amazon’s streaming service contains shows and movies with missing episodes and error-riddled translations, resulting in thousands of complaints from customers, according to Business Insider.

NBCUniversal and Paramount have continued to see their streams of NFL games contribute to increased usage of their respective streaming services, according to Deadline.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.