Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Inside The Wall Street Journal’s video-based approach to this year’s election coverage

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how The Wall Street Journal is using video to cover this year’s U.S. presidential election.

- Video Journal

- Disney retakes TV watch time crown

- Adobe’s AI payments to creators, LinkedIn’s video rev-share program and more

Video Journal

When The Wall Street Journal was sorting out its coverage strategy for this year’s U.S. presidential election, video took on a key role.

“When we think about the election broadly, the election coverage strategy is: What does the audience need? And a lot of times, the audience needs to see things, and the audience needs to hear things. The audience needs to look at things,” said Charles Forelle, deputy editor in chief at WSJ.

“Video is an increasingly important storytelling tool as we look towards new audiences with different expectations from us: younger generations of news consumers are more likely to want to watch,” said Taneth Evans, head of digital at WSJ, in an email.

Case in point: The newspaper publisher debuted a series on its YouTube channel this year called “State of the Stat” that takes a single data point and breaks it down through visuals that include motion graphics, interviews with WSJ reporters and outside experts and clips of the presidential campaigns.

“We take one figure, and we explain what this figure says about the election overall. And we made it for YouTube first, but we brought it to our own platform, and we are versioning it elsewhere,” said Amanda Wills, head of video at WSJ.

In other words, the Journal’s 65-person global video team keeps busy. While that team includes people in technical roles, “the vast majority of them are video journalists or supervising producers or executive producers in some manner,” said Wills. And while that team did reduce its headcount by laying off some employees after Google decided not to renew its “Journalists As Creators” program that provided funding to the Journal, the size of the team is “not shrinking by any means,” she said.

Nor is its video footprint. YouTube is the news outlet’s largest video platform, with 5.7 million subscribers to its main channel that is averaging 79,000 new subscribers per month this year through Oct. 21, according to data from Tubular Labs. But its TikTok account has also been growing. The Journal now counts 524,300 followers on the short-form video platform and has added, on average, 21,500 new followers per month this year, per Tubular Labs data.

The growth of WSJ’s short-form video presence coincides with a new component to the publisher’s election coverage strategy: quick-turn visual investigations.

Wills is standing up a dedicated team of roughly five people, to start, that will work with the publication’s larger investigative team to tackle election-related misinformation that is likely to spread across video platforms.

“I have an entire team that is going to be basically on standby to do quick-turn visual investigations to say, ‘No, the thing that you’re seeing over and over isn’t true’ or ‘Everyone is talking about this moment that happened at this polling center. Here’s what we know visually actually happened, and here’s how we’re disproving it,” Wills said.

Those quick-turn visual investigations are emblematic of the type of visual journalism that WSJ has found its audience to be seeking more in general.

A key metric that the publication tracks is subscriber engagement, which incorporates page views as well as how far into a story someone may have read. When people don’t read very far into a story, “in many cases the answer is that we didn’t present visually a thing that we should have presented visually, that we asked the reader to wade through a lot of text,” said Forelle.

Going forward, video seems likely to only grow in importance to the Journal’s overall coverage strategy as well as its subscriber strategy.

“Everything that we do is in service to quality subscription growth: engaging our current audience to reduce rates of churn, and seeking new audiences with high propensity to become long-term Wall Street Journal subscribers,” said Evans.

For the moment, the overwhelming majority of its videos are freely available on platforms like YouTube and TikTok, so they serve to expand the reach of the Journal’s journalism beyond its paid subscriber base with the potential to attract subscribers. But the publication has experimented with putting videos behind its subscriber paywall.

“We’re at the very, very, very early stages of that, and we have tended to do it in an experimental fashion on things where it’s really distinctive,” Forelle said.

He cited a video covering drone pilots fighting in the war between Russia and Ukraine, with journalists traveling to a bunker in Ukraine to report on the matter and gathering footage from the drones. “That’s the thing where we said, ‘You know what? That’s a special thing for subscribers.’ So we are experimenting with gated video, but kind of tip-toeing.” For now.

What we’ve heard

“We’ve always been very low with pricing, but I think the marketplace as a whole is finally starting to pressure the streamers back toward reality.”

—Agency executive on streaming ad prices

Disney retakes TV watch time crown

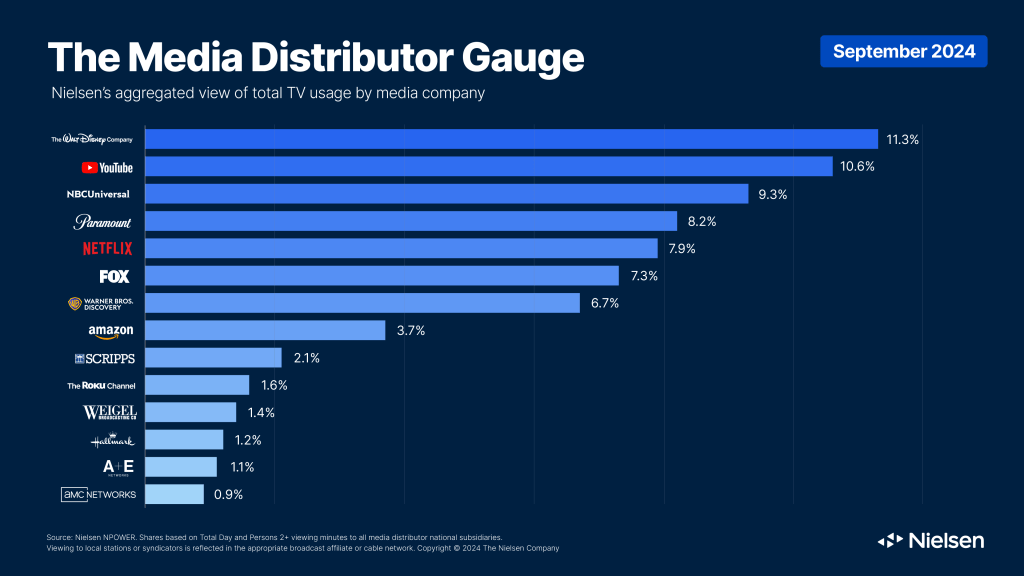

For the latest sign of football’s importance to TV viewership, look no further than the 17% month-over-month jump in watch time that Disney received in September to reclaim the watch time crown from NBCUniversal and leapfrog YouTube in the process, according to Nielsen’s latest Media Distributor Gauge report.

Disney wasn’t the only football beneficiary. Fox and Amazon notched 18% and 13% month-over-month watch time increases. That increase helped Fox to overtake Warner Bros. Discovery in the rankings, while another football broadcaster, Paramount, pushed past Netflix.

Numbers to know

2026: The year in which The Walt Disney Company now plans to name the CEO who will succeed Bob Iger.

282.7 million: Number of paid subscribers that Netflix had at the end of the third quarter of 2024.

$180.9 million: TelevisaUnivision’s net income in Q3 2024, a quarter in which its ViX streaming service became profitable.

£224 million ($290.7 million): How much money Sky lost in 2023.

What we’ve covered

Saturation and cost concerns push brands to concentrate influencer spend on fewer creators:

- Economic factors are leading some brands to prioritize creators with larger followings over micro- and nano-influencers.

- Rising management costs for creator campaigns are a major factor in the move.

Read more about brands’ influencer spending here.

Why retailers like Kroger & Walmart are adding streaming services to their membership programs:

- Walmart has added Paramount+ to its membership program, and Instacart and Peacock announced a similar deal.

- Many of the bundles are for streamers’ ad-supported tiers.

Read more about retailers’ streaming add-ons here.

How one company hopes to expand creators’ presence in TV ads as CTV engagement grows:

- Studio71 has developed a CTV ad product to insert creator videos alongside traditional 30-second ads.

- CTV represents 26% of Studio71’s viewership.

Read more about creators and CTV ads here.

What we’re reading

Adobe’s AI payments to creators:

Adobe has been paying creators bonuses for stock video and other assets they provide the company to train its generative AI tools on, though the payment amounts can range from chump change to thousands of dollars, according to Bloomberg.

LinkedIn’s video rev-share program with publishers:

Since rolling out earlier this year, the Microsoft-own platform’s video advertising rev-share program will generate more than $2 million apiece for Bloomberg and The Wall Street Journal, according to The Information.

Hollywood production’s decline:

The number of film-and-TV shoots in the Los Angeles area reached a new low from July through September, as production has declined across scripted and unscripted TV shows in particular, according to The Hollywood Reporter.

YouTubers’ production growing pains:

Controversies surrounding the shooting of Jimmy “MrBeast” Donaldson’s reality competition show for Amazon Prime Video has drawn a spotlight to broader concerns from industry members about the working conditions on productions helmed by digital video creators, according to CNBC.

As part of the streaming audio platform’s push into video, Spotify has opened up an ad exchange that will initially sell video ad inventory on the platform, according to Axios.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.