Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: A Q&A with Roku’s Sarah Harms about streaming ad measurement

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing features an interview with Roku’s vp of ad marketing and measurement Sarah Harms about the streaming ad measurement landscape.

- Q&A

- Nielsen’s January 2025 Gauge report

- YouTube’s farm league for streaming shows, ESPN’s F1 exit and more

Q&A

This year’s TV and streaming advertising upfront market is — somehow — just around the corner. I know.

So I figured one way to warm myself up for this year’s annual haggle would be to wade into the measurement side of the marketplace. If only to assess how much time I should spend talking about measurement with upfront ad buyers and sellers.

And given Roku’s relatively unique position as a CTV platform that can provide some of the data now informing the newer measurement systems, I thought Roku’s vp of ad marketing and measurement Sarah Harms would be a good person to talk to about the streaming ad measurement landscape.

This interview has been edited for length and clarity.

I feel like I’ve gotten so jaded in talking about measurement because it feels like there’s been such slow progress. And yet upfront season is coming, and the measurement makeover has been a fixture of attention for years. Does Roku have any big changes planned on the measurement front for this year’s upfront?

Roku generally is just on a big transformation. We announced the Roku Data Cloud at CES. It’s the encapsulation of all the amazing data assets off the back of our 90 million households, all logged-in, all direct relationships. Not only is it productizing or commercializing that data and using it with customers, but also seeing our position in the marketplace to use it for the greater good.

This is an acknowledgement and evolution of the business to say, “We know we can’t always be the source of truth. And so yes, we will work with your preferred measurement partners. But hey, we also think they might have some gaps or challenges in this space, so let us help.” We announced iSpot as one of those, just an example of Roku scaled data helping to inform their model.

That strikes me as in line with in like 2018-19 Hulu started trying out co-viewing measurement using Nielsen’s measurement, but it was limited to Roku and, if I’m not mistaken, that was because Roku had to effectively facilitate that from a technical perspective. Are these two kind of in league in a way?

That was before my time, so I can’t speak to that one. But it sounds similar in that, again, Roku’s size and scale, acknowledging that we do have deterministic data as the OS, not just as a streaming channel, helping the ecosystem as we see this big migration away from paid linear into streaming.

Given that positioning of Roku, why isn’t Roku a member of the U.S. Joint Industry Committee?

We’re always in conversations. We are a bit of a complicated player. So I wouldn’t say it’s completely out of the question.

What makes Roku a complicated player?

We are a publisher in that we have The Roku Channel. But also we’re the operating system and the largest in the U.S. So that is a dynamic pretty unique to us in that we’re a scaled publisher as well as the OS.

But Samsung is part of the JIC.

I think they don’t have a streaming channel akin to ours or at the scale of ours.

Shots at Samsung TV Plus.

No, I mean in terms of being a publisher akin to The Roku Channel.

That still sounds a little like shots at Samsung TV Plus. Samsung TV Plus is The Roku Channel, just Samsung’s version.

Fair. I mean, we’re always evaluating partners. I would say this is not a shot at Samsung or the JIC. It’s just a function of we just announced the Roku Data Cloud in January too, and iSpot was the first in many evolving partnerships.

And you all had the deal with iSpot announced last April as iSpot being the preferred measurement partner for Roku. Does that mean advertisers can buy Roku inventory using iSpot as the measurement currency?

We are more into our iSpot relationship as though we’ll take iSpot tags for our campaigns in terms of currency that’s more a function of the advertiser’s choice. And then our partnership with iSpot is allowing us to give signals to improve and inform their methodology.

With the iSpot deal announced last year as the preferred measurement partner, it made me wonder, so what’s the relationship with Nielsen — where Roku has a longstanding history from when you all acquired the advanced video advertising business — but then also VideoAmp, which is one of the other big measurement providers. What is the nature of the partnerships with VideoAmp and Nielsen in light of iSpot being the preferred measurement partner?

We are always led by our customers in terms of how we evaluate the partners in the space. We have a scale program by which we certify partners. And we really think we need to have optionality, just because our customers don’t always have just one preferred partner. They have a vast variety.

So what are the plans, if any, to bring Nielsen, VideoAmp, all the measurement providers other than iSpot into the Data Cloud program?

The Roku Data Cloud is really just the encapsulation of everything our data has to offer. And so that could be insights, that could be audience segmentation, that could be viewership, that could be search data. And so there is the ability for us to partner with measurement companies, buying platforms, publishers in the space for the utilization of our data. And so I would assume that we continue to evaluate partnerships and, where it makes sense for both parties, you engage.

You mentioned part of the deal with iSpot is Roku’s scale, Roku’s data can further inform their models. Can you help me understand what that means?

Just in terms of using a clean room coordination or collaboration with an iSpot, for example, to arm them with information that Roku has against our 90 million households to help inform their optimization or measurement signals.

It could be our understanding of viewership across our households. It could just be using our ACR technology. Their methodology uses proprietary signals, then we’re just helping add more to the mix when they need it.

ISpot gets fees from ad buyers and sellers when they use their measurements. Do you all get a cut of that?

We have our own financial relationship with iSpot, and then they have their own financial relationship with customers.

What need is this addressing in the marketplace?

There’s a variety of them. To pick one specifically: Identity is something that we have against our 90 million households. IP address is an increasingly weak signal. And so if we can bolster IP weaknesses with our data, that’s just one example of weaknesses in streaming that we’re helping.

What we’ve heard

“Growth primarily accelerated on FAST in the middle of 2024, when audience numbers on the FAST networks really took off.”

— Tinuiti’s Harry Browne on streaming’s growing FAST sector

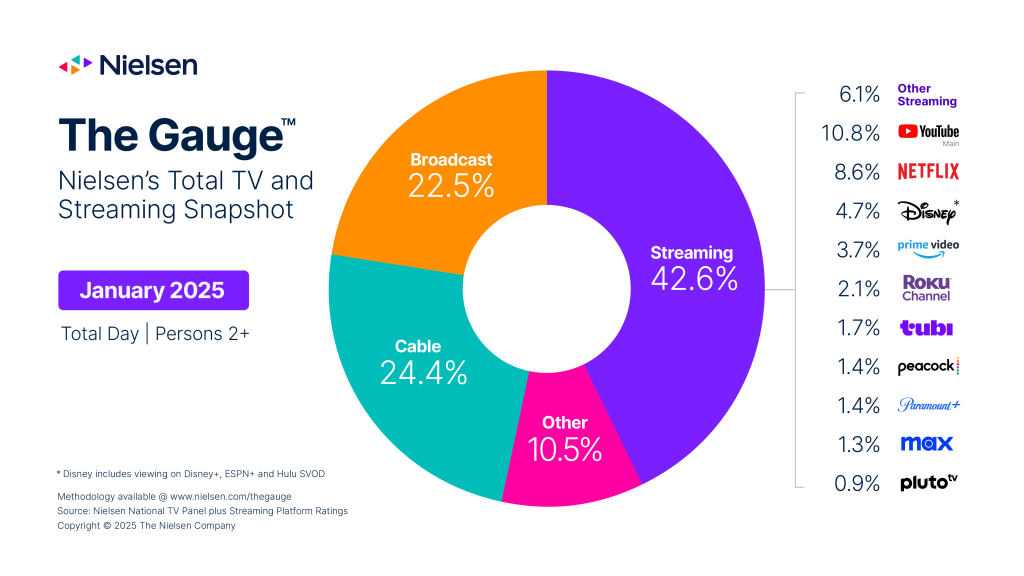

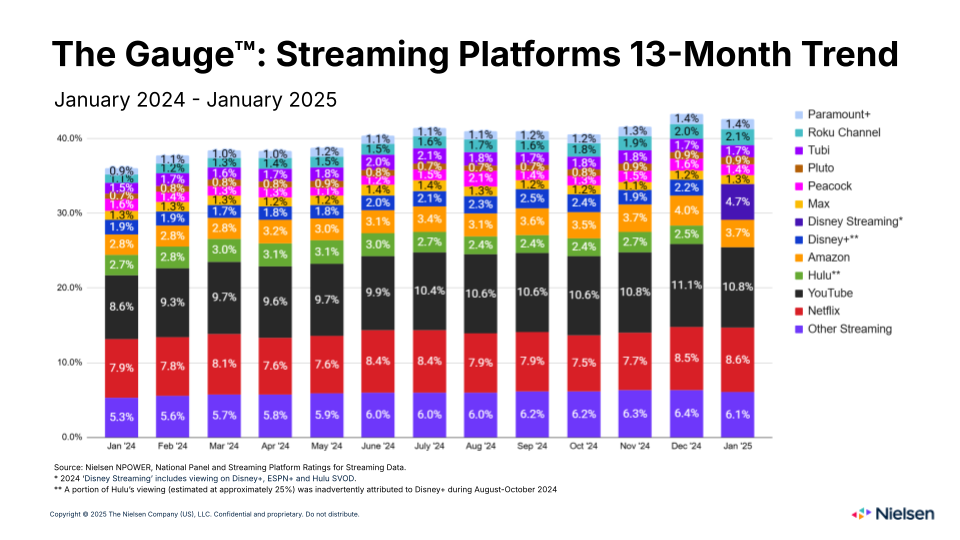

Nielsen’s January 2025 Gauge report

Would it surprise you to hear that people spent more time watching their TV screens in January — when the NFL playoffs got underway — than in December — when people may be holed up at home for the holidays or traveling during their year-end breaks? Yes? No?

Well, either way, it’s true. People spent 5% more time in front of their TV screens in January 2025 compared to December 2024, according to Nielsen’s latest The Gauge viewership report.

In case you can’t tell from the chart above, the December-January watch time increase seems to have been the most notable change in the latest Gauge. Actually, the bundling of Hulu and Disney+ into a singular Disney streaming entry in the below chart is also worth noting, especially since the watch time shares among streaming services didn’t fluctuate all that much month over month.

To be fair, YouTube and Amazon each ceded 0.3 share points, which is notable. But there wasn’t any change to how the streamers ranked. And Paramount’s Pluto TV remained under the 1% mark.

Numbers to know

89.8 million: Number of households that had active Roku-powered connected TVs, at the end of the fourth quarter of 2024.

20%: Percentage increase in video podcast consumption on Spotify since the service updated its Partner Program in January.

12 million: Number of paid streaming subscribers that AMC Networks had at the end of 2024.

$12.5 billion: How much money streaming services are expected to spend on live sports rights in 2025.

What we’ve covered

Rockstar Games talks with top metaverse creators, with an eye on making ‘Grand Theft Auto’ the next creator platform:

- The video game maker has talked with some creators about having custom experiences inside the next edition of “Grand Theft Auto.”

- It’s unclear how creators may be able to make money from the in-game experiences.

Read more about GTA’s creator talks here.

As more creators expand to episodic content, studios want to repurpose and syndicate their shows:

- Digital studios are looking to create episodic series for digital platforms with creators.

- What’s old is new in the creator economy, as ever.

Read more about studios’ creator interest here.

Tubi’s Super Bowl viewership highlights brands’ embrace of FAST channels:

- Tinuiti’s clients have doubled their average weekly investment in FAST channels compared to the second quarter of 2024.

- 13.6 million people watched the Super Bowl through Fox’s free, ad-supported streamer.

Read more about FAST channels here.

As independent, creator-owned media companies flourish, Rooster Teeth is looking to join the party:

- Earlier this month, Rooster Teeth founder bought back the company from Warner Bros. Discovery.

- Multiple creator-founded media companies have floundered under traditional media company ownership.

Read more about creator-owned media companies here.

What we’re reading

YouTube’s farm league for streaming shows:

Netflix is starting to pump its library with more YouTube-style programming, and other streamers are similarly turning to YouTube creators for programming options, according to Business Insider.

NBCUniversal’s upcoming spin-off of (most of) NBCUniversal’s cable TV networks provides the framing device for this Variety autopsy of the still-beating cable TV business, as industry executives try to put on a brave face.

The Disney-owned sports network has opted not to renew its deal to air F1 races, just as Netflix considers making a bid to stream the races, according to Puck.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.