Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: How upfront ad sellers’ ‘advanced audiences’ pitches have, um, advanced this year

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

Thanks to Disney for sponsoring Digiday’s upfront coverage and presenting this edition of the Digiday+ Future of TV Briefing, normally available exclusively to paying subscribers.

This week’s Future of TV Briefing looks at how ad buyers’ and sellers’ discussion around advanced audiences is different in this year’s upfront market.

- The advanced upfront

- Disney tops TV watch time

- Streamers’ talent payment terms, Netflix’s NFL talks and more

The advanced upfront

If you sat through any of this week’s upfront presentations, you’ve likely heard the words “advanced audiences” (or its synonyms “strategic audiences,” “data-driven audiences,” etc.). The buzzword isn’t new. TV and streaming ad sellers have been talking up their targeting capabilities since before the pandemic. But there is a new aspect to the pitch this time around.

A “trend that’s been coming up a lot is really the move to strategic audiences. And I couple that with attribution and measurement to understand the value of those strategic audiences,” said one TV network executive.

While upfront ad buyers and sellers have had the ability to target ads to specific audience segments — for example, high-income households, people with pets, someone in the market for a new car — they’ve had a harder time measuring the ads delivered to those audience segments in a way that could serve as the basis for transactions, according to TV network and agency executives.

“The technology to target and measure below the demo against people that are looking for a car or whatever the [target segment] is, that has been there. There hasn’t been the ability to trade on it at scale, like as an alternative currency,” said a second TV network executive.

“There’s more data at our disposal than we’ve ever had before. And the more data we have, the more ability we have to connect the dots back to effective measurement,” said one agency executive.

That measurement is the puzzle piece finally in place despite the still-chaotic broader measurement currency conversation may be surprising. It kinda stunned me. But in conversations with TV network and agency executives, across the board that was the answer when I asked them whether the discussion of advanced audiences heading into the upfront market is different this year compared to prior years.

“The ability to measure it quickly has been a gap, but that’s not the case anymore. We’re seeing the highest percentage we’ve ever seen of advertisers buying strategic audiences,” said the first TV network executive.

What’s driving that, beyond plugging the measurement gap, is upfront ad sellers being able to close the gap between their traditional TV networks and streaming services so that they can provide targeting and measurement capabilities across their full inventory portfolios. Disney, NBCUniversal and Warner Bros. Discovery have developed first-party data platforms to establish identity graphs for their respective audiences, and Disney, NBCUniversal and Paramount have adopted alternative identifiers like The Trade Desk’s Unified ID 2.0.

“We’ve been able, through some groundbreaking work that we’ve done with a couple partners to essentially decorate linear [TV] ad exposures with universal IDs to unlock a whole set of conversion metrics that we think will make advertisers look at their investments differently and give them the transparency they need to understand the value of their investments with us,” said a third TV network executive.

Meanwhile, on the buy side, what’s driving the push toward advanced audiences is the ongoing erosion of the traditional TV audience. Traditional TV is still a means of reaching a large number of people at the same time, but so many of those people these days may be outside an advertiser’s primary target base. Advanced audience segments are a way to tailor their campaigns’ aim.

“We are seeing a lot more shifts to advanced audiences — or data-driven linear — and I think, honestly, a lot of it is because TV is aging up considerably,” said a second agency executive. “If [an audience of people aged] 50-plus is not your primary audience, the best way to guarantee the highest concentration of the right audience is to plan based on those advanced audiences instead of a Nielsen demo and really get [the TV network and streaming service owners] to build an optimized plan based on that and guarantee based on that.”

Of course, that raises the measurement currency question. If Nielsen’s legacy panel-based measurement system is not the currency of choice for advanced audiences, then what is? And what does that mean in the broader scope of the TV ad industry’s ongoing measurement overhaul and stalled currency changeover? These are not small questions. So we’ll dig into them in next week’s Future of TV Briefing.

What we’ve heard

“[Streaming] is definitely going to increase in share [of total upfront spending this year]. I think, though, it’s probably still going to be less than 50%.”

— Agency executive

Disney tops TV watch time

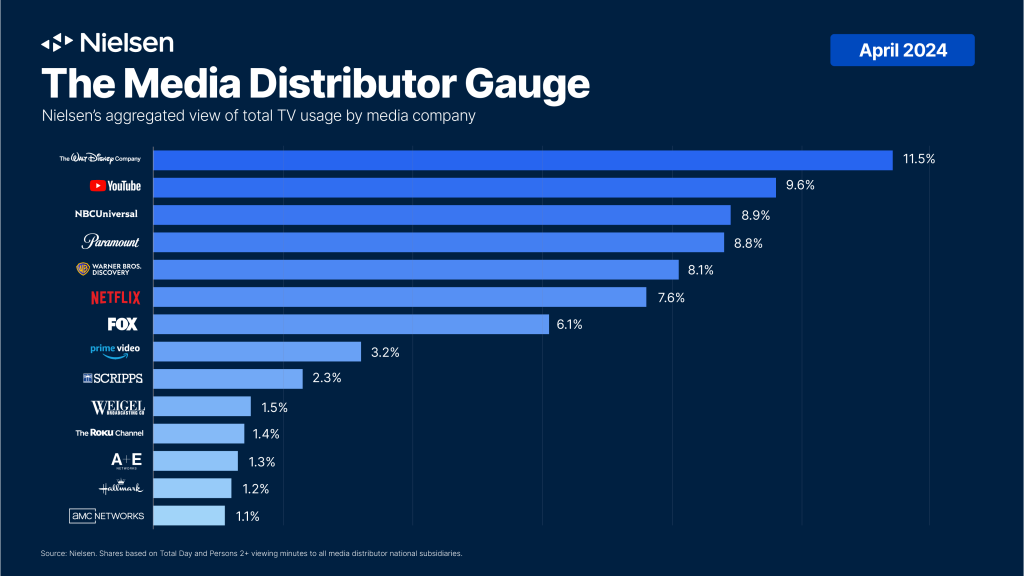

Nielsen’s monthly The Gauge viewership reports breaking down people’s TV watch time has gotten pretty ho-hum since streaming overtook broadcast and cable TV and YouTube surpassed Netflix. Both trends held once again for the April 2024 edition. Fortunately, Nielsen has introduced a new wrinkle in its latest report by breaking out TV watch time by company.

Disney taking the top spot shouldn’t be too surprising. People spend hours watching ESPN alone, not to mention ABC and then of course Disney+ and Hulu. Still, it wouldn’t necessarily have been a given that the House of Mouse would outmatch YouTube.

But that indicates the hold that traditional TV still has on audiences’ attentions. To that point, the second-most dominant streamer in terms of watch time — Netflix — ranked sixth behind TV network owners NBCUniversal, Paramount and Warner Bros. Discovery, each of which also operate their own major streaming services. And Amazon Prime Video and The Roku Channel were the only other standalone streamers to crack a list that featured two local TV network owners, Scripps and Weigel Broadcasting.

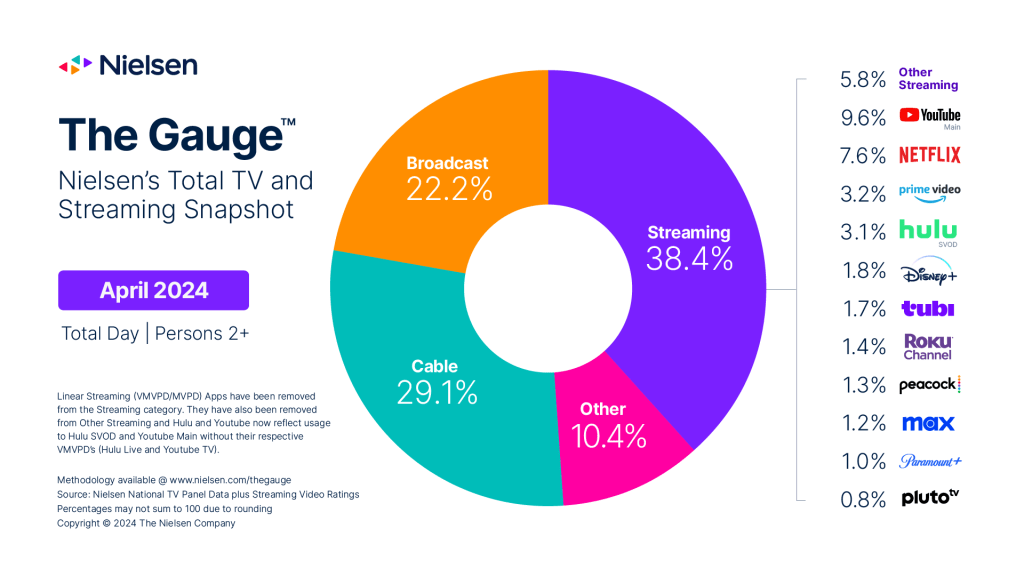

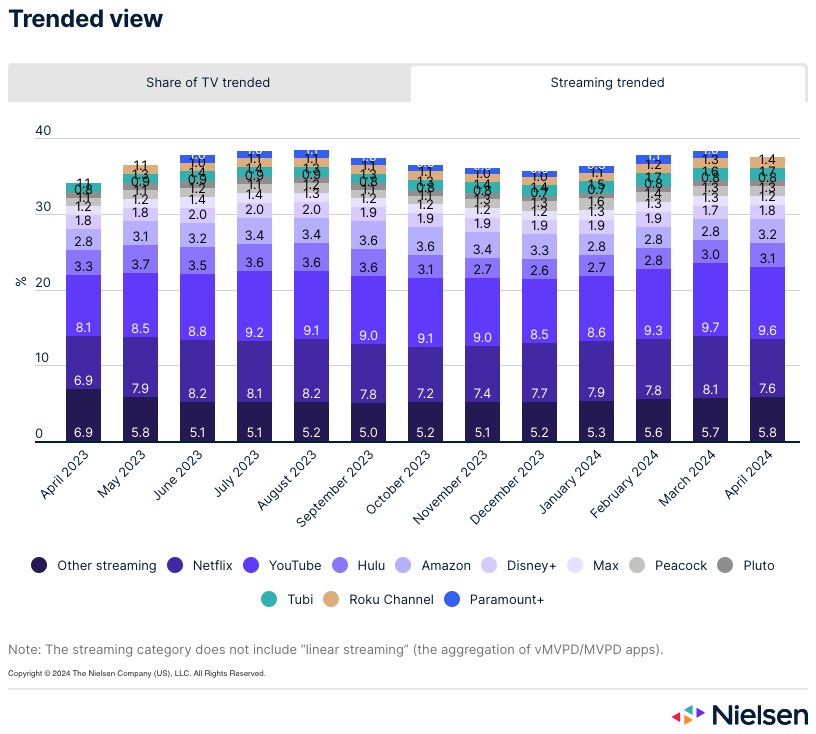

Speaking of tradition, here are the charts breaking down TV watch time by category and by streaming service. As you might notice, not much has changed.

Numbers to know

99.6 million: Number of subscribers that Warner Bros. Discovery had across its streaming services at the end of the first quarter of 2024.

18.6 million: Number of active accounts that Vizio’s connected TV platform had at the end of Q1 2024.

11.5 million: Number of streaming subscribers that AMC Networks had at the end of Q1 2024.

90%: Percentage share of Fox-owned free, ad-supported streaming TV service Tubi’s viewership that is on-demand viewing, as opposed to people streaming 24/7 channels.

What we’ve covered

What to watch for in this year’s TV and streaming advertising upfront market:

- Ad buyers and sellers expect the pace of this year’s upfront negotiations to be on the slow side.

- The longer it takes to close upfront deals, the less likely those commitments will be canceled.

Read more about the upfront market here.

How advertisers are approaching spend in the upfront market:

- The majority of surveyed marketers expect to spend more money on streaming than traditional TV in this year’s upfront market.

- A majority also expect Nielsen to be the primary currency for upfront deals.

Read more about upfront spending here.

Snap bolsters ad offerings and incentives to woo advertisers — but will they take?:

- Snap has been dangling incentives and discounts to win back advertisers that have stopped or cut back spending on the platform.

- The platform’s performance for advertisers has improved in the past year.

Read more about Snap here.

Warner Bros. Discovery Sports and CNN International create marketplace for sports and political ad dollars:

- Through WBD Connect, the media company will make inventory across its properties available for programmatic guaranteed deals.

- WBD Connect claims to reach 350 million global monthly digital unique users.

Read more about WBD here.

What we’re reading

Streamers alter talent payment terms:

Years after Netflix popularized the paradigm of upfront payments for programming, the company as well as Amazon and Apple are looking to adopt performance-based compensation models, according to Bloomberg.

Netflix is looking to expand further into live sports and is discussing a deal with the NFL to air two Christmas Day games, according to Puck.

Disney and Warner Bros. Discovery bundle up:

The owners of Disney+, Hulu and Max (and the upcoming sports streaming joint venture) have decided to sell a combined subscription to their flagship streamers, according to Deadline.

Paramount’s potential breakup:

If Sony Pictures and Apollo Global end up acquiring Paramount, they plan on stripping the media conglomerate for parts by selling off its TV and streaming properties while retaining its film-and-TV studio, according to The New York Times.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.