Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: FAST platforms have become a fixture among audiences and ad buyers

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the state of the free, ad-supported streaming TV market.

- FAST focus

- Paramount+WBD, YouTube’s swappable sponsorships, Netflix’s originals window and more

FAST focus

Honestly, I’ve always been pretty skeptical of the free, ad-supported streaming TV market. Starting more than a decade ago when Tom Ryan demoed a beta version of Pluto TV for me inside a small office on, if I remember right, Melrose Avenue in Los Angeles through the writing of “WTF is FAST?” in 2019 up until, well, as I write this. Turns out, FAST channels have become a fixture of the streaming landscape.

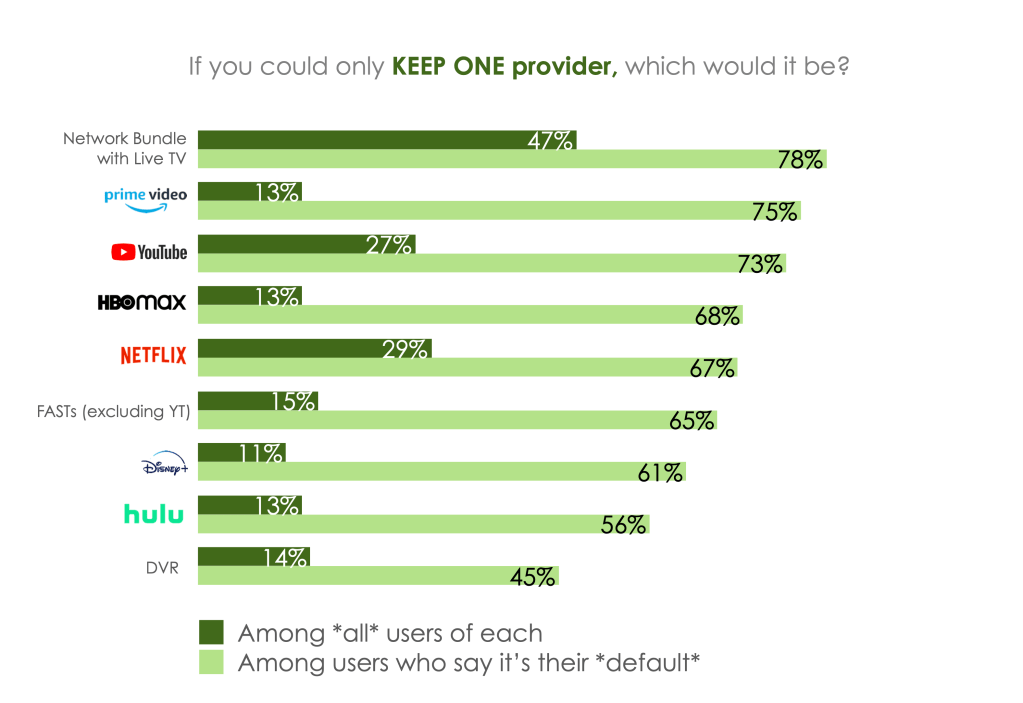

Here’s the chart that confirmed this conclusion for me. It’s from Hub Entertainment Research, and you may need to squint to see the standout stat.

From a survey of 1,600 people in the U.S., 15 percent said that if they could only keep one streaming service, they would choose a FAST service over Netflix or Disney+ or HBO Max or even freaking YouTube. That’s crazy to me. And it’s not the only recent signal of how significant these FAST services have become.

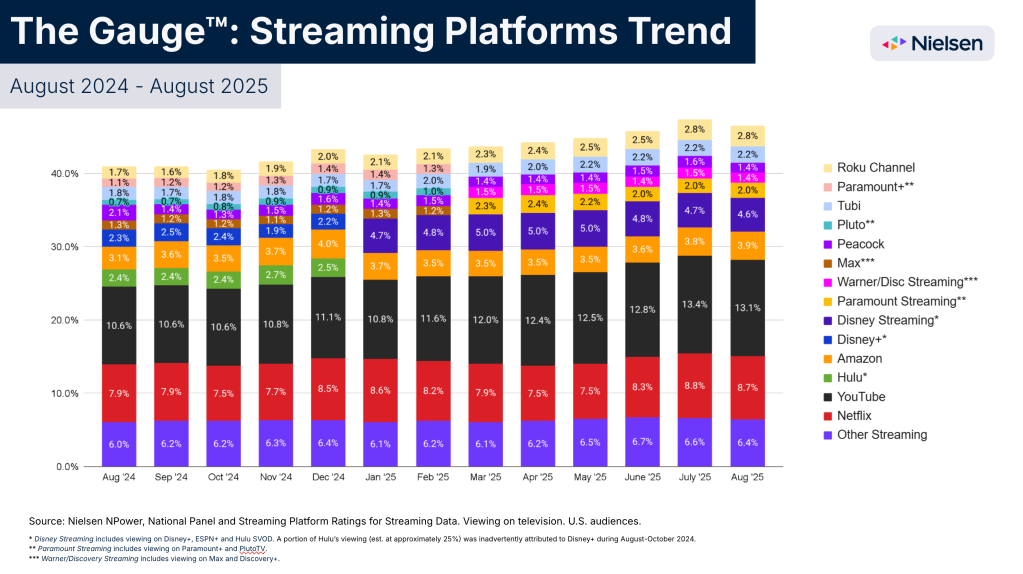

Check out this chart from Nielsen’s The Gauge viewership report for August 2025.

Again, the top-shelf streaming services are dominating the market, as you might expect. But look at how two FAST services — Fox’s Tubi and Roku’s The Roku Channel — secured a higher share of watch time on TV screens in August 2025 than NBCUniversal’s Peacock, not to mention Warner Bros. Discovery’s HBO Max and Discovery+ combined. And that’s been true all year. Now, Tubi and The Roku Channel also exceed the combined share of Paramount’s streaming properties, which includes Pluto TV and that suggests not all FAST services are doing swimmingly. But still. (And that’s not even considering that YouTube is technically a FAST service and the dominant streaming service overall.)

The point is, the FAST platforms and channels have secured their spot in the market. It’s not the spotlight and not even necessarily a primary spot. But it’s a material position. And not just among viewers but also among ad buyers.

“FAST channels play a very important part in my investment approach towards streaming,” said one agency executive. “There’s not a ton of impressions out there [in the overall streaming ad market] with any one entity. So if unique reach is your goal, you’ve got to go everywhere right now. And the scale is with the FAST channels. And a lot of the good pricing is within the FAST channels, quite honestly.”

FAST inventory these days can typically be had for less than $10 per thousand impressions when targeting the broadest possible audience of anyone two years old or older, according to agency executives. That is less than half the low end of the CPMs for major subscription-based, ad-supported streaming services like Amazon’s Prime Video, Disney’s Hulu and Peacock. And even home-screen ad placements on the FAST services — i.e. their tentpole ad products that offer maximum reach — are 30% cheaper than the comparable ad placements on the major streamers, per the agency execs.

As Wpromote head of programmatic and video Skyler McGill said, “They offer a ton of efficiency from a rate standpoint. It’s still very cost-effective to show up in FAST content, and I think the content is getting better. And they’re getting a lot more viewership.”

I’ll shut up now.

What we’ve heard

“What we saw was there’s not a lot of TV [inventory available], and people wanted TV, and it jacked up those rates there.”

— Agency executive on what surprised them in this year’s upfront market

Numbers to know

45%: Percentage increase year over year in the number of YouTube channels making more than $100,000 from CTV viewership.

24 million: Peak number of people who streamed Netflix’s Crawford-Canelo boxing match live on Saturday.

55.8%: Percentage share of Hispanic audiences’ TV screen watch time that is spent on streaming.

36%: Percentage of streaming shows that aired in the past year that were created by women.

$1.15 billion: How much money streaming services spent on British movies and shows last year.

What we’ve covered

Netflix turns to Amazon to make its ads easier to buy:

- Advertisers will be able to use Amazon’s DSP to programmatically purchase Netflix’s inventory.

- Other DSPs with access to Netflix’s inventory are Google’s DV360, The Trade Desk and Yahoo’s DSP.

Read more about Netflix’s Amazon deal here.

Virtual influencers click with young audiences, yet brands’ interest wanes:

- 60% of brands allow virtual influencers to be used in campaigns, as of August 2025.

- That’s down from 86% of surveyed brands in October 2024.

Read more about virtual influencers here.

What we’re reading

Skydance Media apparently has all the money to spend and is now looking to scoop up Warner Bros. Discovery — including it cable TV networks — after closing its purchase of Paramount Global, according to The Wall Street Journal.

YouTube’s dynamic brand placements:

The video platform will start a test early next year to enable creators to replace sponsored segments in long-form videos, according to TechCrunch.

Netflix’s originals window is closing:

The streaming service had secured 10 years of exclusivity for original shows including “Orange Is the New Black,” but that expiration date is coming up and Netflix will need to decide whether to pay to keep the content to itself, according to The Ankler.

TV’s pharma ad revenue in peril:

President Donald Trump has signed a memo that seeks to make advertising more onerous for pharmaceutical brands but stops short of outright banning the category from advertising like is the case in many other countries, according to The New York Times.

Netflix’s product chief exits:

Eunice Kim, a former Disney exec that joined Netflix in 2021, is stepping down as the company’s product boss, according to Bloomberg.

BuzzFeed revives its YouTube channel:

After years of BuzzFeed creators like The Try Guys and Michelle Khare successfully launching independent businesses and careers, the publisher is looking to revive its YouTube channel with new and returning series, according to The Wall Street Journal.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.